Copyright & Fair-use Agreement

UNLV Special Collections provides copies of materials to facilitate private study, scholarship, or research. Material not in the public domain may be used according to fair use of copyrighted materials as defined by copyright law. Please cite us.

Please note that UNLV may not own the copyright to these materials and cannot provide permission to publish or distribute materials when UNLV is not the copyright holder. The user is solely responsible for determining the copyright status of materials and obtaining permission to use material from the copyright holder and for determining whether any permissions relating to any other rights are necessary for the intended use, and for obtaining all required permissions beyond that allowed by fair use.

Read more about our reproduction and use policy.

I agree.Information

Digital ID

Permalink

Details

More Info

Rights

Digital Provenance

Publisher

Transcription

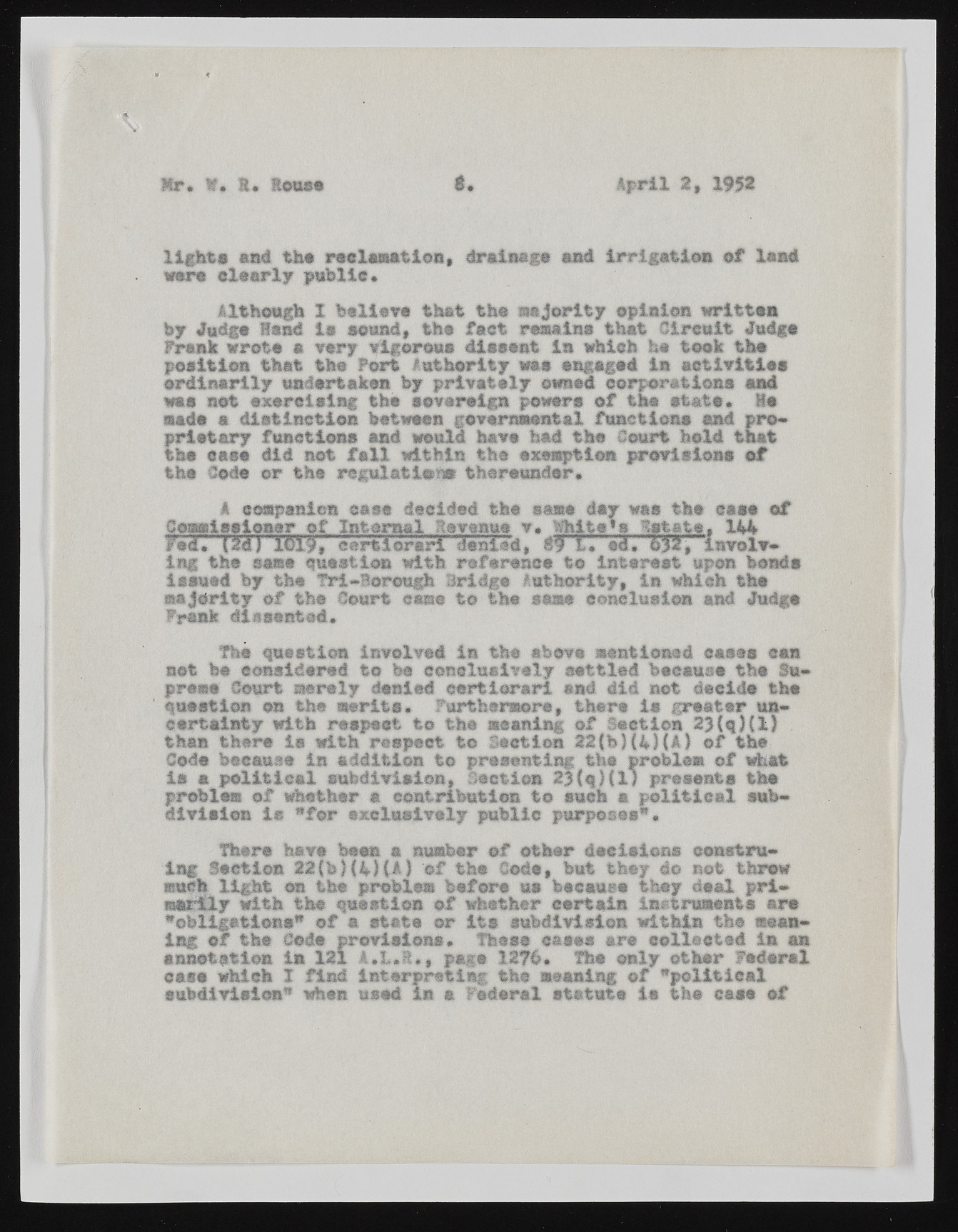

Hr* SU louse $ April 2, 1953 light® and the reclamation, drainage and irrigation of land were dearly public• Although X believe that th® majority opinion wrltt®*i by Judge Hand 1® sound, the feet remain® that Circuit Judge Frank wrot® a very vigorous dissent in which h« took th® position that the Fort Authority was engaged in activities ordinarily undertaken by privately owned corporations and was not exercising th® sovereign powers of the state• He mad® a distinction between governmental function® and pro* prietary functions and would have bad the Court hold that th® eas® did not fall within the exemption provisions of the Code or the regulations thereunder* A companion case decided the same day was tbs case of Commissioner of Internal levenue v. n r..darreis, ass®, «Wrhti:t e'«<si .Estate. 144 lug the same question with reference to interest upon bonds issued by the l^ri-Borough Bridge Authority, in which tha majority of the Court came to th© same conclusion and Judge Frank dissented* The question involved in the above mentioned cases eas not be considered to be conclusively settled because the Su* pram® Court merely denied certiorari and did not decide the question on the merits* furthermore, there is greater un* csrtainty with respect to the meaning of Section 23{q){l) than there is with respect to Section 22(b)(4)(A) of the Code because in addition to presenting the problem of what is a political subdivision, Section ifClKl) presents ths problem of whether a contribution to such a political sub* division is "for exclusively public purposes"• There have been a number of other decisions coiastru* lug Section 22(b)(4)(A) of the Code, but they do not throw much light on the problem before us became* they deal pri* msrily with the question of whether certain instruments are "obligations" of a state or its subdivision within the mean* lag of the Code provisions• These cases are collected in an annotation in 121 A,L*t*., page 1276* The only other federal csss which X find interpreting the meaning of "political subdivision" when used in a Federal statute is the case of