Copyright & Fair-use Agreement

UNLV Special Collections provides copies of materials to facilitate private study, scholarship, or research. Material not in the public domain may be used according to fair use of copyrighted materials as defined by copyright law. Please cite us.

Please note that UNLV may not own the copyright to these materials and cannot provide permission to publish or distribute materials when UNLV is not the copyright holder. The user is solely responsible for determining the copyright status of materials and obtaining permission to use material from the copyright holder and for determining whether any permissions relating to any other rights are necessary for the intended use, and for obtaining all required permissions beyond that allowed by fair use.

Read more about our reproduction and use policy.

I agree.Information

Digital ID

Permalink

Details

Member of

More Info

Rights

Digital Provenance

Publisher

Transcription

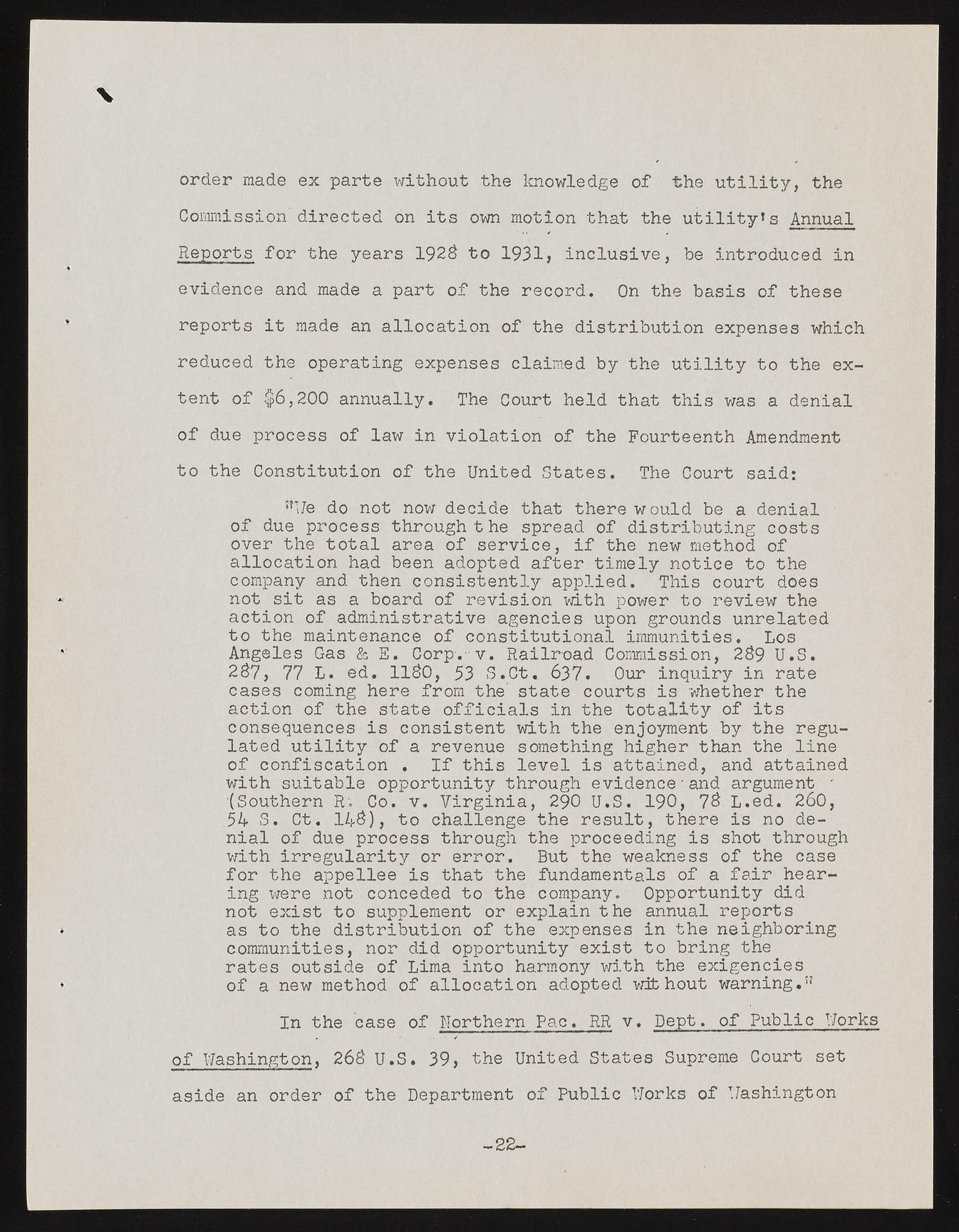

V order made ex parte without the knowledge of the utility, the Commission directed on its own motion that the utility’s Annual Reports for the years 1923 to 1931, inclusive, be introduced in evidence and made a part of the record. On the basis of these reports it made an allocation of the distribution expenses which reduced the operating expenses claimed by the utility to the extent of $6,200 annually. The Court held that this was a denial of due process of law in violation of the Fourteenth Amendment to the Constitution of the United States. The Court said: jjjjg do not now decide that there would be a denial of due process through the spread of distributing costs over the total area of service, if the new method of allocation had been adopted after timely notice to the company and then consistently applied. This court does not sit as a board of revision with power to review the action of administrative agencies upon grounds unrelated to the maintenance of constitutional immunities. Los Angeles Gas & E. Corpvv. Railroad Commission, 239 U.S. 2$7, 77 L. ed. 1130, 53 S.Ct. 637. Our inquiry in rate cases coming here from the’ state courts is whether the action of the state officials in the totality of its consequences is consistent with the enjoyment by the regulated utility of a revenue something higher than the line of confiscation , If this level is attained, and attained with suitable opportunity through evidence and argument ' (Southern R. Co. v. Virginia, 290 U.S. 190, 7$ L.ed. 260, 54 S. Ct. 14$)j to challenge the result, there is no denial of due process through the proceeding is shot through with irregularity or error. But the weakness of the case for the appellee is that the fundamentals of a fair hearing were not conceded to the company. Opportunity did not exist to supplement or explain the annual reports * as to the distribution of the expenses in the neighboring communities, nor did opportunity exist to bring the rates outside of Lima into harmony with the exigencies ? of a new method of allocation adopted without warning.” In the case of Northern Pac. RR v. Dept, of Public TJorks of Washington, 263 U.S. 39, the United States Supreme Court set aside an order of the Department of Public Works of Washington -22-