Copyright & Fair-use Agreement

UNLV Special Collections provides copies of materials to facilitate private study, scholarship, or research. Material not in the public domain may be used according to fair use of copyrighted materials as defined by copyright law. Please cite us.

Please note that UNLV may not own the copyright to these materials and cannot provide permission to publish or distribute materials when UNLV is not the copyright holder. The user is solely responsible for determining the copyright status of materials and obtaining permission to use material from the copyright holder and for determining whether any permissions relating to any other rights are necessary for the intended use, and for obtaining all required permissions beyond that allowed by fair use.

Read more about our reproduction and use policy.

I agree.Information

Digital ID

Permalink

Details

More Info

Rights

Digital Provenance

Publisher

Transcription

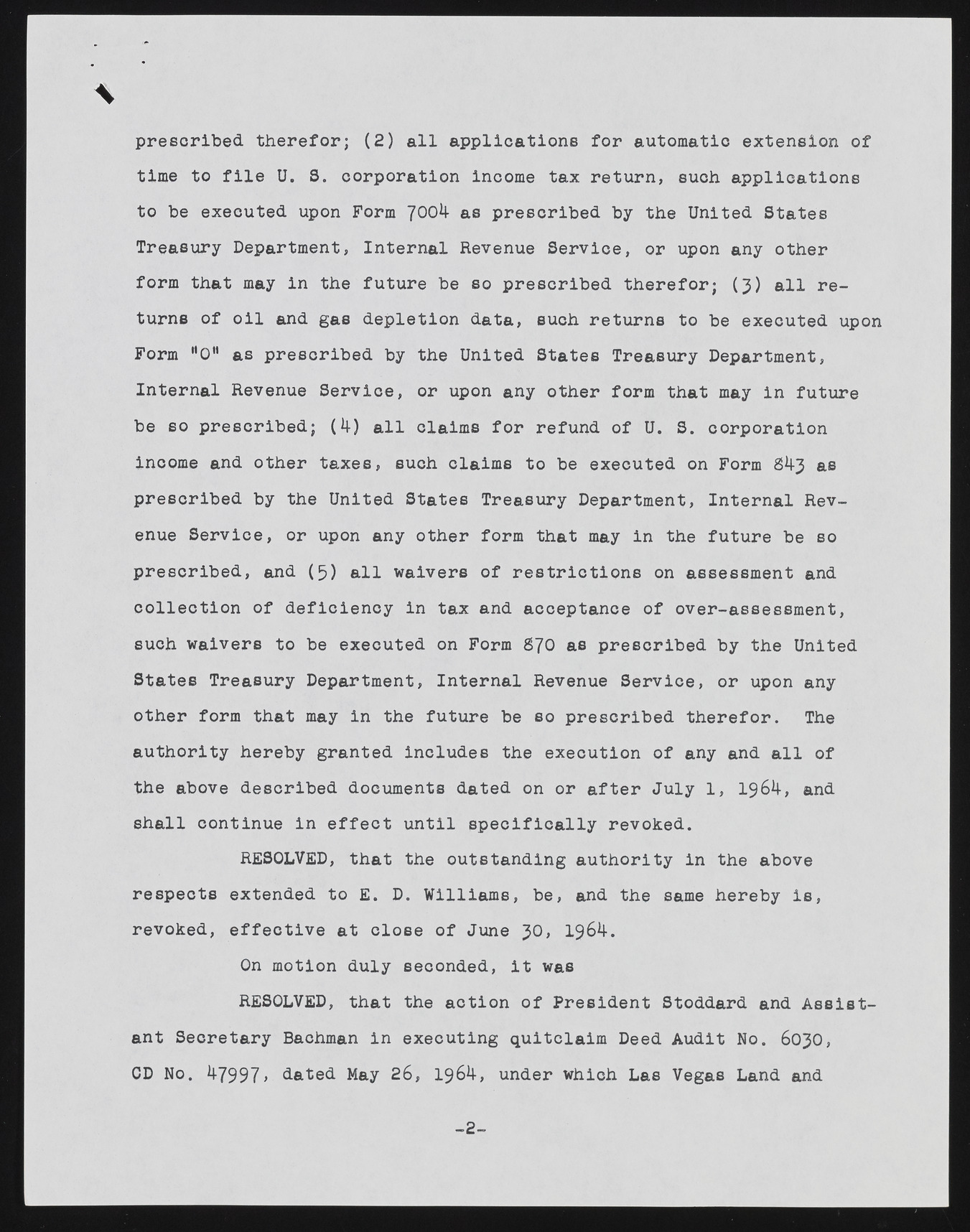

prescribed therefor; (2 ) all applications for automatic extension of time to file U. S. corporation income tax return, such applicatlone to be executed upon Form 700^ as prescribed by the United States Treasury Department, Internal Revenue Service, or upon any other form that may in the future be so prescribed therefor; (3 ) all returns of oil and gas depletion data, such returns to be executed upon Form "0" as prescribed by the United States Treasury Department, Internal Revenue Service, or upon any other form that may in future be so prescribed; (4) all claims for refund of U. S. corporation income and other taxes, such claims to be executed on Form £>43 as prescribed by the United States Treasury Department, Internal Revenue Service, or upon any other form that may in the future be so prescribed, and (5 ) all waivers of restrictions on assessment and collection of deficiency in tax and acceptance of over-assessment, such waivers to be executed on Form 670 as prescribed by the United States Treasury Department, Internal Revenue Service, or upon any other form that may in the future be so prescribed therefor. The authority hereby granted includes the execution of any and all of the above described documents dated on or after July 1, 1964, and shall continue in effect until specifically revoked. RESOLVED, that the outstanding authority in the above respects extended to E. D. Williams, be, and the same hereby is, revoked, effective at close of June 30, 1964. On motion duly seconded, it was RESOLVED, that the action of President Stoddard and Assistant Secretary Bachman in executing quitclaim Deed Audit No. 6030, CD No. 47997> dated May 26, 1964, under which Las Vegas Land and - 2 -