Copyright & Fair-use Agreement

UNLV Special Collections provides copies of materials to facilitate private study, scholarship, or research. Material not in the public domain may be used according to fair use of copyrighted materials as defined by copyright law. Please cite us.

Please note that UNLV may not own the copyright to these materials and cannot provide permission to publish or distribute materials when UNLV is not the copyright holder. The user is solely responsible for determining the copyright status of materials and obtaining permission to use material from the copyright holder and for determining whether any permissions relating to any other rights are necessary for the intended use, and for obtaining all required permissions beyond that allowed by fair use.

Read more about our reproduction and use policy.

I agree.Information

Digital ID

Permalink

Details

More Info

Rights

Digital Provenance

Publisher

Transcription

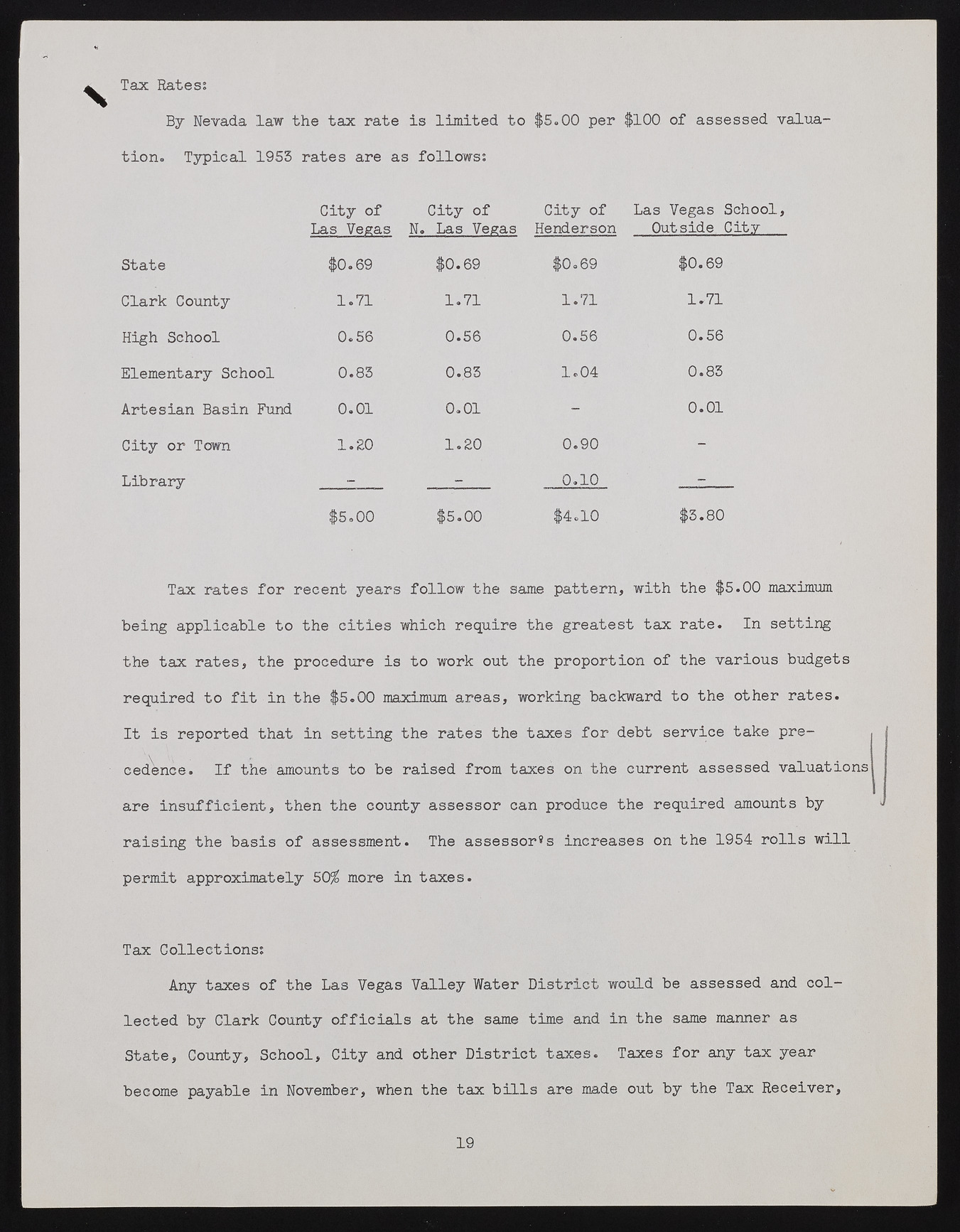

Tax Rates; By Nevada law the tax rate is limited to $5.00 per $100 of assessed valua- V tion. Typical 1953 rates are as follows; City of City of City of Las Vegas Schoc Las Vegas N. Las Vegas Henderson Outside City State $0.69 $0.69 $0.69 $0.69 Clark County 1.71 1.71 1.71 1.71 High School 0.56 0.56 0.56 0.56 Elementary School 0.83 0.83 1.04 0.83 Artesian Basin Fund 0.01 0.01 - 0.01 City or Town 1.20 1.20 0.90 - Library _ 0.10 — $5.00 $5.00 $4.10 $3.80 Tax rates for recent years follow the same pattern, with the $5.00 maximum being applicable to the cities which require the greatest tax rate. In setting the tax rates, the procedure is to work out the proportion of the various budgets required to fit in the $5.00 maximum areas, working backward to the other rates. It is reported that in setting the rates the taxes for debt service take precedence. If the amounts to be raised from taxes on the current assessed valuations are insufficient, then the county assessor can produce the required amounts by >? raising the basis of assessment. The assessor's increases on the 1954 rolls will permit approximately 50% more in taxes. Tax Collections; Any taxes of the Las Vegas Valley Water District would be assessed and collected by Clark County officials at the same time and in the same manner as State, County, School, City and other District taxes. Taxes for any tax year become payable in November, when the tax bills are made out by the Tax Receiver, 19