Copyright & Fair-use Agreement

UNLV Special Collections provides copies of materials to facilitate private study, scholarship, or research. Material not in the public domain may be used according to fair use of copyrighted materials as defined by copyright law. Please cite us.

Please note that UNLV may not own the copyright to these materials and cannot provide permission to publish or distribute materials when UNLV is not the copyright holder. The user is solely responsible for determining the copyright status of materials and obtaining permission to use material from the copyright holder and for determining whether any permissions relating to any other rights are necessary for the intended use, and for obtaining all required permissions beyond that allowed by fair use.

Read more about our reproduction and use policy.

I agree.Information

Digital ID

Permalink

Details

More Info

Rights

Digital Provenance

Publisher

Transcription

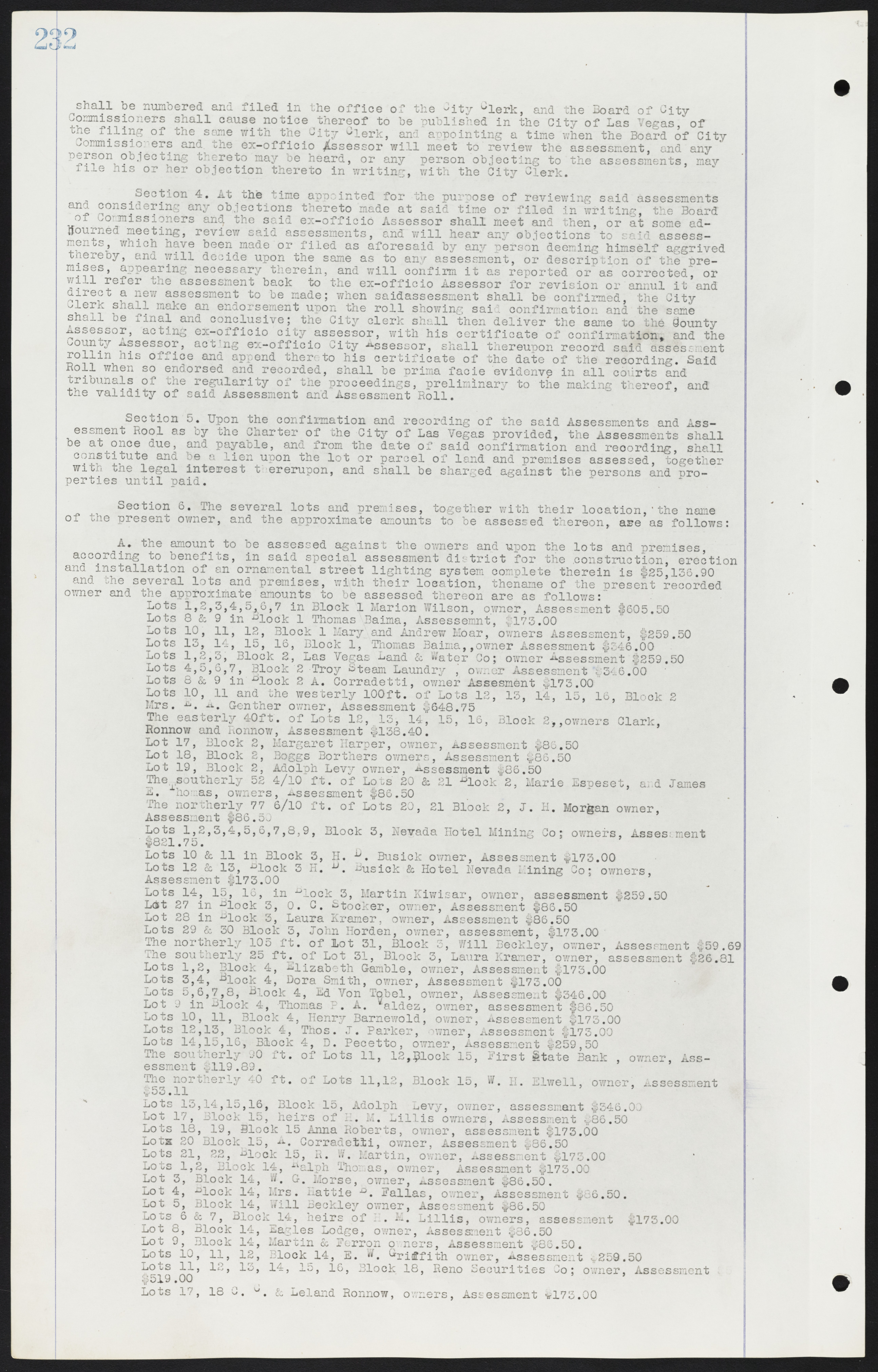

shall be numbered and filed in the office of the City Clerk, and the Board of City Commissioners shall cause notice thereof to be published in the City of Las Vegas of the filing of the same with the City Clerk, and appointing a time when the Board of City Commissioners and the ex-officio Assessor will meet to review the assessment, and any person objecting thereto may be heard, or any person objecting to the assessments, may file his or her objection thereto in writing, with the City Clerk. Section 4. At the time appointed for the purpose of reviewing said assessments and considering any objections thereto made at said time or filed in writing the Board of Commissioners and the said ex-officio Assessor shall meet and then, or at some adjourned meeting, review said assessments, and will hear any objections to said assessments, which have been made or filed as aforesaid by any person deeming himself aggrieved thereby, and will decide upon the same as to any assessment, or description of the premises, appearing necessary therein, and will confirm it as reported or as corrected, or will refer the assessment back to the ex-officio Assessor for revision or annul it and direct a new assessment to be made; when said assessment shall be confirmed, the City Clerk shall make an endorsement upon the roll showing said confirmation and the same shall be final and conclusive; the City clerk shall then deliver the same to the County Assessor, acting ex-officio city assessor, with his certificate of confirmation, and the County Assessor, acting ex-officio City Assessor, shall thereupon record said assessment rollin his office and append thereto his certificate of the date of the recording. Said Roll when so endorsed and recorded, shall be prima facie evidence in all courts and tribunals of the regularity of the proceedings, preliminary to the making thereof, and the validity of said Assessment and Assessment Roll. Section 5. Upon the confirmation and recording of the said Assessments and Assessment Roll as by the Charter of the City of Las Vegas provided, the Assessments shall be at once due, and payable, and from the date of said confirmation and recording, shall constitute and be a lien upon the lot or parcel of land and premises assessed, together with the legal interest thereupon, and shall be charged against the persons and properties until paid. Section 6. The several lots and premises, together with their location, the name of the present owner, and the approximate amounts to be assessed thereon, are as follows: A. the amount to be assessed against the owners and upon the lots and premises, according to benefits, in said special assessment district for the construction, erection and installation of an ornamental street lighting system complete therein is $25,136.90 and the several lots and premises, with their location, the name of the present recorded owner and the approximate amounts to be assessed thereon are as follows: Lots 1, 2, 3,4, 5, 6, 7 in Block 1 Marion Wilson, owner, Assessment $605.50 Lots 8 & 9 in Block 1 Thomas Baima, Assessment, $173.00 Lots 10, 11, 12, Block 1 Mary and Andrew Moar, owners Assessment, $259.50 Lots 13, 14, 15, 16, Block 1, Thomas Baima, owner Assessment $346.00 Lots 1, 2, 3, Block 2, Las Vegas Land & Water Co; owner Assessment $259.50 Lots 4, 5, 6, 7, Block 2 Troy Steam Laundry, owner Assessment $346.00 Lots 8 & 9 in Block 2 A. Corradetti, owner Assessment $173.00 Lots 10, 11 and the westerly 100ft. of Lots 12, 13, 14, 15, 16, Block 2 Mrs. E. A. Genther owner, Assessment $648.75 The easterly 40ft. of Lots 12, 13, 14, 15, 16, Block 2, owners Clark, Ronnow and Ronnow, Assessment $138.40. Lot 17, Block 2, Margaret Harper, owner, Assessment $86.50 Lot 18, Block 2, Boggs Brothers owners, Assessment $86.50 Lot 19, Block 2, Adolph Levy owner, Assessment $86.50 The southerly 52 4/10 ft. of Lots 20 & 21 Block 2, Marie Espeset, and James E. Thomas, owners, Assessment $86.50 The northerly 77 6/10 ft. of Lots 20, 21 Block 2, J. H. Morgan owner, Assessment $86.50 Lots 1, 2, 3, 4, 5, 6, 7, 8, 9, Block 5, Nevada Hotel Mining Co; owners, Assessment $821.75. Lots 10 & 11 in Block 3, H. B. Busick owner, Assessment $173.00 Lots 12 & 13, Block 3 H. D. Busick & Hotel Nevada Mining Co; owners, Assessment $173.00 Lots 14, 15, 16, in Block 3, Martin Kiwisar, owner, assessment $259.50 Lot 27 in Block 3, O. C. Stocker, owner, Assessment $86.50 Lot 28 in Block 3, Laura Kramer, owner, Assessment $86.50 Lots 29 & 30 Block 3, John Horden, owner, assessment, $173.00 The northerly 105 ft. of Lot 31, Block 3, Will Beckley, owner, Assessment $59.69 The southerly 25 ft. of Lot 31, Block 3, Laura Kramer, owner, assessment $26.81 Lots 1, 2, Block 4, Elizabeth Gamble, owner, Assessment $173.00 Lots 3, 4, Block 4, Dora Smith, owner, Assessment $173.00 Lots 5, 6, 7, 8, Block 4, Ed Von Tobel, owner, Assessment $346.00 Lot 9 in Block 4, Thomas P. A. Valdez, owner, assessment $86.50 Lots 10, 11, Block 4, Henry Barnewold, owner, Assessment $173.00 Lots 12, 13, Block 4, Thos. J. Parker, owner, Assessment $173.00 Lots 14, 15, 16, Block 4, D. Pecetto, owner, Assessment $259.50 The southerly 90 ft. of Lots 11, 12, Block 15, First State Bank, owner, Assessment $119.89. The northerly 40 ft. of Lots 11,12, Block 15, W. H. Elwell, owner, Assessment $53.11 Lots 13, 14, 15, 16, Block 15, Adolph Levy, owner, assessment $346.00 Lot 17, Block 15, heirs of H. M. Lillis owners, Assessment $86.50 Lots 18, 19, Block 15 Anna Roberts, owner, assessment $173.00 Lots 20 Block 15, A. Corradetti, owner, Assessment $86.50 Lots 21, 22, Block 15, R. W. Martin, owner, Assessment $173.00 Lots 1, 2, Block 14, Ralph Thomas, owner, Assessment $173.00 Lot 3, Block 14, W. G. Morse, owner, assessment $86.50. Lot 4, Block 14, Mrs. Hattie B. Fallas, owner, Assessment $86.50. Lot 5, Block 14, Will Beckley owner, Assessment $86.50 Lots 6 & 7, Block 14, heirs of H. M. Lillis, owners, assessment $173.00 Lot 8, Block 14, Eagles Lodge, owner, Assessment $86.50 Lot 9, Block 14, Martin & Ferron owners, Assessment $86.50. Lots 10, 11, 12, Block 14, E. Griffith owner, Assessment $259.50 Lots 11, 12, 13, 14, 15, 16, Block 18, Reno Securities Co; owner, Assessment $519.00 Lots 17, 18 C. C. Leland Ronnow, owners, Assessment $l73.00