Copyright & Fair-use Agreement

UNLV Special Collections provides copies of materials to facilitate private study, scholarship, or research. Material not in the public domain may be used according to fair use of copyrighted materials as defined by copyright law. Please cite us.

Please note that UNLV may not own the copyright to these materials and cannot provide permission to publish or distribute materials when UNLV is not the copyright holder. The user is solely responsible for determining the copyright status of materials and obtaining permission to use material from the copyright holder and for determining whether any permissions relating to any other rights are necessary for the intended use, and for obtaining all required permissions beyond that allowed by fair use.

Read more about our reproduction and use policy.

I agree.Information

Digital ID

Permalink

Details

More Info

Rights

Digital Provenance

Publisher

Transcription

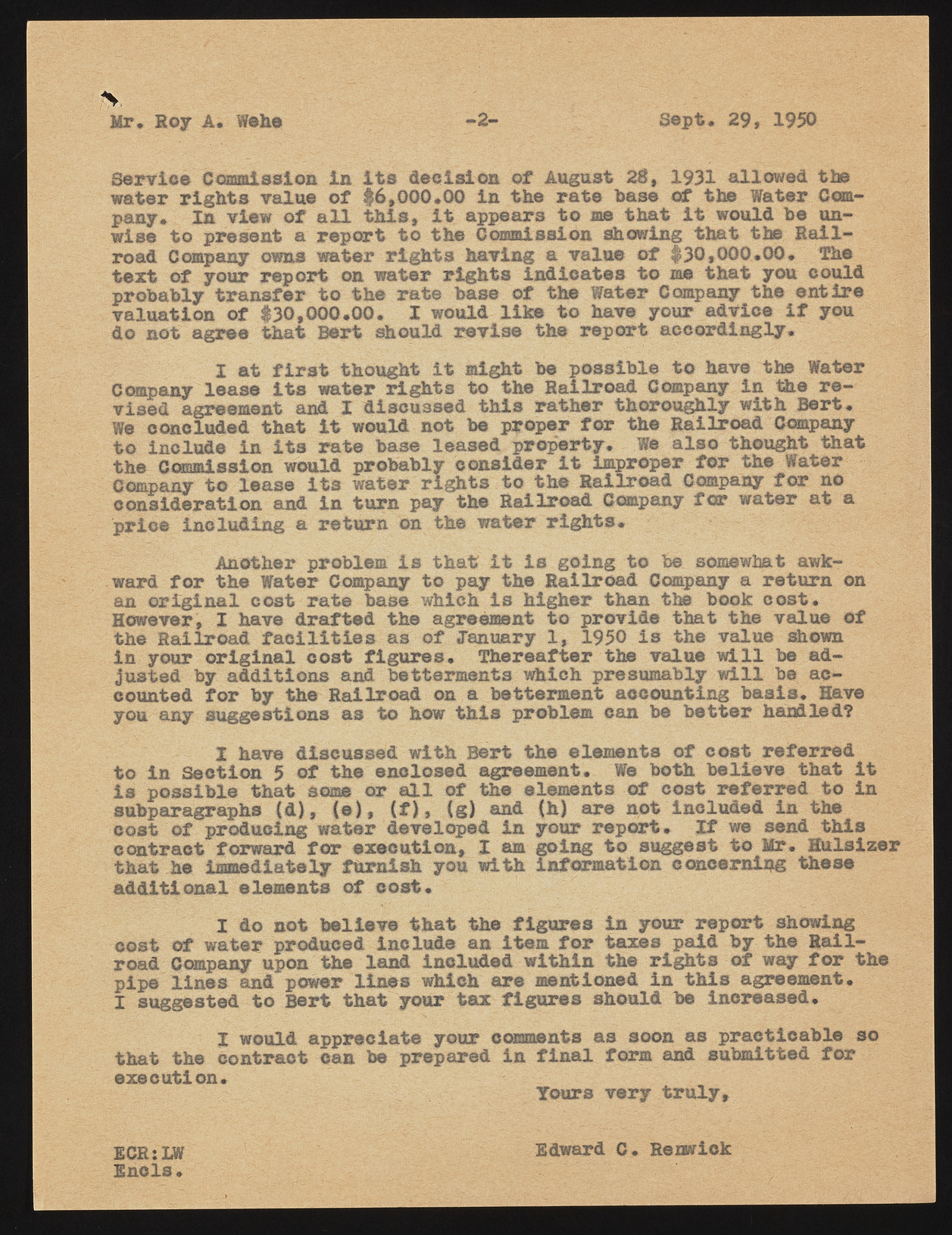

Mr, Hoy Am wehs Sept* 29, 1950 Service C canal salon in its decision of August 26, 1931 allowed tbs water rights value of $6,000,00 in the rate base of the Water Company, In view of all this, It appears to me that it would be unwise to present a report to the Commission showing that the Railroad Company owns water rights having a value of $30,000*00, The text of your report on water rights indicates to me that you could probably transfer to the rate base of the Water Company the entire valuation of #30,000.00. I would like to have your advice if you do not agree that Bert should revise the report accordingly. I at first thought it might be possible to have the Water Company lease its water rights to the Railroad Company in the revised agreement and I discussed this rather thoroughly with Bert* We concluded that it would not be proper for the Railroad Company to include in its rate base leased property. We also thought that the Commission would probably consider it improper for the Water Company to lease its water rights to the Railroad Company for no consideration and in turn pay the Railroad Company for water at a price including a return on the water rights* Another problem Is that It is going to be somewhat awkward for the Water Company to pay the Railroad Company a return on an original cost rate base which is higher than the book cost* However, I have drafted the agreement to provide that the value of the Railroad facilities as of January 1, 1950 is the value shown in your original cost figures* Thereafter the value will be adjusted by additions and betterments which presumably will be accounted for by the Railroad on a betterment accounting basis. Have you any suggestions as to how this problem can be better handled? 1 have discussed with Bert the elements of cost referred to in Section 5 of the enclosed agreement. We both believe that it Is possible that some or all of the elements of cost referred to in subparagraphs (d), (e), (f), {g) and (h) are not included in the cost of producing water developed in your report* If we send this contract forward for execution, I am going to suggest to Mr. Hulsizer that be immediately furnish you with information concerning these additional elements of cost. I do not believe that the figures in your report showing cost of water produced include an Item for taxes paid by the Railroad Company upon the land included within the rights of way for the pipe lines and power lines which are mentioned in this agreement. I suggested to Bert that your tax figures should be increased. I would appreciate your comments as soon as practicable so that the contract can be prepared in final form and submitted for execution. yours very truly. ECR:LW E n d s . Edward C. Renwick