Copyright & Fair-use Agreement

UNLV Special Collections provides copies of materials to facilitate private study, scholarship, or research. Material not in the public domain may be used according to fair use of copyrighted materials as defined by copyright law. Please cite us.

Please note that UNLV may not own the copyright to these materials and cannot provide permission to publish or distribute materials when UNLV is not the copyright holder. The user is solely responsible for determining the copyright status of materials and obtaining permission to use material from the copyright holder and for determining whether any permissions relating to any other rights are necessary for the intended use, and for obtaining all required permissions beyond that allowed by fair use.

Read more about our reproduction and use policy.

I agree.Information

Digital ID

Permalink

Details

More Info

Rights

Digital Provenance

Publisher

Transcription

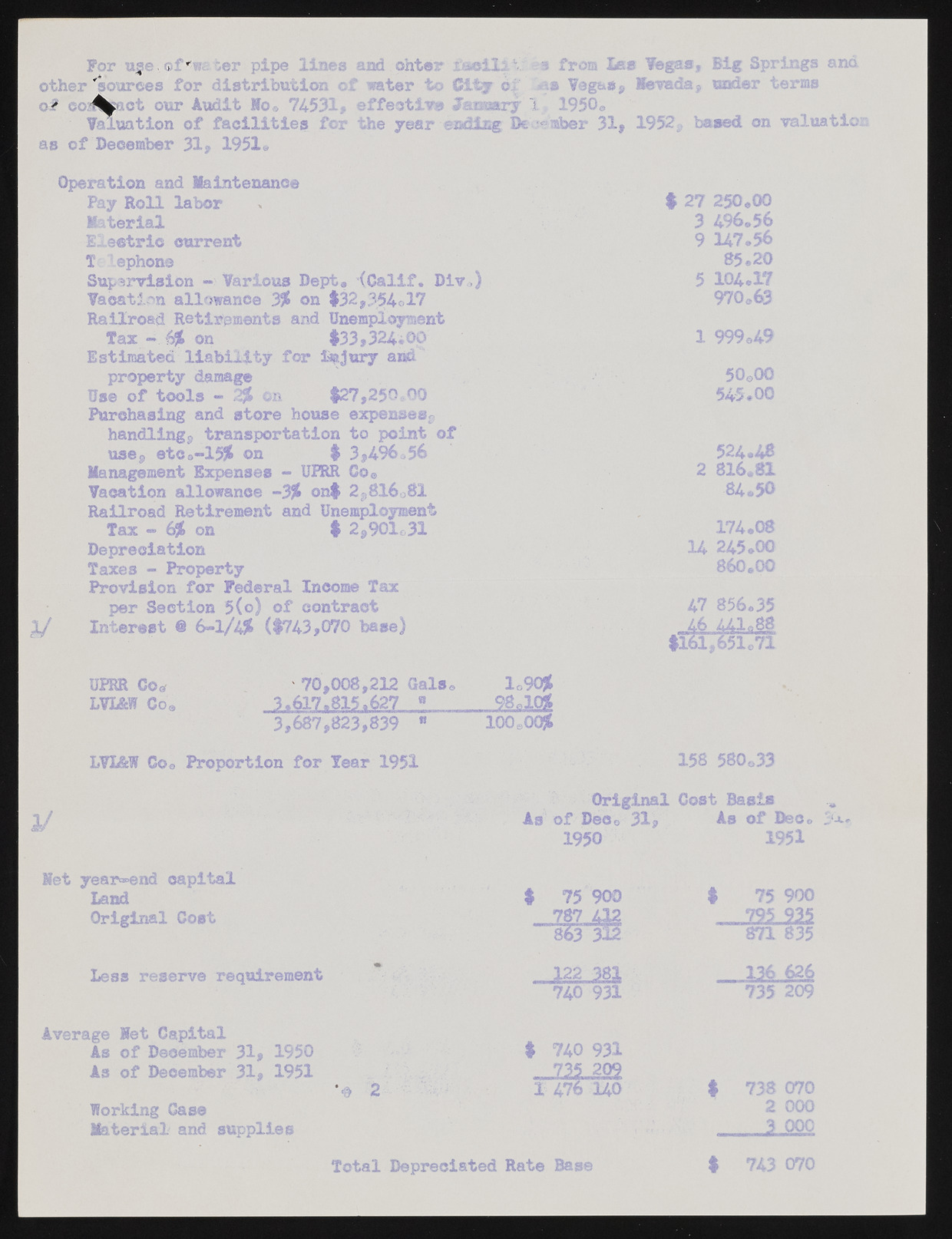

For u$e, of*** other 'sources for distribution of water to City o| <a» Vegas s levada, under terms of co«feaot our Audit Wo,, 7453 Valuation of facilities for the year ending DeWaber 31, 1952;, based on valuation as of December 31, 1951® Operation and Maintenance Pay Roll labor Material Electric current T lephone Supervision - Various Dept. -(Calif. Div>) Vacation allowance 3% on $32,354ol7 Railroad Retirements and Unemployment Tax - 6$ on $33,324iOO Estimated liability for injury and property damage Use of tools - 2$ on $27,250,00 Purchasing and store house expenses*, handling, transportation to point of use, etca-15% on $ 3,496^56 Management Expenses - UFRR Co. Vacation allowance -3% on$ 2,816081 Railroad Retirement and Unemployment Tax - 6% on $ 2,901-31 Depreciation Taxes - Property Provision for Federal Income Tax per Section 5(o) of contract 3/ Interest @ 6-1/4$ ($743,070 base) UPRR Co* 8 70,008,212 Gals. l«90Jt LVL&W Coa 3.617.815.627 »_______ 98»10$ 3,687,823,839 * 100o0<# $ 27 250.00 3 496.56 9 147.56 85.20 5 104.17 970.63 1 999.49 50©00 545.00 524.48 2 816.81 84.50 174.08 14 245.00 860.00 47 856.35 46 411.88 $161,651.71 LVI&W Co. Proportion for Tear 1951 158 580.33 V Met year=end capital Land Original Cost Less reserve requirement Original Cost Basis As of Deo. 31, As of Deo. 1950 1951 1 75 900 $ 75 900 787 412 . 792 215 863 312 871 835 122 381 136 626 740 931 735 209 Average Net Capital As of Deoember 31, 1950 As of Deoember 31, 1951 *? 2 Working Case Material and supplies $ 740 931 735 209 1 476 140 $ 738 070 2 000 3 000 Total Depreciated Rate Base $ 743 070