Copyright & Fair-use Agreement

UNLV Special Collections provides copies of materials to facilitate private study, scholarship, or research. Material not in the public domain may be used according to fair use of copyrighted materials as defined by copyright law. Please cite us.

Please note that UNLV may not own the copyright to these materials and cannot provide permission to publish or distribute materials when UNLV is not the copyright holder. The user is solely responsible for determining the copyright status of materials and obtaining permission to use material from the copyright holder and for determining whether any permissions relating to any other rights are necessary for the intended use, and for obtaining all required permissions beyond that allowed by fair use.

Read more about our reproduction and use policy.

I agree.Information

Digital ID

Permalink

Details

More Info

Rights

Digital Provenance

Publisher

Transcription

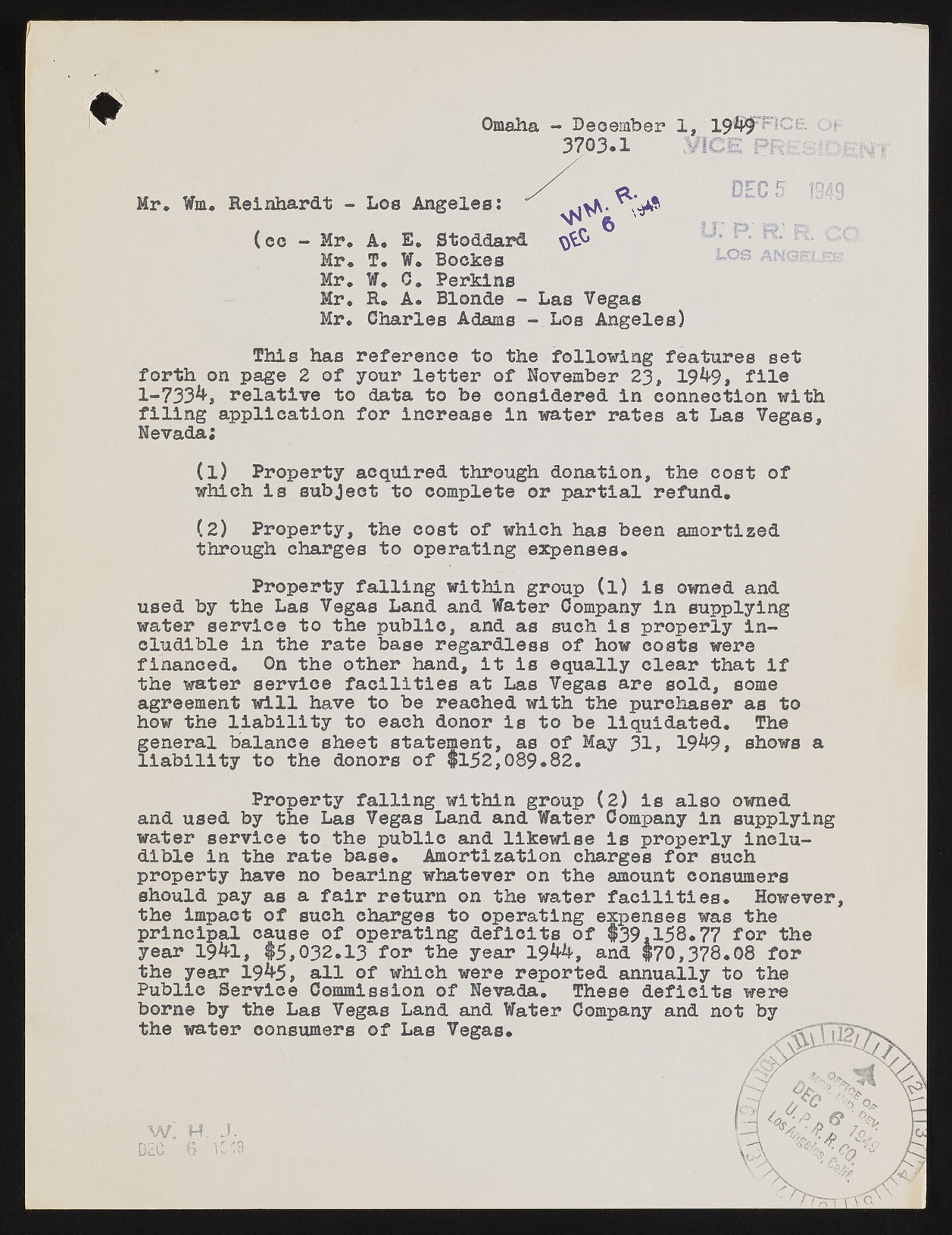

Sr Omaha - December 1 , ®9^ F F 1C £ 3703.1 Mr. Mm. Reinhardt - Los Angeles: (cc - Mr. A. E. Stoddar Mr. T. W. Boekes Mr. M. 0. Perkins Mr. R. A. Blonde - Las Vegas Mr. Charles Adams - Los Angeles) This has reference to the following features set forth on page 2 of your letter of November 2 3 , 19% , file 1-733% relative to data to be considered in connection with filing application for increase in water rates at Las Vegas, Nevada; (1) Property acquired through donation, the cost of which is subject to complete or partial refund. (2) Property, the cost of which has been amortized through charges to operating expenses. Property falling within group (l) is owned and used by the Las Vegas Land and Mater Company in supplying water service to the public, and as such is properly includible in the rate base regardless of how costs were financed. On the other hand, it is equally clear that if the water service facilities at Las Vegas are sold, some agreement will have to be reached with the purchaser as to how the liability to each donor is to be liquidated. The general balance sheet statement, as of May 31, 1 9 % , shows a liability to the donors of #152,089.82. Property falling within group (2) is also owned and used by the Las Vegas Land and Mater Company in supplying water service to the public and likewise is properly includible in the rate base. Amortization charges for such property have no bearing whatever on the amount consumers should pay as a fair return on the water facilities. However, the impact of such charges to operating expenses was the principal cause of operating deficits of 139,158.77 for the year 19&L, #5,032.13 for the year 1 9 ^ % and #70,378.08 for the year 19% , all of which were reported annually to the Public Service Commission of Nevada. These deficits were borne by the Las Vegas Land and Mater Company and not by the water consumers of Las Vegas. DEWC. 6W . iCJ'., 9 TnrTb