Copyright & Fair-use Agreement

UNLV Special Collections provides copies of materials to facilitate private study, scholarship, or research. Material not in the public domain may be used according to fair use of copyrighted materials as defined by copyright law. Please cite us.

Please note that UNLV may not own the copyright to these materials and cannot provide permission to publish or distribute materials when UNLV is not the copyright holder. The user is solely responsible for determining the copyright status of materials and obtaining permission to use material from the copyright holder and for determining whether any permissions relating to any other rights are necessary for the intended use, and for obtaining all required permissions beyond that allowed by fair use.

Read more about our reproduction and use policy.

I agree.Information

Digital ID

Permalink

Details

More Info

Rights

Digital Provenance

Publisher

Transcription

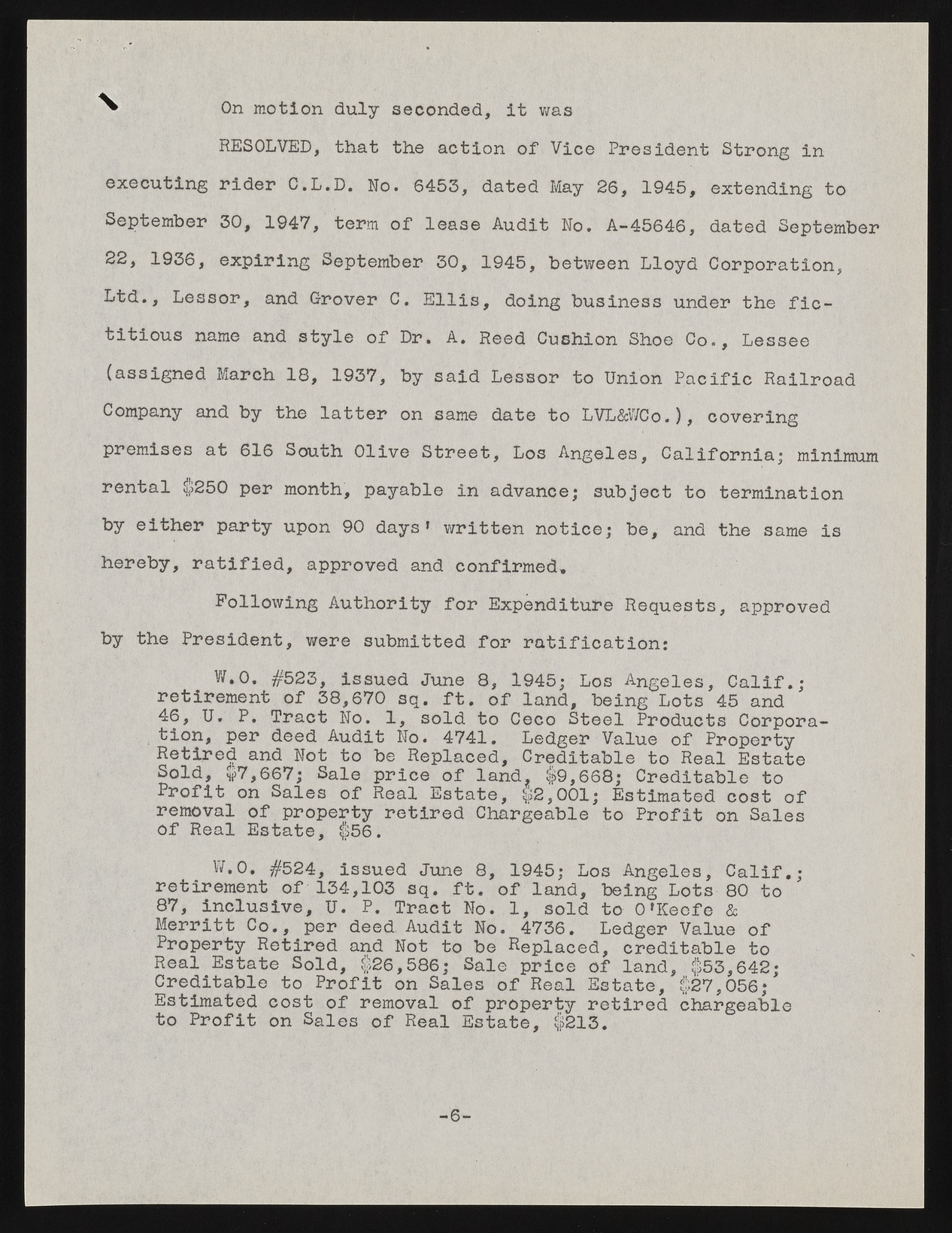

RESOLVED, that the action of Vice President Strong in executing rider C.L.D. No. 6453, dated May 26, 1945, extending to September 30, 1947, term of lease Audit No. A-45646, dated September 22, 1936, expiring September 30, 1945, between Lloyd Corporation, Ltd., Lessor, and Grover C. Ellis, doing business under the fictitious name and style of Dr. A. Reed Cushion Shoe Co., Lessee (assigned March 18, 1937, by said Lessor to Union Pacific Railroad Company and by the latter on same date to LVL&WCo.), covering premises at 616 South Olive Street, Los Angeles, California; minimum rental $250 per month, payable in advance; subject to termination by either party upon 90 days’ written notice; be, and the same is hereby, ratified, approved and confirmed. Following Authority for Expenditure Requests, approved by the President, were submitted for ratification: W.O. #523, issued June 8, 1945; Los Angeles, Calif.; retirement of 38,670 sq. ft. of land, being Lots 45 and 46, U. P. Tract No. 1, sold to Ceco Steel Products Corpora-tion, per deed Audit No. 4741. Ledger Value of Property Retired and Not to be Replaced, Creditable to Real Estate Sold, $7,667; Sale price of land. $9,668; Creditable to Profit on Sales of Real Estate, $2,001; Estimated cost of removal of property retired Chargeable to Profit on Sales Of Real Estate, $56. W.O. #524, issued June 8, 1945; Los Angeles, Calif.; retirement of 134,103 sq. ft. of land, being Lots 80 to 87, inclusive, U. P. Tract No. 1, sold to O'Keefe & Merritt Co., per deed Audit No. 4736. Ledger Value of Property Retired and Not to be Replaced, creditable to Real Estate Sold, $26,586; Sale price of land, $53,642; Creditable to Profit on Sales of Real Estate, $27,056; Estimated cost of removal of property retired chargeable to Profit on Sales of Real Estate, $213. ^ On motion duly seconded, it was -6-