Copyright & Fair-use Agreement

UNLV Special Collections provides copies of materials to facilitate private study, scholarship, or research. Material not in the public domain may be used according to fair use of copyrighted materials as defined by copyright law. Please cite us.

Please note that UNLV may not own the copyright to these materials and cannot provide permission to publish or distribute materials when UNLV is not the copyright holder. The user is solely responsible for determining the copyright status of materials and obtaining permission to use material from the copyright holder and for determining whether any permissions relating to any other rights are necessary for the intended use, and for obtaining all required permissions beyond that allowed by fair use.

Read more about our reproduction and use policy.

I agree.Information

Digital ID

Permalink

Details

More Info

Rights

Digital Provenance

Publisher

Transcription

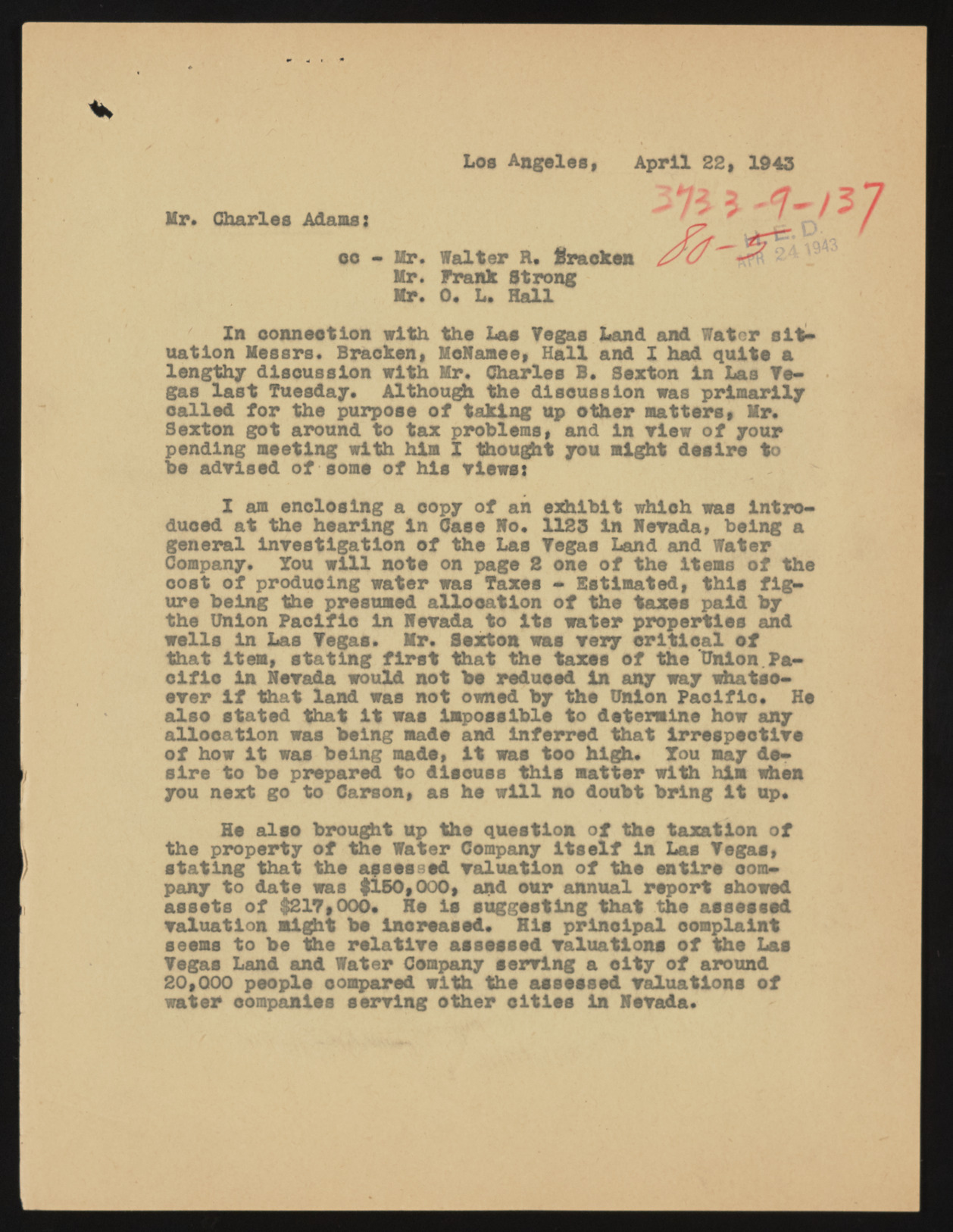

Los Angeles, April 22, 1943 Mr* Charles Adams: ir.nD oo - Hr. Valter R. Bracken ,a ^943 Mr* Frank Strong Mr. 0. L. Rail In connection with the Las Vegas Land and Water sit* uation Messrs. Bracken, HoNamse, Hall and I had quits a lengthy discussion with Mr. Charles B. Sexton in Las Vegas last Tuesday. Although the disoussion was primarily called for the purpose of taking up other matters, Mr. Sexton got around to tax problems, and in view of your pending meeting with him 1 thought you might desire to be adwised of some of his views! Z am enclosing a oopy of an exhibit which was introduced at the hearing in Cass Mo. 1123 in Nevada, being a general investigation of the Las Vegas land and Vater Company. You will note on page 2 one of the items of the oost of produoing water was Taxes - Estimated, this figt» ure being the presumed allooatlon of the taxes paid by the Union Paoifio in Nevada to its water properties and wells in Las Vegas. Mr. Sexton was very critical of that item, stating first that the taxes of the Union.Pacific in Nevada would not be reduced in any way Whatsoever if that land was not owned by the Union Paoifio. He also stated that it was impossible to determine how any allocation was being made and inferred that irrespective of how it was being made, it was too high. You may desire to be prepared to dlsoues this natter with him shea you next go to Carson, as he will no doubt bring it up. He also brought up the question of the taxation of the property of the Vater Company Itself in Las Vegas, stating that the assessed valuation of the satire company to date was #150,000, and our annual report showed assets of #217,000. He is suggesting that the assessed valuation might be increased. His principal oomplaint seems to be the relative assessed valuations of the Las Vegas Land and Vater Company serving a city of around 20,000 people compared with the assessed valuations of water companies serving other cities in Nevada.