Copyright & Fair-use Agreement

UNLV Special Collections provides copies of materials to facilitate private study, scholarship, or research. Material not in the public domain may be used according to fair use of copyrighted materials as defined by copyright law. Please cite us.

Please note that UNLV may not own the copyright to these materials and cannot provide permission to publish or distribute materials when UNLV is not the copyright holder. The user is solely responsible for determining the copyright status of materials and obtaining permission to use material from the copyright holder and for determining whether any permissions relating to any other rights are necessary for the intended use, and for obtaining all required permissions beyond that allowed by fair use.

Read more about our reproduction and use policy.

I agree.Information

Digital ID

Permalink

More Info

Rights

Digital Provenance

Publisher

Transcription

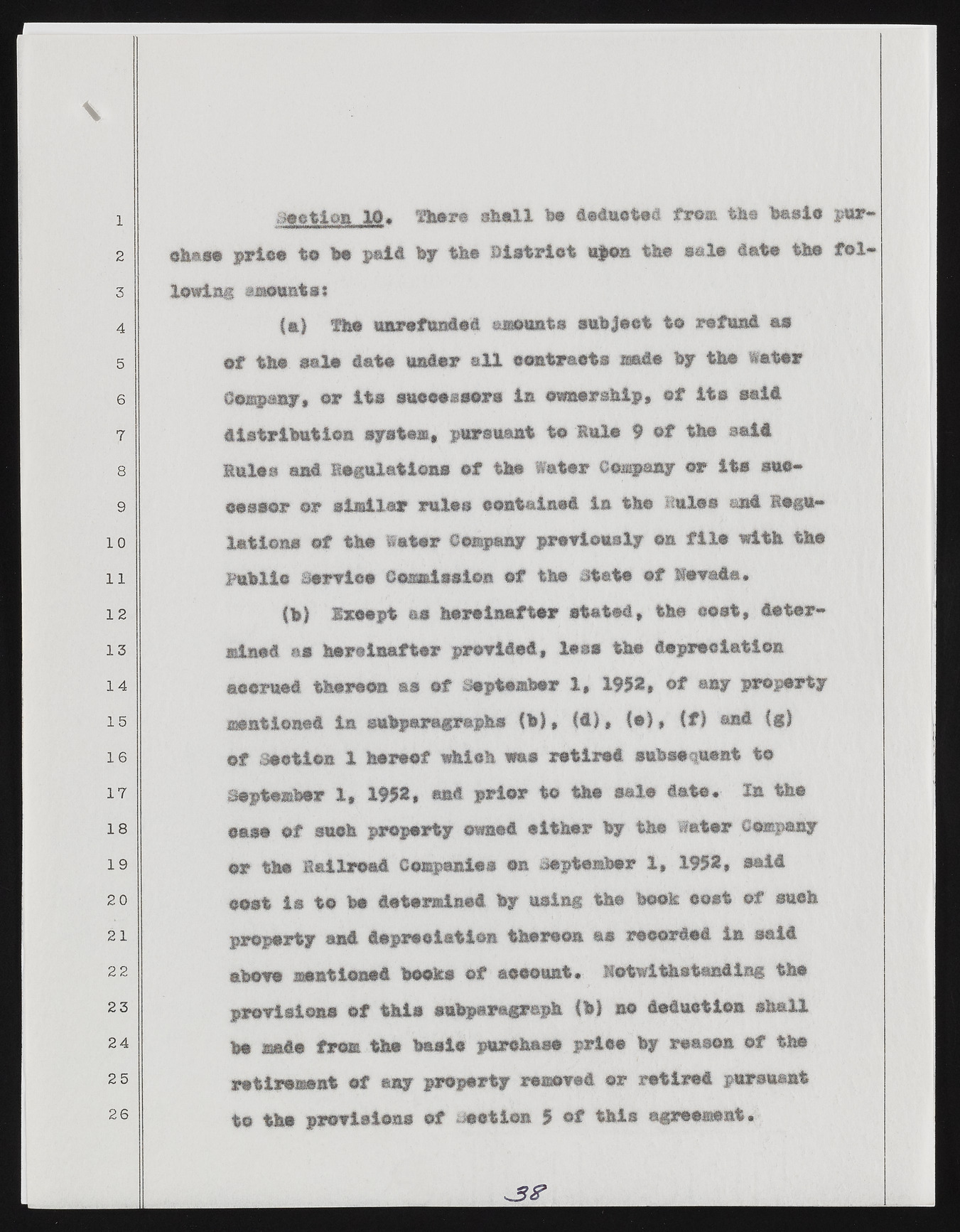

1 2 3 4 5 6 7 8 9 10 11 12 1 3 1 4 1 5 1 6 1 7 1 8 1 9 20 21 22 2 3 2 4 2 5 2 6 io a 1 0 , r£her® shell fee d e d u c te d fr o m th e b a s i c p w r-ehas ® p r ic e t o b e p a id b y t h e C i a t r l e t u p o n t h e sa l® d a t e th e f o l lo w in g s n m k IHM ( a ) The a n r e f U B d e d am ounts s u b l e t t© r e fu n d a s o f th e s a l© l a t e t u t o r a l l e o lit r a c t s a to o b y th e i s t e r Com pany, o r It ® m s&m &m m i n o w n e r s h ip , o f i t © s a i d d i s t r i b u t i o n sy ste m , p u rs u a n t t o 1 m l# 9 o f th e s a i l lm l# a am t l e g u l a t l o n s o f th e f e t o r Company o r i t s s u c c e s s o r o r s i m i l a r r u l e s e t o t e in s A l a th e tm lo s s a l l o g * - l o t i o n s o f th e i n t e r Company p r e v i o u s ly ©a f i l # w it h th e M b i t © S e r v ic e OmmimX&m © f th e t o s t # o f l e v e l # • fb) Ireept as hereinafter stated, the tost, determined as hereinafter provided, lees the depreciation accrued thereon as of September 1, w % of any property mentioned in subparagraphs (b), (d), (e), (#1 end Cl) of Section 1 hereof which was retired subsequent to September 1, 1952, and prior to the sale into* la the ease of sueh property owned either by the inter Company or the lailrosd Companies on September 1, 1952, sold sent is to be determined by using the booh tost of sueh property and depreelation thereon m recorded in said above mentioned books of account. Motwi the tendlag the provisions of this subparagraph (b) no deduction shall be made from the basic purchase price by reason of the retirement of any property removed or retired pursuant to the provisions of ....section 5 of this agreement*