Copyright & Fair-use Agreement

UNLV Special Collections provides copies of materials to facilitate private study, scholarship, or research. Material not in the public domain may be used according to fair use of copyrighted materials as defined by copyright law. Please cite us.

Please note that UNLV may not own the copyright to these materials and cannot provide permission to publish or distribute materials when UNLV is not the copyright holder. The user is solely responsible for determining the copyright status of materials and obtaining permission to use material from the copyright holder and for determining whether any permissions relating to any other rights are necessary for the intended use, and for obtaining all required permissions beyond that allowed by fair use.

Read more about our reproduction and use policy.

I agree.Information

Digital ID

Permalink

Details

More Info

Rights

Digital Provenance

Publisher

Transcription

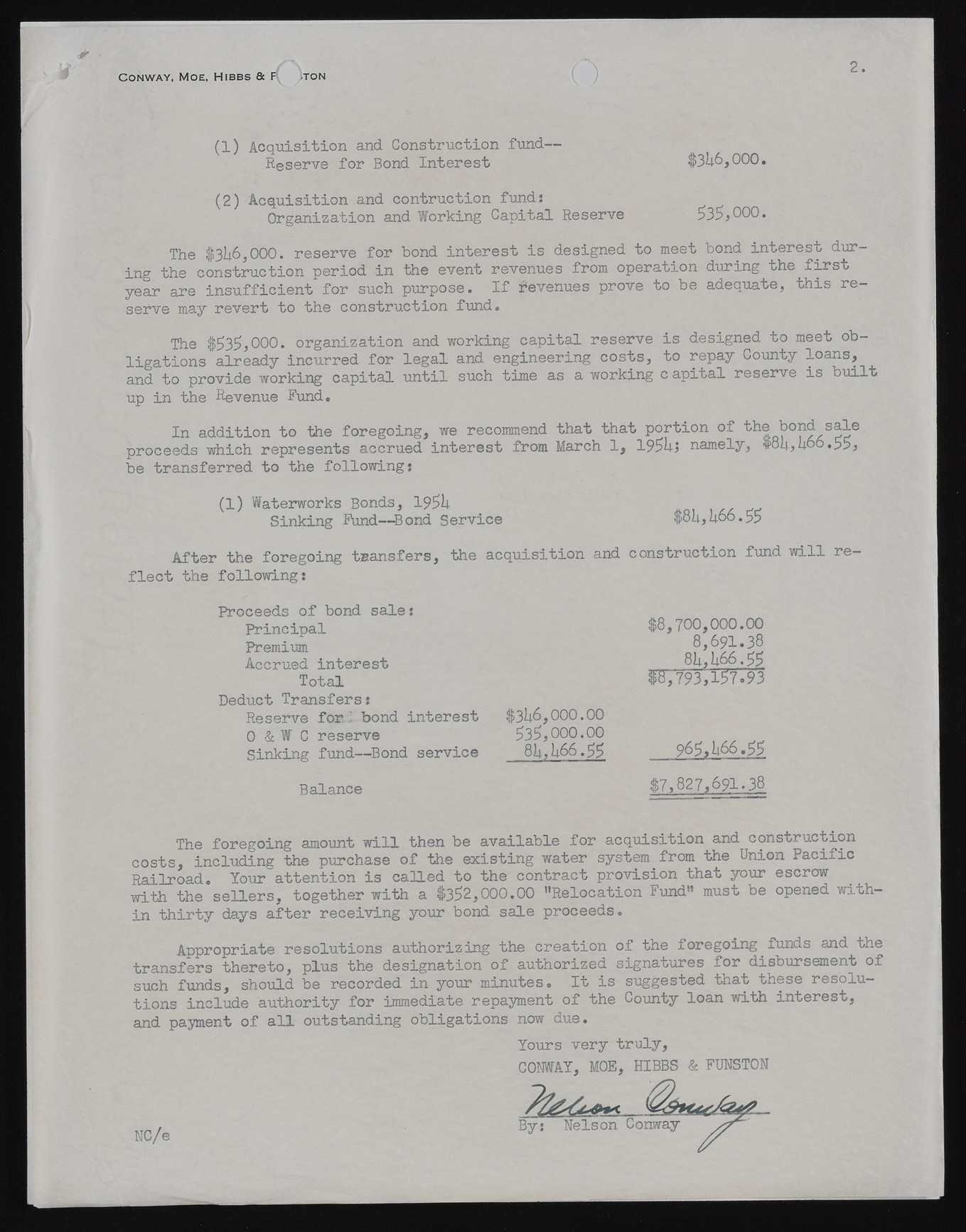

C o n w a y , M o e , H ib b s & F‘ /TON 0 2 . (1) Acquisition and Construction fund— Reserve for Bond Interest $314.6,000. (2) Acquisition and contruction fund: Organization and Working Capital Reserve 535,000. The $3l|.6,000. reserve for bond interest is designed to meet bond interest during the construction period in the event revenues from operation during the first year are insufficient for such purpose. If Revenues prove to be adequate, this reserve may revert to the construction fund. The $535,000. organization and working capital reserve is designed to meet obligations already incurred for legal and engineering costs, to repay County loans, and to provide working capital until such time as a working c apital reserve is built up in the Revenue Fund, In addition to the foregoing, we recommend that that portion of the bond sale proceeds which represents accrued interest from March 1, 19514-3 namely, $814,2466.55, be transferred to the following: (1) Waterworks Bonds, 195U Sinking Fund-Bond Service $8l4,U66.55 After the foregoing transfers, the acquisition and construction fund will reflect the following: Proceeds of bond sale: Principal Premium Accrued interest Total Deduct Transfers: Reserve fond bond interest 0 & W C reserve Sinking fund—Bond s e rv ic e $8,700,000.00 8,691.38 814,166.55 $8,793,157793 $3146,000.00 535,000.00 814,166.55 965.U66,55 Balance $7,827,691.38 The foregoing amount will then be available for acquisition and construction costs, including the purchase of the existing water system from the Union Pacific Railroad. Your attention is called to the contract provision that your escrow with the sellers, together with a $352,000.00 ’’Relocation Fund” must be opened within thirty days after receiving your bond sale proceeds. Appropriate resolutions authorizing the creation of the foregoing funds and the transfers thereto, plus the designation of authorized signatures for disbursement of such funds, should be recorded in your minutes. It is suggested that these resolutions include authority for immediate repayment of the County loan with interest, and payment of all outstanding obligations now due. Yours very truly, CONWAY, MOE, HIBBS & FUNST0N .. .. By: Nelson Conway