Copyright & Fair-use Agreement

UNLV Special Collections provides copies of materials to facilitate private study, scholarship, or research. Material not in the public domain may be used according to fair use of copyrighted materials as defined by copyright law. Please cite us.

Please note that UNLV may not own the copyright to these materials and cannot provide permission to publish or distribute materials when UNLV is not the copyright holder. The user is solely responsible for determining the copyright status of materials and obtaining permission to use material from the copyright holder and for determining whether any permissions relating to any other rights are necessary for the intended use, and for obtaining all required permissions beyond that allowed by fair use.

Read more about our reproduction and use policy.

I agree.Information

Digital ID

Permalink

Details

More Info

Rights

Digital Provenance

Publisher

Transcription

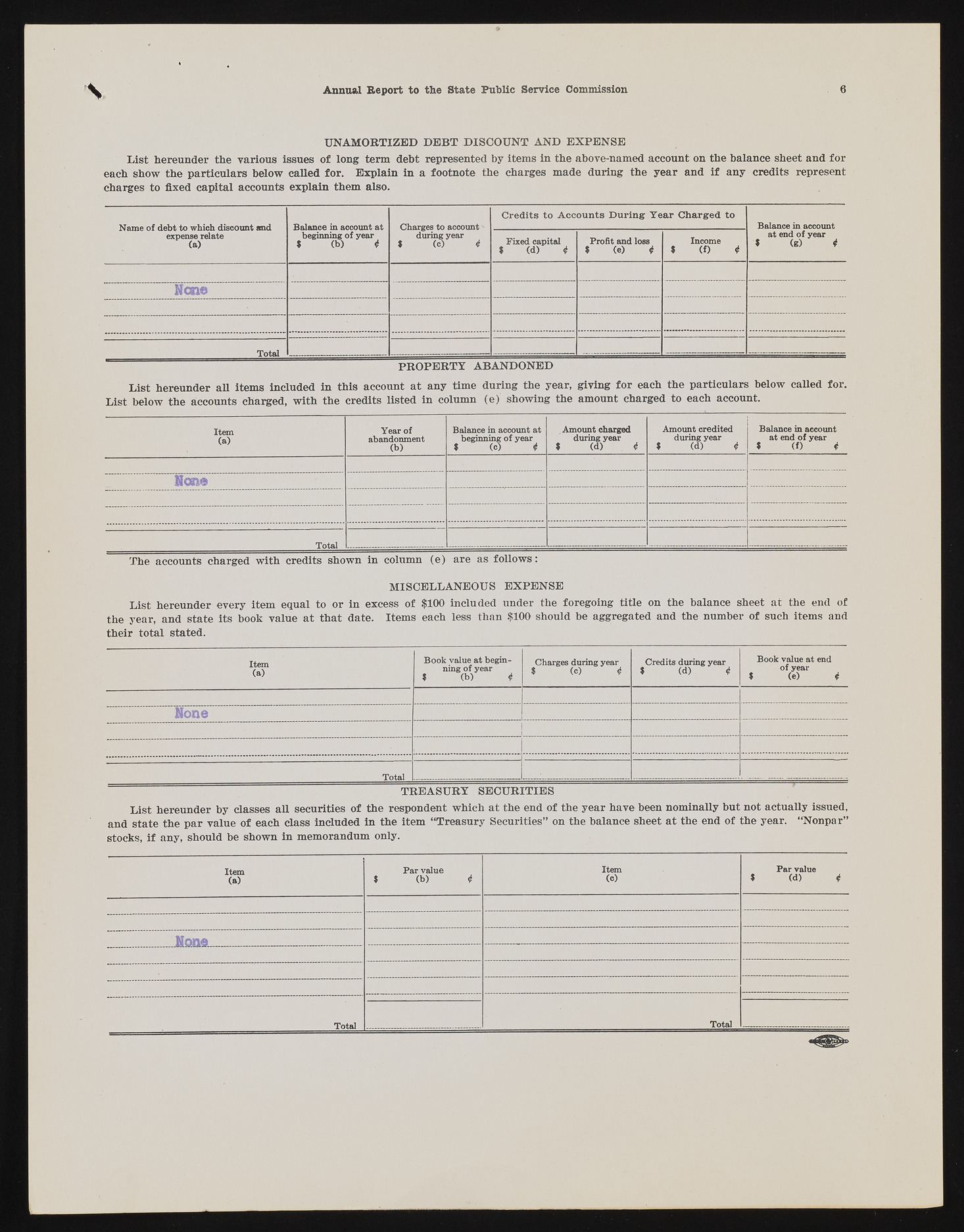

V Annual Report to the State Public Service Commission 6 UNAMORTIZED DEBT DISCOUNT AND EXPENSE List hereunder the various issues of long term debt represented by items in the above-named account on the balance sheet and for each show the particulars below called for. Explain in a footnote the charges made during the year and if any credits represent charges to fixed capital accounts explain them also. Name of debt to which discount and expense relate (a) Balance in account at beginning of year * (b) 4 Charges to account' during year $ (c) 4 C redits to A cco u n ts D u rin g Y e a r C h arged to Balance in account at end of year Fixed capital $ (g) 4 $ (d) 4 Profit and loss $ (e) 4 Income « (f) 4 Ncane Total PROPERTY ABANDONED List hereunder all items included in this account at any time during the year, giving for each the particulars below called for. List below the accounts charged, with the credits listed in column (e) showing the amount charged to each account. Item (a) Year of abandonment (b) Balance in account at beginning of year * (c) <t . Amount charged during year $ (d) , 4 Amount credited during year $ (d) 4 Balance in account at end of year 1 (f) 4 None Total The accounts charged with credits shown in column (e) are as follows: MISCELLANEOUS EXPENSE List hereunder every item equal to or in excess of $100 included under the foregoing title on the balance sheet at the end of the year, and state its book value at that date. Items each less than $100 should be aggregated and the number of such items and their total stated. Item (a) Book value at beginning of year $ (b) 4 Charges during year $ (c) 4 Credits during year $ (d) 4 Book value at end of year $ (e) 4 None Total TREASURY SECURITIES List hereunder by classes all securities of the respondent which at the end of the year have been nominally but not actually issued, and state the par value of each class included in the item “Treasury Securities” on the balance sheet at the end of the year. “Nonpar” stocks, if any, should be shown in memorandum only. Item (a) Par value $ (b) 4 Item (0 Par value * (d) 4 Nona Total Total