Copyright & Fair-use Agreement

UNLV Special Collections provides copies of materials to facilitate private study, scholarship, or research. Material not in the public domain may be used according to fair use of copyrighted materials as defined by copyright law. Please cite us.

Please note that UNLV may not own the copyright to these materials and cannot provide permission to publish or distribute materials when UNLV is not the copyright holder. The user is solely responsible for determining the copyright status of materials and obtaining permission to use material from the copyright holder and for determining whether any permissions relating to any other rights are necessary for the intended use, and for obtaining all required permissions beyond that allowed by fair use.

Read more about our reproduction and use policy.

I agree.Information

Digital ID

Permalink

Details

Member of

More Info

Rights

Digital Provenance

Publisher

Transcription

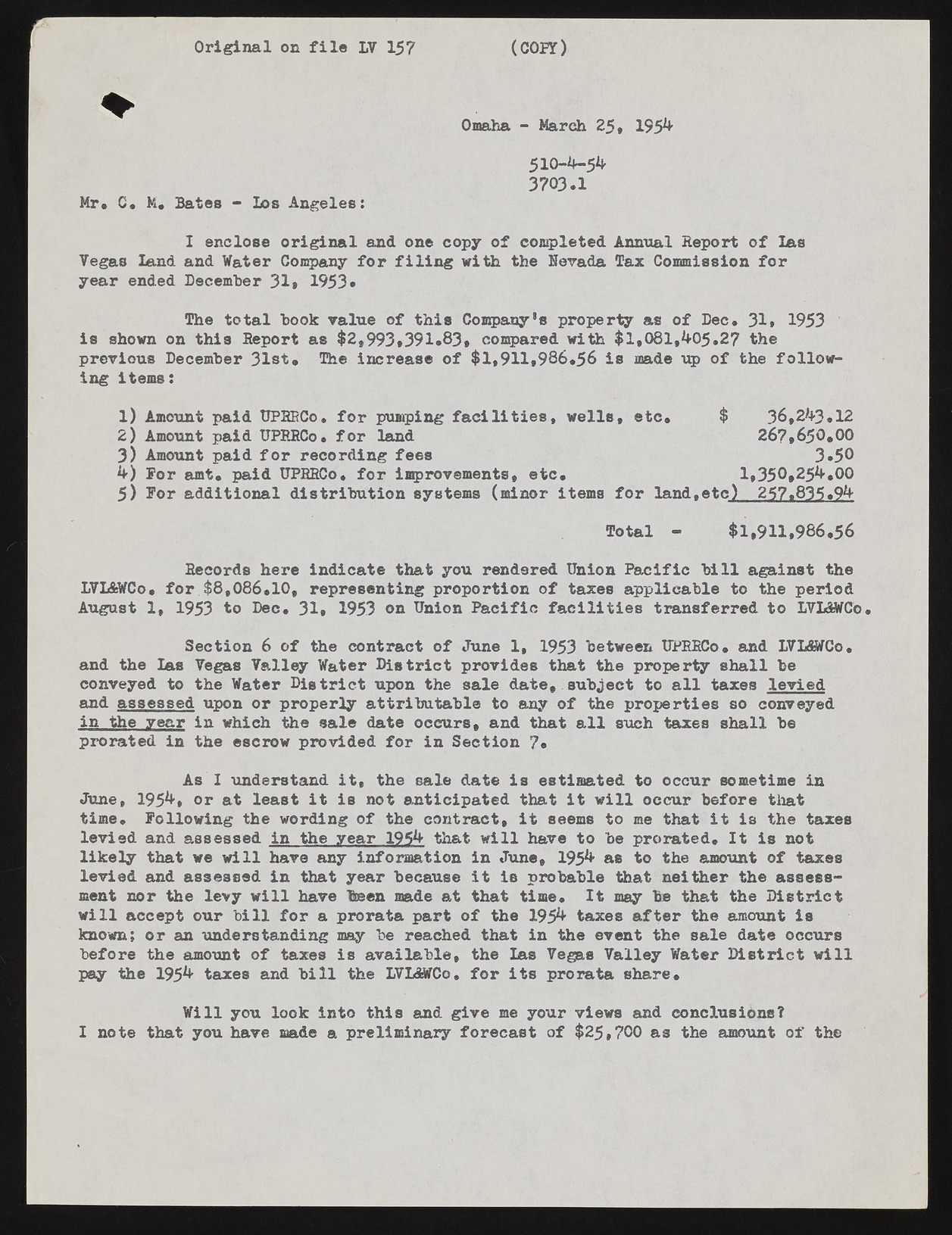

O r ig in a l on f i l e LV 157 (COPY) Omaha - March 25» 195^ 510-4-5^ 3703.1 Mr. C. M. Bates - Los Angeles: I enclose original and one copy of completed Annual Report of las Yegas land and Water Company for filing with the Nevada Tax Commission for year ended December 31» 1953. The total book value of this Company's property as of Dec. 31» 1953 is shown on this Report as $2,993,391.83, compared with $1,081,4'05.27 the previous December 31st. The increase of $1,911,986.56 is made up of the following items: 1) Amount paid tJPRRCo. for pumping facilities, wells, etc. $ 36.2h3.12 2) Amount paid TJPRRCo. for land 267,650.00 3) Amount paid for recording fees 3.50 h) For amt. paid tJPRRCo. for improvements, etc. 1,350,25^.00 5) For additional distribution systems (minor items for land.etc) 257.835.9h Total - $1,911,986,56 Records here indicate that you rendered Union Pacific bill against the LVLSiWCo. for $8,086.10, representing proportion of taxes applicable to the period August 1, 1953 to Dec. 31, 1953 on Union Pacific facilities transferred to IVLSWCo Section 6 of the contract of June 1, 1953 between UPRRCo. and LVLSWCo. and the las Yegas Yalley Water District provides that the property shall be conveyed to the Water District upon the sale date, subject to all taxes levied and assessed upon or properly attributable to any of the properties so conveyed in the year in which the sale date occurs, and that all such taxes shall be prorated in the escrow provided for in Section 7. As I understand it, the sale date is estimated to occur sometime in June, 195^, or at least it is not anticipated that it will occur before that time. Following the wording of the contract, it seems to me that it is the taxes levied and assessed in the year 195^ that will have to be prorated. It is not likely that we will have any information in June, 195^ as to the amount of taxes levied and assessed in that year because it is probable that neither the assessment nor the levy will have been made at that time. It may he that the District will accept our bill for a prorata part of the 195^ taxes after the amount is known; or an understanding may be reached that in the event the sale date occurs before the amount of taxes is available, the las Vegas Valley Water District will pay the 195^ taxes and bill the LVLSfcWCo. for its prorata share. Will you look into this and give me your views and conclusions? I note that you have made a preliminary forecast of $25,700 as the amount of the