Copyright & Fair-use Agreement

UNLV Special Collections provides copies of materials to facilitate private study, scholarship, or research. Material not in the public domain may be used according to fair use of copyrighted materials as defined by copyright law. Please cite us.

Please note that UNLV may not own the copyright to these materials and cannot provide permission to publish or distribute materials when UNLV is not the copyright holder. The user is solely responsible for determining the copyright status of materials and obtaining permission to use material from the copyright holder and for determining whether any permissions relating to any other rights are necessary for the intended use, and for obtaining all required permissions beyond that allowed by fair use.

Read more about our reproduction and use policy.

I agree.Information

Digital ID

Permalink

Details

Member of

More Info

Rights

Digital Provenance

Publisher

Transcription

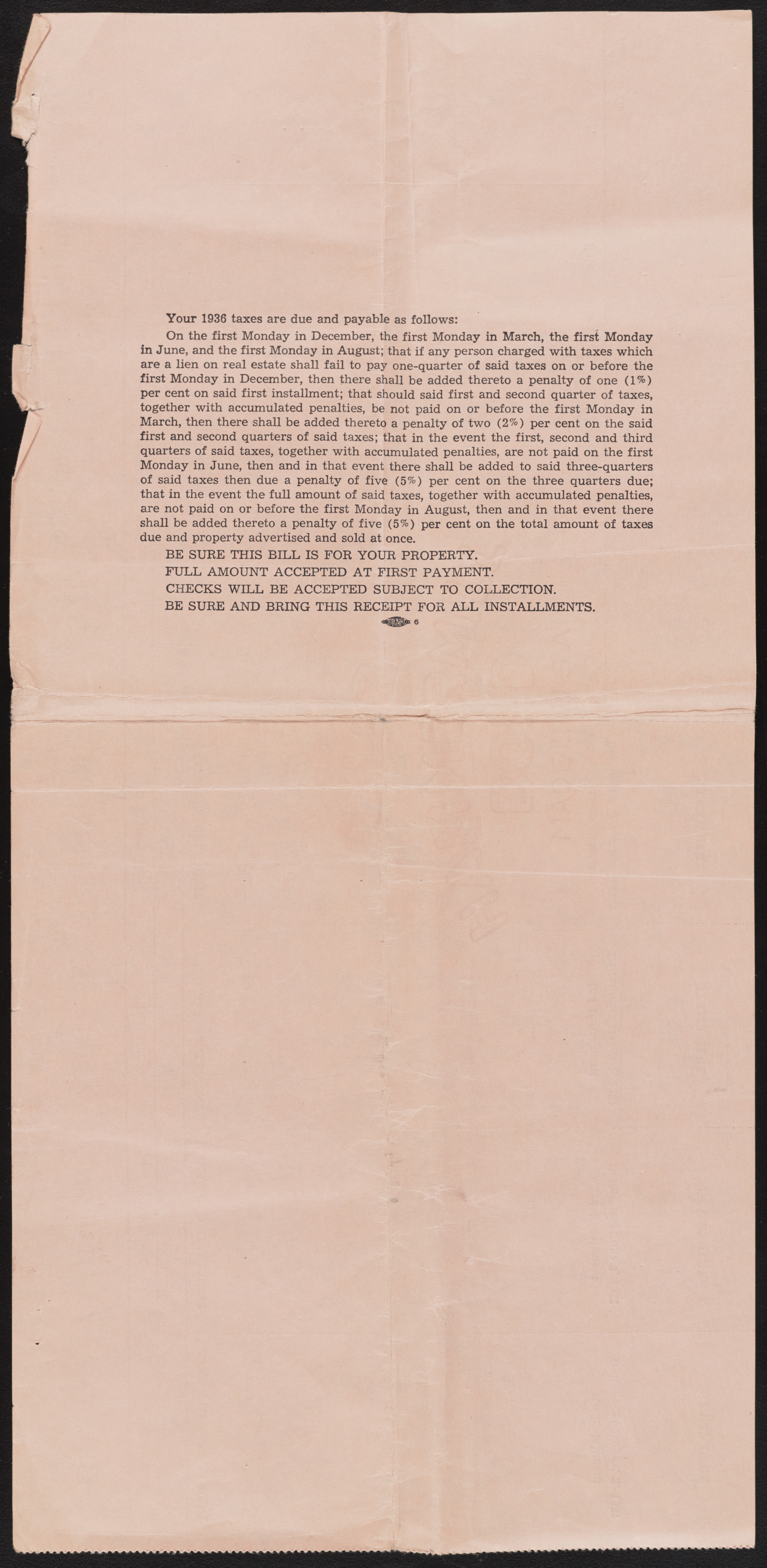

Your 1936 taxes are due and payable as follows: On the first Monday in December, the first Monday in March, the first Monday in June, and the first Monday in August; that if any person charged with taxes which are a lien on real estate shall fail to pay one-quarter of said taxes on or before the first Monday in December, then there shall be added thereto a penalty of one (1%) per cent on said first installment; that should said first and second quarter of taxes, together with accumulated penalties, be not paid on or before the first Monday in March, then there shall be added thereto a penalty of two (2%) per cent on the said first and second quarters of said taxes; that in the event the first, second and third quarters of said taxes, together with accumulated penalties, are not paid on the first Monday in June, then and in that event there shall be added to said three-quarters of said taxes then due a penalty of five (5%) per cent on the three quarters due; that in the event the full amount of said taxes, together with accumulated penalties, are not paid on or before the first Monday in August, then and in that event there shall be added thereto a penalty of five (5%) per cent on the total amount of taxes due and property advertised and sold at once. BE SURE THIS BILL IS FOR YOUR PROPERTY. FULL AMOUNT ACCEPTED AT FIRST PAYMENT. CHECKS WILL BE ACCEPTED SUBJECT TO COLLECTION. BE SURE AND BRING THIS RECEIPT FOR ALL INSTALLMENTS. 6