Copyright & Fair-use Agreement

UNLV Special Collections provides copies of materials to facilitate private study, scholarship, or research. Material not in the public domain may be used according to fair use of copyrighted materials as defined by copyright law. Please cite us.

Please note that UNLV may not own the copyright to these materials and cannot provide permission to publish or distribute materials when UNLV is not the copyright holder. The user is solely responsible for determining the copyright status of materials and obtaining permission to use material from the copyright holder and for determining whether any permissions relating to any other rights are necessary for the intended use, and for obtaining all required permissions beyond that allowed by fair use.

Read more about our reproduction and use policy.

I agree.Information

Digital ID

Permalink

Details

Member of

More Info

Rights

Digital Provenance

Publisher

Transcription

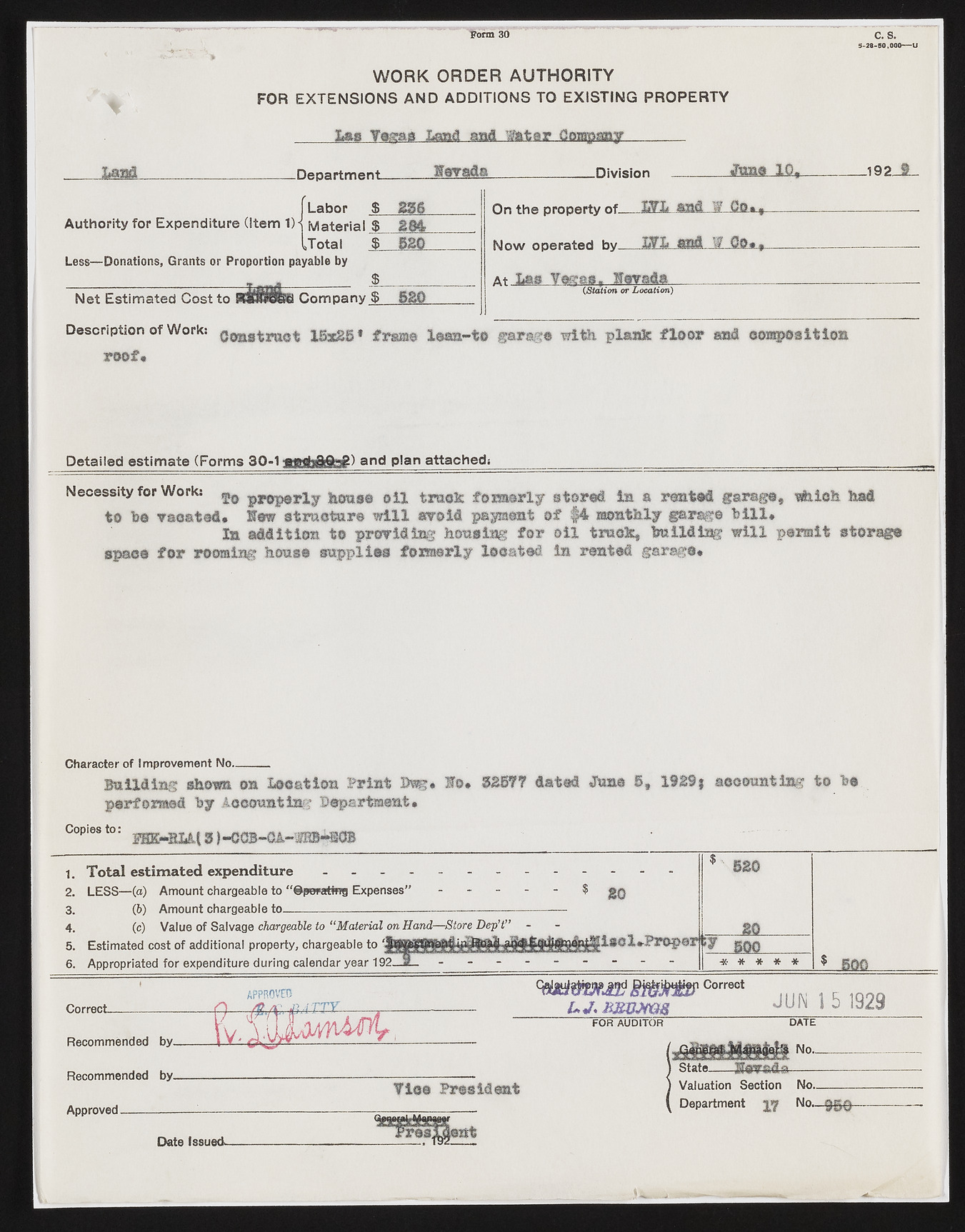

Form 30 C. S. 5-20-90,000-----U W O R K O R D E R A U TH O R IT Y FOR EXTENSIONS AND ADDITIONS TO EXISTING PROPERTY Las Yegas Land and Water Company_____ Land -Department. Kevada Less— Donations, Grants or Proportion payable by .Division June 10, Net Estimated Cost to Description of Work: roof. $ 236 $ 234 $ 520 $ $ 520 On the property of__ L?L sasL y Qo«» Now operated by XiFL mid W C?0. , At Las Yogasr Nevada (Station or Location) .192 _S_ Construct 15x25* frame lean-to gar®go with plank floor and composition Detailed estimate (Forms 30-1; >) and plan attached: Necessity for Work: ^ &oas@ ©11 trank formerly stored in a rented garage, e h ie h had to he ?seated, law structure will avoid payment of |4 monthly In addition to providing housing for garage hill. oil truck, building will permit storage space for rooming house supplies formerly located, in rented garage* Character of Improvement No_____ Building shown on location Print Bw*. Sfo. 32577 dated June 5, 1929§ accounting to he performed hy Accounting Department. Copies to: EHE-HLM 3 )-CCB-OA-$BB*SCB 1. Total estimated expenditure - - - - - - - 2. LESS— (a) Amount chargeable to “©pewrttng Expenses” - 3. (6) Amount chargeable to----------------------------------------------------------- 4. (c) Value of Salvage chargeable to “ Material on Hand—Stare Dep’t” 5. Estimated cost of additional property, chargeable to ‘J 6. Appropriated for expenditure during calendar year 192_ $ 20 ^iacl.Properi;y rjCG 520 20 * * * * * -5.00 APPROVE!) Correct t , 1Q0Q L j . m a m M _________ JLm i o laza FOR AUDITOR Recommended by, Recommended by. Approved------------- Tice President DATE N o - Nevada Date Issued- State- Valuation Section No----------- t Department jy No—QgQ