Copyright & Fair-use Agreement

UNLV Special Collections provides copies of materials to facilitate private study, scholarship, or research. Material not in the public domain may be used according to fair use of copyrighted materials as defined by copyright law. Please cite us.

Please note that UNLV may not own the copyright to these materials and cannot provide permission to publish or distribute materials when UNLV is not the copyright holder. The user is solely responsible for determining the copyright status of materials and obtaining permission to use material from the copyright holder and for determining whether any permissions relating to any other rights are necessary for the intended use, and for obtaining all required permissions beyond that allowed by fair use.

Read more about our reproduction and use policy.

I agree.Information

Digital ID

Permalink

More Info

Rights

Digital Provenance

Publisher

Transcription

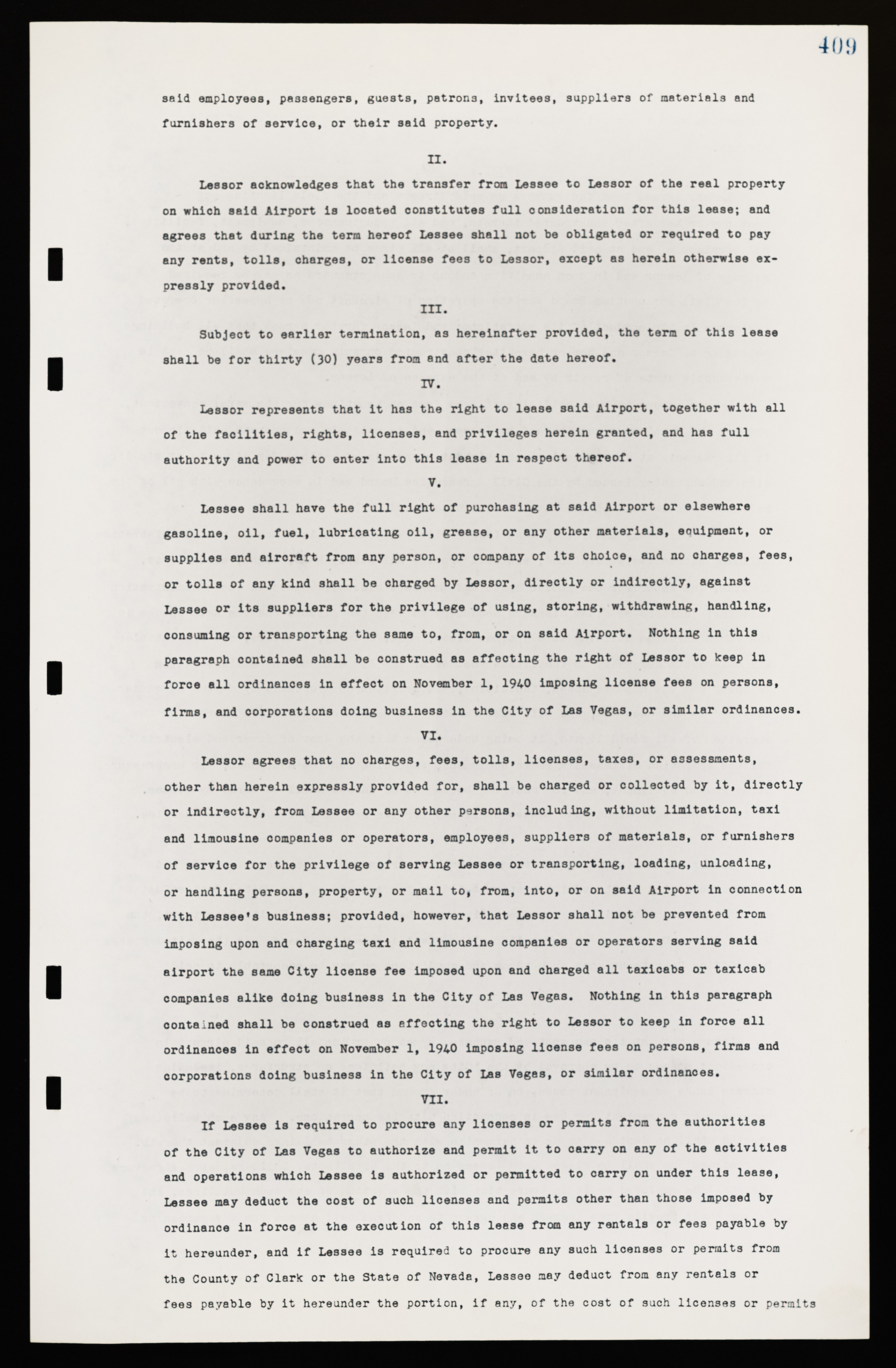

409 said employees, passengers, guests, patrons, invitees, suppliers of materials and furnishers of service, or their said property. II. Lessor acknowledges that the transfer from Lessee to Lessor of the real property on which said Airport is located constitutes full consideration for this lease; and agrees that during the term hereof Lessee shall not be obligated or required to pay any rents, tolls, charges, or license fees to Lessor, except as herein otherwise expressly provided. III. Subject to earlier termination, as hereinafter provided, the term of this lease shall be for thirty (30) years from and after the date hereof. IV. Lessor represents that it has the right to lease said Airport, together with all of the facilities, rights, licenses, and privileges herein granted, and has full authority and power to enter into this lease in respect thereof. V. Lessee shall have the full right of purchasing at said Airport or elsewhere gasoline, oil, fuel, lubricating oil, grease, or any other materials, equipment, or supplies and aircraft from any person, or company of its choice, and no charges, fees, or tolls of any kind shall be charged by Lessor, directly or indirectly, against Lessee or its suppliers for the privilege of using, storing, withdrawing, handling, consuming or transporting the same to, from, or on said Airport. Nothing in this paragraph contained shall be construed as affecting the right of Lessor to keep in force all ordinances in effect on November 1, 1940 Imposing license fees on persons, firms, and corporations doing business in the City of Las Vegas, or similar ordinances. VI. Lessor agrees that no charges, fees, tolls, licenses, taxes, or assessments, other than herein expressly provided for, shall be charged or collected by it, directly or indirectly, from lessee or any other persons, including, without limitation, taxi and limousine companies or operators, employees, suppliers of materials, or furnishers of service for the privilege of serving Lessee or transporting, loading, unloading, or handling persons, property, or mail to, from, into, or on said Airport in connection with Lessee's business; provided, however, that Lessor shall not be prevented from imposing upon and charging taxi and limousine companies or operators serving said airport the same City license fee imposed upon and charged all taxicabs or taxicab companies alike doing business in the City of Las Vegas. Nothing in this paragraph contained shall be construed as affecting the right to Lessor to keep in force all ordinances in effect on November 1, 1940 imposing license fees on persons, firms and corporations doing business in the City of Las Vegas, or similar ordinances. VII. If lessee is required to procure any licenses or permits from the authorities of the City of Las Vegas to authorize and permit it to carry on any of the activities and operations which Lessee is authorized or permitted to carry on under this lease, Lessee may deduct the cost of such licenses and permits other than those imposed by ordinance in force at the execution of this lease from any rentals or fees payable by it hereunder, and if Lessee is required to procure any such licenses or permits from the County of Clark or the State of Nevada, Lessee may deduct from any rentals or fees payable by it hereunder the portion, if any, of the cost of such licenses or permits