Copyright & Fair-use Agreement

UNLV Special Collections provides copies of materials to facilitate private study, scholarship, or research. Material not in the public domain may be used according to fair use of copyrighted materials as defined by copyright law. Please cite us.

Please note that UNLV may not own the copyright to these materials and cannot provide permission to publish or distribute materials when UNLV is not the copyright holder. The user is solely responsible for determining the copyright status of materials and obtaining permission to use material from the copyright holder and for determining whether any permissions relating to any other rights are necessary for the intended use, and for obtaining all required permissions beyond that allowed by fair use.

Read more about our reproduction and use policy.

I agree.Information

Digital ID

Permalink

Details

More Info

Rights

Digital Provenance

Publisher

Transcription

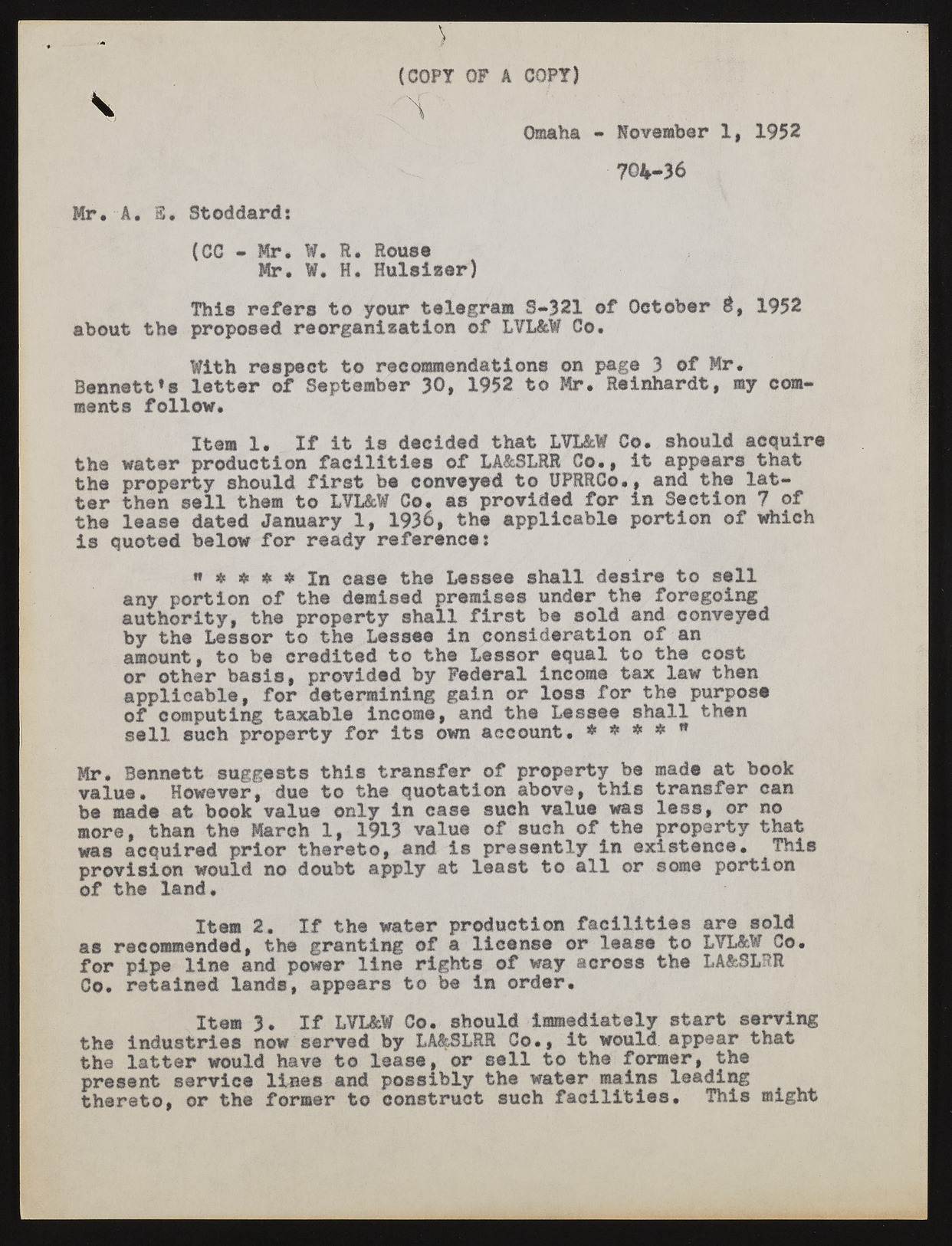

(COPT OF A COPT) I w Omaha - November 1, 1952 704-36 Mr. A, E, Stoddard: (CC • Mr. W. R. Roust Mr. W. H. Hulsiaer) This refers to your taltgraa 8*321 of October 8, 1952 about the proposed reorganisation of LVL&W Co, With respect to recommendations on page 3 of Mr* Bennett’s letter of September 30, 1952 to Mr. Reinhardt, my comments follow. Item 1. If it is decided that LVL&W Co. should acquire the water production facilities of LA&SLRR Co., it appears that the property should first be conveyed to UPRRCo., and the latter then sell them to LVL&W Co. as provided for in Section 7 of the lease dated January 1, 1936, the applicable portion of which is quoted below for ready reference: it # # $ * in case the Lessee shall desire to sell any portion of the demised premises under the foregoing authority, the property shall first be sold and conveyed by the Lessor to the Lessee in consideration of an amount, to be credited to the Lessor equal to the cost or other basis, provided by Federal income tax law then applicable, for determining gain or loss for the purpose of computing taxable income, and the Lessee shall then sell such property for its own account, * * * * w Mr, Bennett suggests this transfer of property be made at book value. However, due to the quotation above, this transfer can be made at book value only in case such value was less, or no more, than the March 1, 1913 value of such of the property that was acquired prior thereto, and is presently in existence. This provision would no doubt apply at least to all or some portion of the land. Item 2. If the water production facilities are sold as recommended, the granting of a license or lease to LVL&W Co. for pipe line and power line rights of way across the LA&SLRR Co. retained lands, appears to be in order. Item 3. If LVL&W Co. should immediately start serving the Industries now served by LA&SLRR Co., it would appear that the latter would have to lease, or sell to the former, the present service lines and possibly the water mains leading thereto, or the former to construct such facilities. This might