Copyright & Fair-use Agreement

UNLV Special Collections provides copies of materials to facilitate private study, scholarship, or research. Material not in the public domain may be used according to fair use of copyrighted materials as defined by copyright law. Please cite us.

Please note that UNLV may not own the copyright to these materials and cannot provide permission to publish or distribute materials when UNLV is not the copyright holder. The user is solely responsible for determining the copyright status of materials and obtaining permission to use material from the copyright holder and for determining whether any permissions relating to any other rights are necessary for the intended use, and for obtaining all required permissions beyond that allowed by fair use.

Read more about our reproduction and use policy.

I agree.Information

Digital ID

Permalink

Details

More Info

Rights

Digital Provenance

Publisher

Transcription

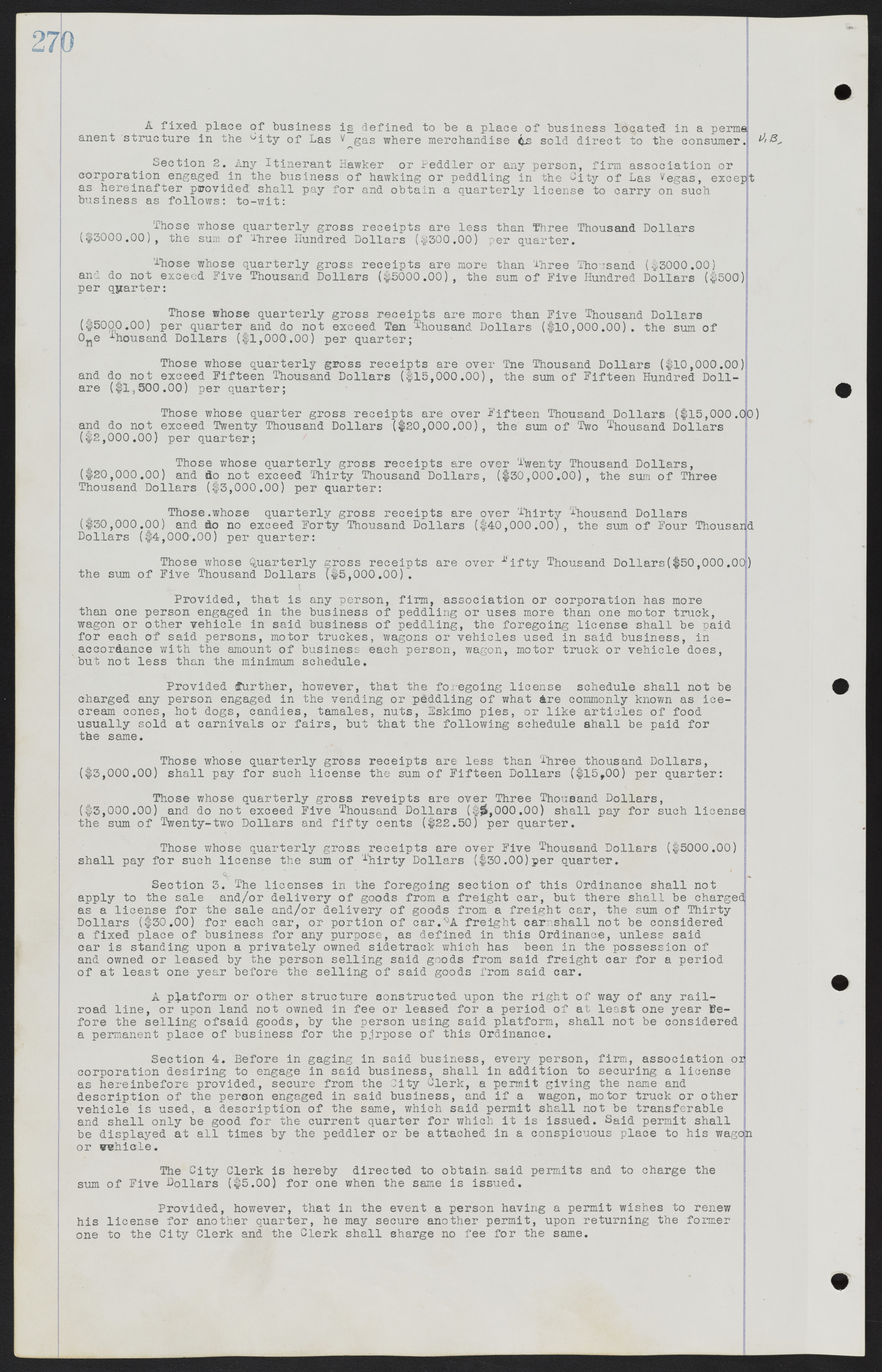

A fixed place of business is defined to be a place of business located in a permanent structure in the City of Las Vegas where merchandise is sold direct to the consumer. Section 2. Any Itinerant Hawker or Peddler or any person, firm association or corporation engaged in the business of hawking or peddling in the City of Las Vegas, except as hereinafter provided shall pay for and obtain a quarterly license to carry on such business as follows: to-wit: Those whose quarterly gross receipts are less than Three Thousand Dollars ($3000.00), the sum of Three Hundred Dollars ($300.00) per quarter. Those whose quarterly gross receipts are more than Three Thousand ($3000.00) and do not exceed Five Thousand Dollars ($5000.00), the sum of Five Hundred Dollars ($500) per quarter: Those whose quarterly gross receipts are more than Five Thousand Dollars ($5000.00) per quarter and do not exceed Ten Thousand Dollars ($10,000.00), the sum of One Thousand Dollars ($1,000.00) per quarter; Those whose quarterly gross receipts are over Ten Thousand Dollars ($10,000.00) and do not exceed Fifteen Thousand Dollars ($15,000.00), the sum of Fifteen Hundred Dollars ($1,500.00) per quarter; Those whose quarter gross receipts are over Fifteen Thousand Dollars ($15,000.00) and do not exceed Twenty Thousand Dollars ($20,000.00), the sum of Two Thousand Dollars ($2,000.00) per quarter; Those whose quarterly gross receipts are over Twenty Thousand Dollars, ($20,000.00) and do not exceed Thirty Thousand Dollars, ($30,000.00), the sum of Three Thousand Dollars ($3,000.00) per quarter: Those whose quarterly gross receipts are over Thirty Thousand Dollars ($30,000.00) and do no exceed Forty Thousand Dollars ($40,000.00), the sum of Four Thousand Dollars ($4,000.00) per quarter: Those whose Quarterly gross receipts are over Fifty Thousand Dollars ($50,000.00) the sum of Five Thousand Dollars ($5,000.00). Provided, that is any person, firm, association or corporation has more than one person engaged in the business of peddling or uses more than one motor truck, wagon or other vehicle in said business of peddling, the foregoing license shall be paid for each of said persons, motor trucks, wagons or vehicles used in said business, in accordance with the amount of business each person, wagon, motor truck or vehicle does, but not less than the minimum schedule. Provided further, however, that the foregoing license schedule shall not be charged any person engaged in the vending or peddling of what are commonly known as ice cream cones, hot dogs, candies, tamales, nuts, Eskimo pies, or like articles of food usually sold at carnivals or fairs, but that the following schedule shall be paid for the same. Those whose quarterly gross receipts are less than Three thousand Dollars, ($3,000.00) shall pay for such license the sum of Fifteen Dollars ($15.00) per quarter: Those whose quarterly gross receipts are over Three Thousand Dollars, ($3,000.00) and do not exceed Five Thousand Dollars ($5,000.00) shall pay for such license the sum of Twenty-two Dollars and fifty cents ($22.50) per quarter. Those whose quarterly gross receipts are over Five Thousand Dollars ($5000.00) shall pay for such license the sum of Thirty Dollars ($30.00) per quarter. Section 3. The licenses in the foregoing section of this Ordinance shall not apply to the sale and/or delivery of goods from a freight car, but there shall be charged as a license for the sale and/or delivery of goods from a freight car, the stun of Thirty Dollars ($30.00) for each car, or portion of car. A freight car shall not be considered a fixed place of business for any purpose, as defined in this Ordinance, unless said car is standing upon a privately owned sidetrack which has been in the possession of and owned or leased by the person selling said goods from said freight car for a period of at least one year before the selling of said goods from said car. A platform or other structure constructed upon the right of way of any railroad line, or upon land not owned in fee or leased for a period of at least one year before the selling of said goods, by the person using said platform, shall not be considered a permanent place of business for the purpose of this Ordinance. Section 4. Before in gaging in said business, every person, firm, association or corporation desiring to engage in said business, shall in addition to securing a license as hereinbefore provided, secure from the City Clerk, a permit giving the name and description of the person engaged in said business, and if a wagon, motor truck or other vehicle is used, a description of the same, which said permit shall not be transferable and shall only be good for the current quarter for which it is issued. Said permit shall be displayed at all times by the peddler or be attached in a conspicuous place to his wagon or vehicle. The City Clerk is hereby directed to obtain, said permits and to charge the stun of Five Dollars ($5.00) for one when the same is issued. Provided, however, that in the event a person having a permit wishes to renew his license for another quarter, he may secure another permit, upon returning the former one to the City Clerk and the Clerk shall charge no fee for the same.