Copyright & Fair-use Agreement

UNLV Special Collections provides copies of materials to facilitate private study, scholarship, or research. Material not in the public domain may be used according to fair use of copyrighted materials as defined by copyright law. Please cite us.

Please note that UNLV may not own the copyright to these materials and cannot provide permission to publish or distribute materials when UNLV is not the copyright holder. The user is solely responsible for determining the copyright status of materials and obtaining permission to use material from the copyright holder and for determining whether any permissions relating to any other rights are necessary for the intended use, and for obtaining all required permissions beyond that allowed by fair use.

Read more about our reproduction and use policy.

I agree.Information

Digital ID

Permalink

Details

More Info

Rights

Digital Provenance

Publisher

Transcription

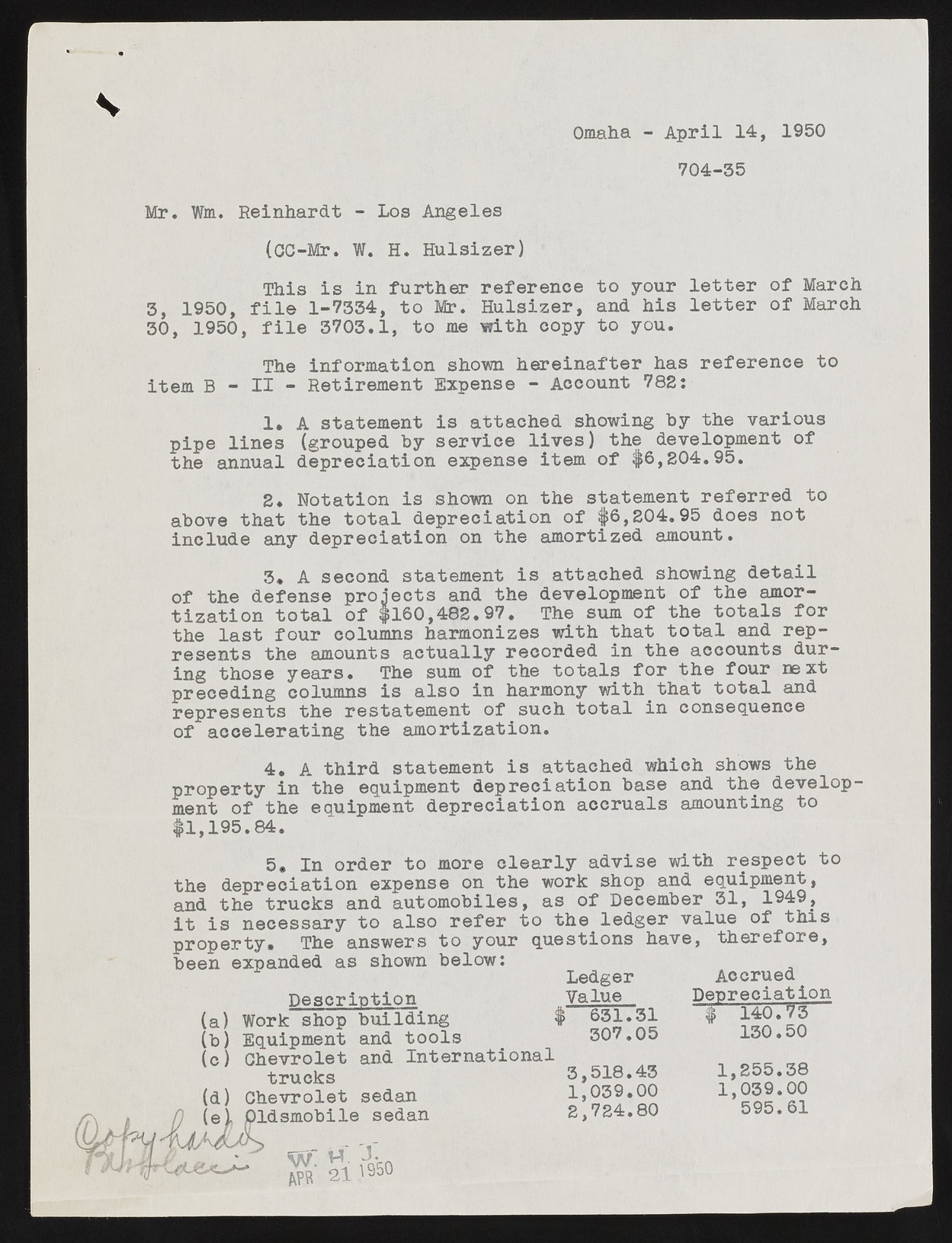

V Omaha - April 14, 1950 704-35 Mr. Wm. Reinhardt - Los Angeles (CC-Mr. W. H. Hulsizer) This is in further reference to your letter of March 3, 1950, file 1-7334, to Mr. Hulsizer, and his letter of March 30, 1950, file 3703.1, to me with copy to you. The information shown hereinafter has reference to item B - II - Retirement Expense - Account 782: 1. A statement is attached showing hy the various pipe lines (grouped by service lives) the development of the annual depreciation expense item of $6,204.95. 2. Notation is shown on the statement referred to above that the total depreciation of $6,204.95 does not include any depreciation on the amortized amount. 3* A second statement is attached showing detail of the defense projects and the development of the amortization total of $160,482.97. The sum of the totals for the last four columns harmonizes with that total and represents the amounts actually recorded in the accounts dur ing those years. The sum of the totals for the four next preceding columns is also in harmony with that total and represents the restatement of such total in consequence of accelerating the amortization. 4. A third statement is attached which shows the property in the equipment depreciation base and the development of the equipment depreciation accruals amounting to $1,195.84. 5* In order to more clearly advise with respect to the depreciation expense on the work shop and equipment, and the trucks and automobiles, as of December 31, 1949, it is necessary to also refer to the ledger value of this property. The answers to your questions have, therefore, been expanded as shown below: Description (a) Work shop building \ ((bc)) ECqhueivprmoelnett aanndd tIonotlesrnational Chtervurcoklset sedan ildsmobile sedan lAiPfRe H21 iH n™ Ledger Value ^ 363017..3015 3,518.43 1,039.00 2,724.80 Accrued Depreciation $ 140.73 130.50 1,255.38 1,039.00 595.61