Copyright & Fair-use Agreement

UNLV Special Collections provides copies of materials to facilitate private study, scholarship, or research. Material not in the public domain may be used according to fair use of copyrighted materials as defined by copyright law. Please cite us.

Please note that UNLV may not own the copyright to these materials and cannot provide permission to publish or distribute materials when UNLV is not the copyright holder. The user is solely responsible for determining the copyright status of materials and obtaining permission to use material from the copyright holder and for determining whether any permissions relating to any other rights are necessary for the intended use, and for obtaining all required permissions beyond that allowed by fair use.

Read more about our reproduction and use policy.

I agree.Information

Digital ID

Permalink

Details

Member of

More Info

Rights

Digital Provenance

Publisher

Transcription

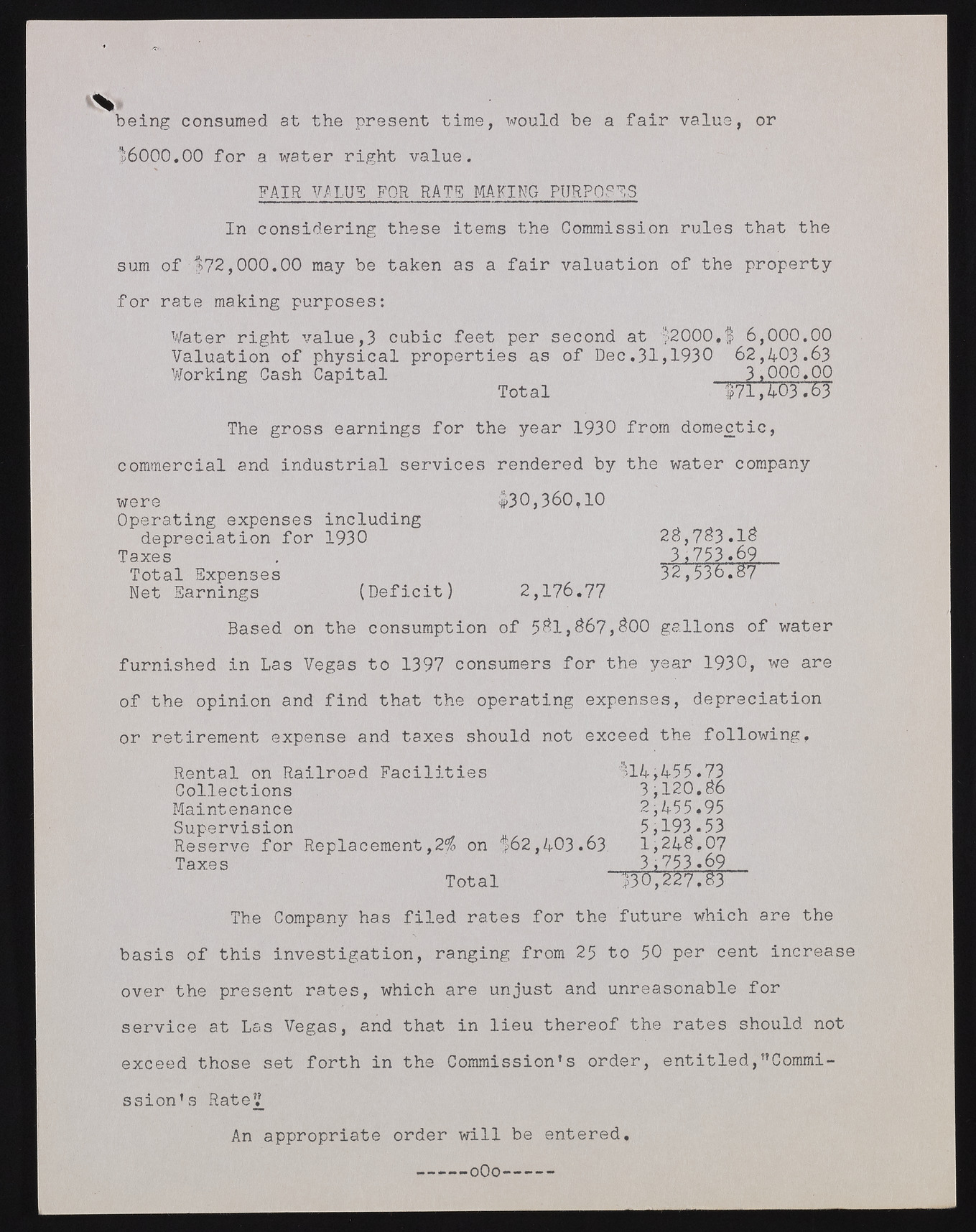

being consumed at the present time, would be a fair value, or 16000.00 for a water right value. FAIR VALUE FOR RATE MAKING PURPOSES In considering these items the Commission rules that the sum of $72,000.00 may be taken as a fair valuation of the property for rate making purposes: Water right value,3 cubic feet per second at $2000,1 6,000.00 Valuation of physical properties as of Dec.31,1930 62,403.63 Working Cash Capital 3,000*00 Total $71,403.63 The gross earnings for the year 1930 from domectic, commercial and industrial services rendered by the water company were Operating expenses including depreciation for 1930 Taxes Total Expenses Net Earnings (Deficit) $30,360,10 2d,733.13 3,753.69 32,5307 2,176.77 Based on the consumption of 5$1,$67,$00 gallons of water furnished in Las Vegas to 1397 consumers for the year 1930, we are of the opinion and find that the operating expenses, depreciation or retirement expense and taxes should not exceed the following. Rental on Railroad Facilities $14,455.73 Collections 3,120.$6 Maintenance 2^455,95 Supervision 5,193.53 Reserve for Replacement,2% on $62,403.63 1,248,07 Taxes 3,753.69 Total 330,227.83 The Company has filed rates for the future which are the basis of this investigation, ranging from 25 to 50 per cent increase over the present rates, which are unjust and unreasonable for service at Las Vegas, and that in lieu thereof the rates should not exceed those set forth in the Commission’s order, entitled,’’Commission’s RateT. An appropriate order will be entered. 0O0