Copyright & Fair-use Agreement

UNLV Special Collections provides copies of materials to facilitate private study, scholarship, or research. Material not in the public domain may be used according to fair use of copyrighted materials as defined by copyright law. Please cite us.

Please note that UNLV may not own the copyright to these materials and cannot provide permission to publish or distribute materials when UNLV is not the copyright holder. The user is solely responsible for determining the copyright status of materials and obtaining permission to use material from the copyright holder and for determining whether any permissions relating to any other rights are necessary for the intended use, and for obtaining all required permissions beyond that allowed by fair use.

Read more about our reproduction and use policy.

I agree.Information

Digital ID

Permalink

Details

Member of

More Info

Rights

Digital Provenance

Publisher

Transcription

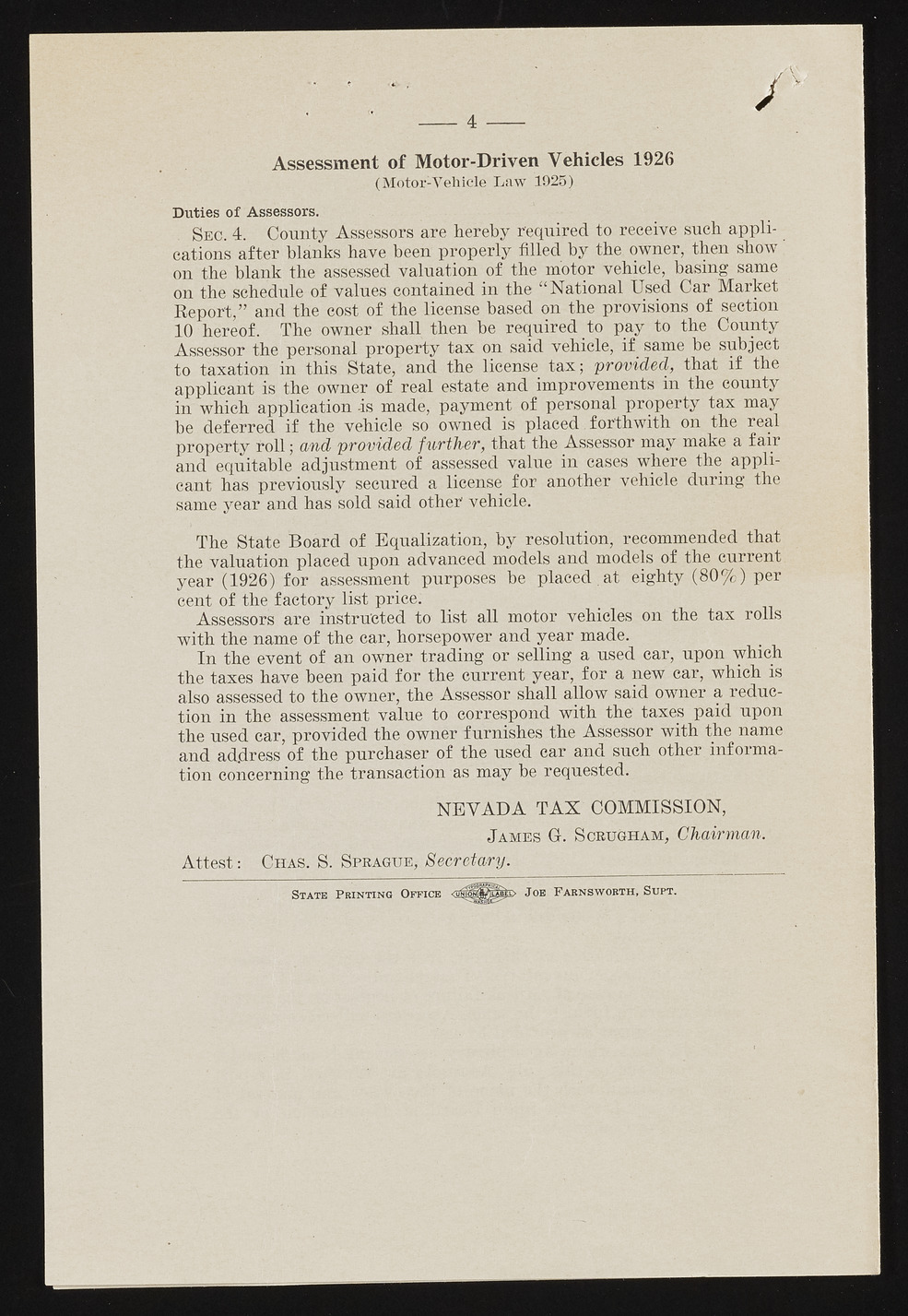

Assessment of Motor-Driven Vehicles 1926 (Motor-Vehicle Law 1925) Duties of Assessors. Sec. 4. County Assessors are hereby required to receive such appli-cations after blanks have been properly filled by the owner, then show on the blank the assessed valuation of the motor vehicle, basing same on the schedule of values contained in the “National Used Car Market Report,” and the cost of the license based on the provisions of section 10 hereof. The owner shall then be required to pay to the County Assessor the personal property tax on said vehicle, if same be subject to taxation in this State, and the license tax; provided, that if the applicant is the owner of real estate and improvements in the county in which application -is made, payment of personal property tax may be deferred if the vehicle so owned is placed. forthwith on the real property roll; and provided further, that the Assessor may make a fair and equitable adjustment of assessed value in cases where the applicant has previously secured a license for another vehicle during the same year and has sold said other vehicle. The State Board of Equalization, by resolution, recommended that the valuation placed upon advanced models and models of the current year (1926) for assessment purposes be placed , at eighty (80%) per cent of the factory list price: Assessors are instructed to list all motor vehicles on the tax rolls with the name of the car, horsepower and year made. In the event of an owner trading or selling a used car, upon which the taxes have been paid for the current year, for a new ear, which is also assessed to the owner, the Assessor shall allow said owner a reduction in the assessment value to correspond with the taxes paid upon the used car, provided the owner furnishes the Assessor with the name and address of the purchaser of the used car and such other information concerning the transaction as may be requested. NEVADA TAX COMMISSION, J ames G. S cktjgham, Chairman. Attest* Chas. S. Sekagi7e> Secretary. _____ State P rinting Office J oe F arnsworth, Supt.