Copyright & Fair-use Agreement

UNLV Special Collections provides copies of materials to facilitate private study, scholarship, or research. Material not in the public domain may be used according to fair use of copyrighted materials as defined by copyright law. Please cite us.

Please note that UNLV may not own the copyright to these materials and cannot provide permission to publish or distribute materials when UNLV is not the copyright holder. The user is solely responsible for determining the copyright status of materials and obtaining permission to use material from the copyright holder and for determining whether any permissions relating to any other rights are necessary for the intended use, and for obtaining all required permissions beyond that allowed by fair use.

Read more about our reproduction and use policy.

I agree.Information

Digital ID

Permalink

Details

More Info

Rights

Digital Provenance

Publisher

Transcription

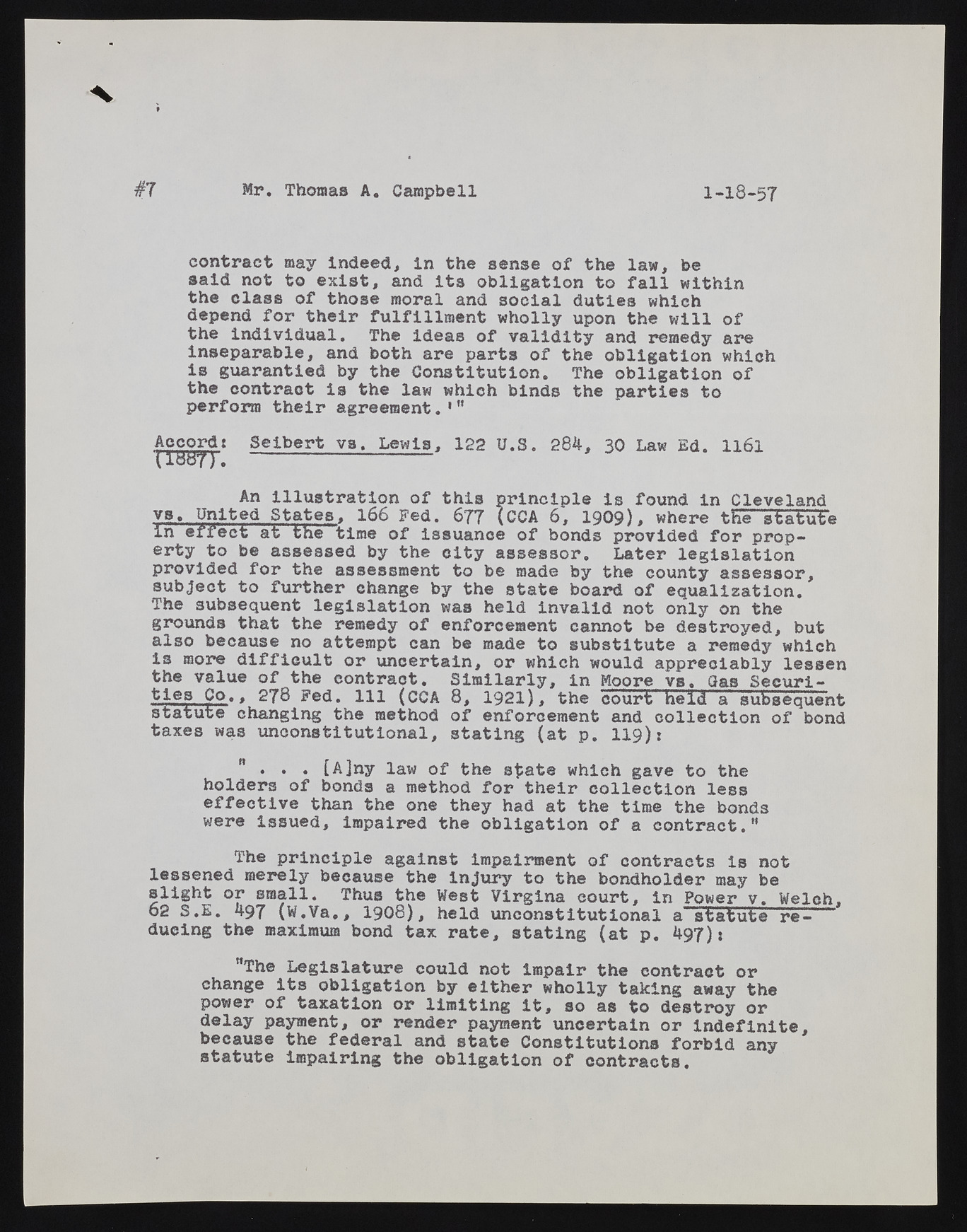

#7 Mr. Thomas A. Campbell 1-18-57 contract may Indeed, in the sense of the law, be said not to exist, and Its obligation to fall within the class of those moral and social duties which depend for their fulfillment wholly upon the will of the individual. The ideas of validity and remedy are inseparable, and both are parts of the obligation which is guarantied by the Constitution. The obligation of the contract la the law which binds the parties to perform their agreement. 1” Accord* TT887T. Seibert va. Lewis, 122 U.S. 284, 30 Law Ed. Il6l An illustration of this principle is found in Cleveland vs. United States, 166 Fed. 677 (CCA 6, 1909), where tEeTiaFuFe in effect at the time of issuance of bonds provided for property to be assessed by the city assessor. Later legislation provided for the assessment to be made by the county assessor, subject to further change by the state board of equalization. The subsequent legislation was held invalid not only on the grounds that the remedy of enforcement cannot be destroyed, but also because no attempt can be made to substitute a remedy which is more difficult or uncertain, or which would appreciably lessen the value of the eontraot. Similarly, in Moore vs, Gas Securi-t i e s C o . , 278 Fed. Ill (CCA 8, 1921), the court held a subsequent statute changing the method of enforcement and collection of bond taxes was unconstitutional, stating (at p. 119): ” . . . [Ajny law of the sfcate which gave to the holders of bonds a method for their collection less effective than the one they had at the time the bonds were issued, impaired the obligation of a contract.” The principle against impairment of contracts is not lessened merely because the injury to the bondholder may be slight or small. Thus the West Virgina court, in Power v. Welch. 62 S.E. 497 (W.Va,, 1 9 0 8 ), held unconstitutional a s t a t u t e re-dueing the maximum bond tax rate, stating (at p. 497): ”Th© Legislature could not Impair the contract or change its obligation by either wholly taking away the power of taxation or limiting it, so as to destroy or delay payment, or render payment uncertain or Indefinite, because the federal and state Constitutions forbid any statute impairing the obligation of contracts.