Copyright & Fair-use Agreement

UNLV Special Collections provides copies of materials to facilitate private study, scholarship, or research. Material not in the public domain may be used according to fair use of copyrighted materials as defined by copyright law. Please cite us.

Please note that UNLV may not own the copyright to these materials and cannot provide permission to publish or distribute materials when UNLV is not the copyright holder. The user is solely responsible for determining the copyright status of materials and obtaining permission to use material from the copyright holder and for determining whether any permissions relating to any other rights are necessary for the intended use, and for obtaining all required permissions beyond that allowed by fair use.

Read more about our reproduction and use policy.

I agree.Information

Digital ID

Permalink

Details

More Info

Rights

Digital Provenance

Publisher

Transcription

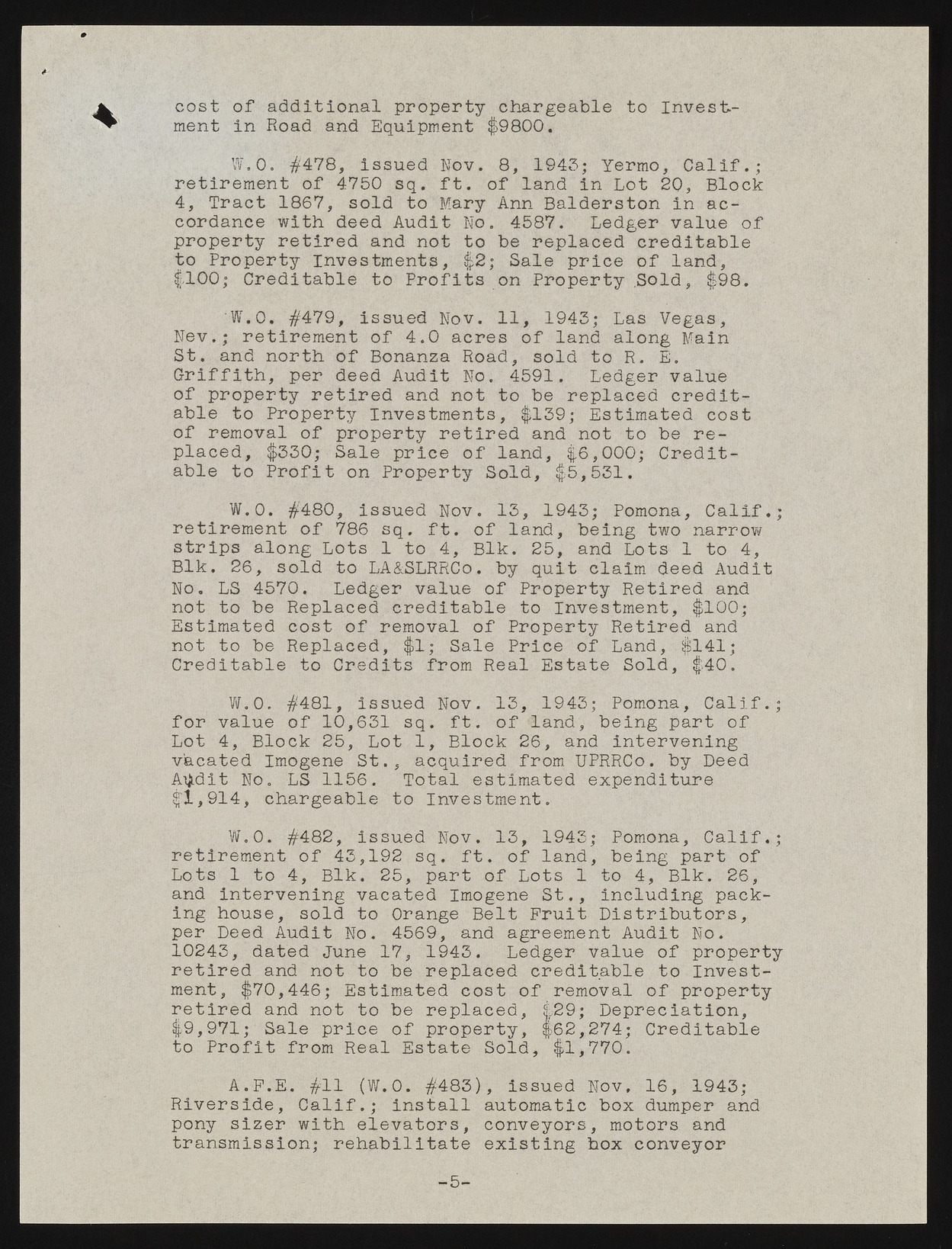

% cost of additional property chargeable to Investment in Road and Equipment $9800. #.6. #478, issued Nov. 8, 1943; Yermo, Calif.; retirement of 4750 sq. ft. of land in Lot 20, Block 4, Tract 1867, sold to Mary Ann Balderston In accordance with deed Audit No. 4587. Ledger value of property retired and not to be replaced creditable to Property Investments, $2; Sale price of land, $100; Creditable to Profits on Property .Sold, $98. W.0. #479, issued Nov. 11, 1943; Las Vegas, Nev.; retirement of 4.0 acres of land along Main St. and north of Bonanza Road, sold to R. E. Griffith, per deed Audit No. 4591. Ledger value of property retired and not to be replaced creditable to Property Investments, $139; Estimated cost of removal of property retired and not to be replaced, $330; Sale price of land, $6,000; Creditable to Profit on Property Sold, $5,531. W.0. #480, issued Nov. 13, 1943; Pomona, Calif.; retirement of 786 sq, ft. of land, being two narrow strips along Lots 1 to 4, Blk. 25, and Lots 1 to 4, Blk. 26, sold to LA&SLRRCo. by quit claim deed Audit No. LS 4570. Ledger value of Property Retired and not to be Replaced creditable to Investment, $100; Estimated cost of removal of Property Retired and not to be Replaced, $1; Sale Price of Land, $141; Creditable to Credits from Real Estate Sold, $40. W.0. #481, issued Nov. 13, 1943; Pomona, Calif.; for value of 10,631 sq. ft. of land, being part of Lot 4, Block 25, Lot 1, Block 26, and intervening vacated Imogene St., acquired from UPRRCo. by Deed A\J.dit No. LS 1156. Total estimated expenditure $1,914, chargeable to Investment. W.0. #482, issued Nov. 13, 1943; Pomona, Calif.; retirement of 43,192 sq. ft. of land, being part of Lots 1 to 4, Blk. 25, part of Lots 1 to 4, Blk. 26, and intervening vacated Imogene St., including packing house, sold to Orange Belt Fruit Distributors, per Deed Audit No. 4569, and agreement Audit No. 10243, dated June 17, 1943. Ledger value of property retired and not to be replaced creditable to Investment, $70,446; Estimated cost of removal of property retired and not to be replaced, $29; Depreciation, $9,971; Sale price of property, $62,274; Creditable to Profit from Real Estate Sold, $1,770. A.F.E. #11 (W.0. #483), issued Nov, 16, 1943; Riverside, Calif.; install automatic box dumper and pony sizer with elevators, conveyors, motors and transmission; rehabilitate existing box conveyor -5-