Copyright & Fair-use Agreement

UNLV Special Collections provides copies of materials to facilitate private study, scholarship, or research. Material not in the public domain may be used according to fair use of copyrighted materials as defined by copyright law. Please cite us.

Please note that UNLV may not own the copyright to these materials and cannot provide permission to publish or distribute materials when UNLV is not the copyright holder. The user is solely responsible for determining the copyright status of materials and obtaining permission to use material from the copyright holder and for determining whether any permissions relating to any other rights are necessary for the intended use, and for obtaining all required permissions beyond that allowed by fair use.

Read more about our reproduction and use policy.

I agree.Information

Digital ID

Permalink

Details

More Info

Rights

Digital Provenance

Publisher

Transcription

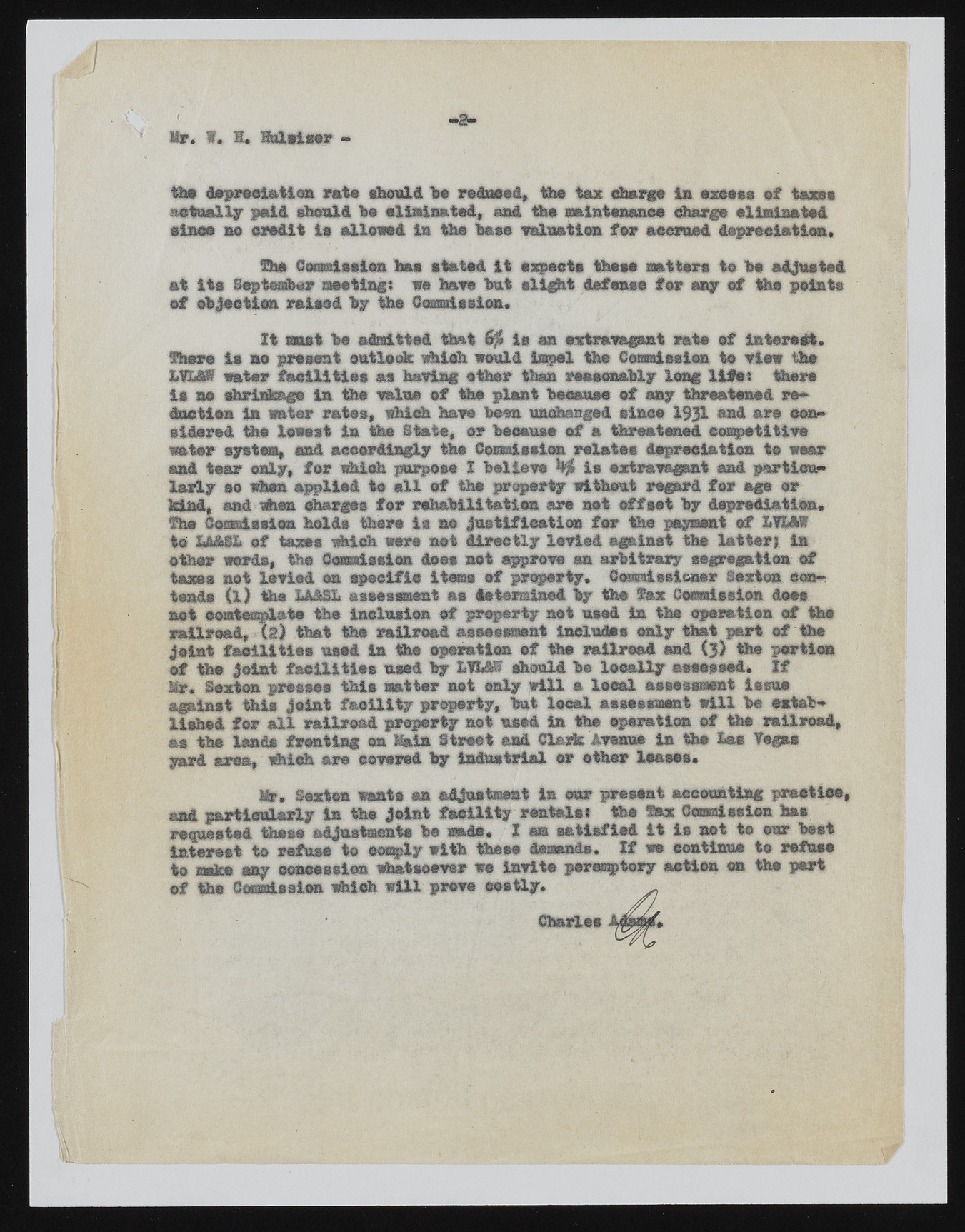

Mr. 9. H. Hulwiser * -2 - the depreelation rate should be reduced, the tax Charge in excess af taxaa actually paid should ha eliminated, and the maintenance sfcarge eliminated since no credit la sllewed l a the haea valuation fa r aeernad depreciation. The Commission has stated i t expects thaaa matters to ha adjusted at ite September seating} we hare hut slight defense for any of the points of objection raieed by the CoBsaission. It must ha admitted that la an extravagant rata of lettered!, there is no present outlook which would impel the Commission to view the LVL&f water fa c ilitie s as having other than reasonably long life * there is ns shrinkage in the wains of the plant because at any threatened re* doe ties in water rates, which hare been unchanged since l# | l and are con* eidsred the lowest in the State, or because ef a threatened coapetltive water system, and accordingly the Commission relates depreciation to wear and tear only, for which purpose 1 haliers kji is extravagant and particula rly so than applied to a ll of the property without regard for age or kind, and when Charges fo r rehabilitation are not offset by deprediatien. The Ceaadssiea holds there is no justification for the payasnt of LVXAi to Lft&SL of taxes which wars net directly levied against the latter} in other words, the Commission does not approve an arbitrary segregation of taxes not loried on specific items of property. Commissioner Sexton eon-teade ( l ) the I J M t aseeswaent as deteralned by t&@ fax Commission dots net contemplate the inclusion of property not used in the operation ef the railroad. (2) that the railroad assessment includes only that part of the joint fa c ilitie s used in the operation of the railroad and ( 3 ) tho portion of tho joint fa c ilitie s used by LVh«8 should be locally assessed. I f Mr. Sexton presses this matter n o t only w ill a local assessment issue against thie joint fac ility property, but local assessment w ill be extab-* llshed for a ll railroad property not used in ths operation of the railroad, as the lands fronting on Main Street and CUsfe Arenas in the Las Vegas yard area, which are covered by industrial or ether leases. Mr. Sexton wants an adjustment In cur present accounting practise, and particularly in the joint fac ility rentals} ths fax Commission has requests* these adjustments be made. I m satisfied it is not to our best interest to refuse to comply with theee dasmnds. I f we continue to refuse to »»*«> any concession whatsoever we invite peremptory action on the pert of the Commission which w ill prove costly. - Charles *