Copyright & Fair-use Agreement

UNLV Special Collections provides copies of materials to facilitate private study, scholarship, or research. Material not in the public domain may be used according to fair use of copyrighted materials as defined by copyright law. Please cite us.

Please note that UNLV may not own the copyright to these materials and cannot provide permission to publish or distribute materials when UNLV is not the copyright holder. The user is solely responsible for determining the copyright status of materials and obtaining permission to use material from the copyright holder and for determining whether any permissions relating to any other rights are necessary for the intended use, and for obtaining all required permissions beyond that allowed by fair use.

Read more about our reproduction and use policy.

I agree.Information

Digital ID

Permalink

Details

More Info

Rights

Digital Provenance

Publisher

Transcription

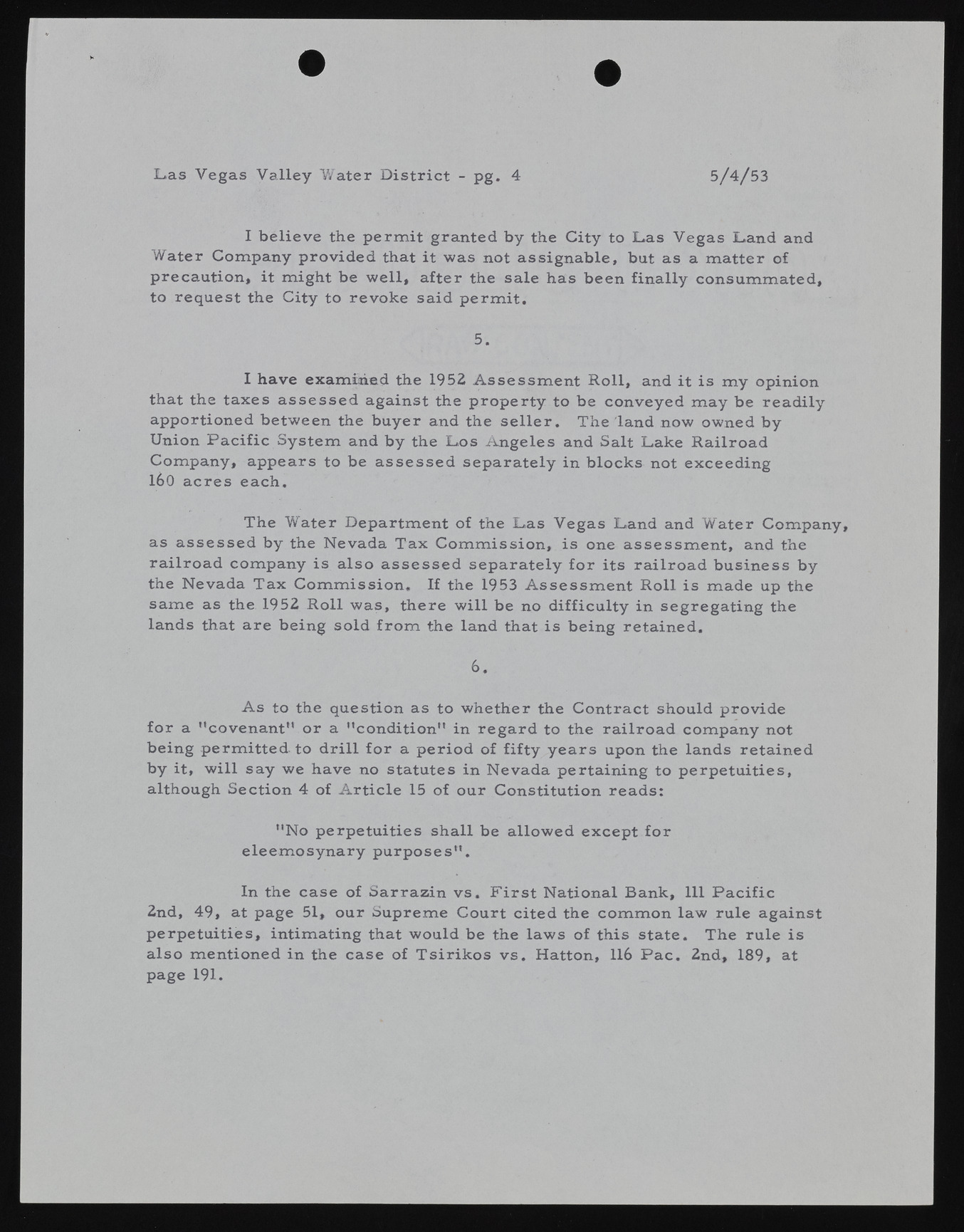

L a s Vegas Valley W ater D istrict - pg. 4 5 /4 /5 3 I believe the permit granted by the City to Las Vegas Land and Water Company provided that it was not assignable, but as a m atter of precaution, it might be well, after the sale has been finally consummated, to request the City to revoke said permit. 5. I have examined the 1952 Assessment Roll, and it is my opinion that the taxes assessed against the property to be conveyed may be readily apportioned between the buyer and the seller. The land now owned by Union Pacific System and by the Los Angeles and Salt Lake Railroad Company, appears to be assessed separately in blocks not exceeding 160 acres each. The Water Department of the Las Vegas Land and Water Company, as assessed by the Nevada Tax Commission, is one assessm ent, and the railroad company is also assessed separately for its railroad business by the Nevada Tax Commission. If the 1953 Assessment Roll is made up the same as the 1952 Roll was, there will be no difficulty in segregating the lands that are being sold from the land that is being retained. 6, As to the question as to whether the Contract should provide for a "covenant*' or a "condition" in regard to the railroad company not being permitted to drill for a period of fifty years upon the lands retained by it, will say we have no statutes in Nevada pertaining to perpetuities, although Section 4 of Article 15 of our Constitution reads: "No perpetuities shall be allowed except for eleemosynary purposes". In the case of Sarrazin vs. F irs t National Bank, 111 Pacific 2nd, 49, at page 51, our Supreme Court cited the common law rule against perpetuities, intimating that would be the laws of this state. The rule is also mentioned in the case of Tsirikos vs. Hatton, 116 P a c. 2nd, 189, at page 191.