Copyright & Fair-use Agreement

UNLV Special Collections provides copies of materials to facilitate private study, scholarship, or research. Material not in the public domain may be used according to fair use of copyrighted materials as defined by copyright law. Please cite us.

Please note that UNLV may not own the copyright to these materials and cannot provide permission to publish or distribute materials when UNLV is not the copyright holder. The user is solely responsible for determining the copyright status of materials and obtaining permission to use material from the copyright holder and for determining whether any permissions relating to any other rights are necessary for the intended use, and for obtaining all required permissions beyond that allowed by fair use.

Read more about our reproduction and use policy.

I agree.Information

Digital ID

Permalink

Details

More Info

Rights

Digital Provenance

Publisher

Transcription

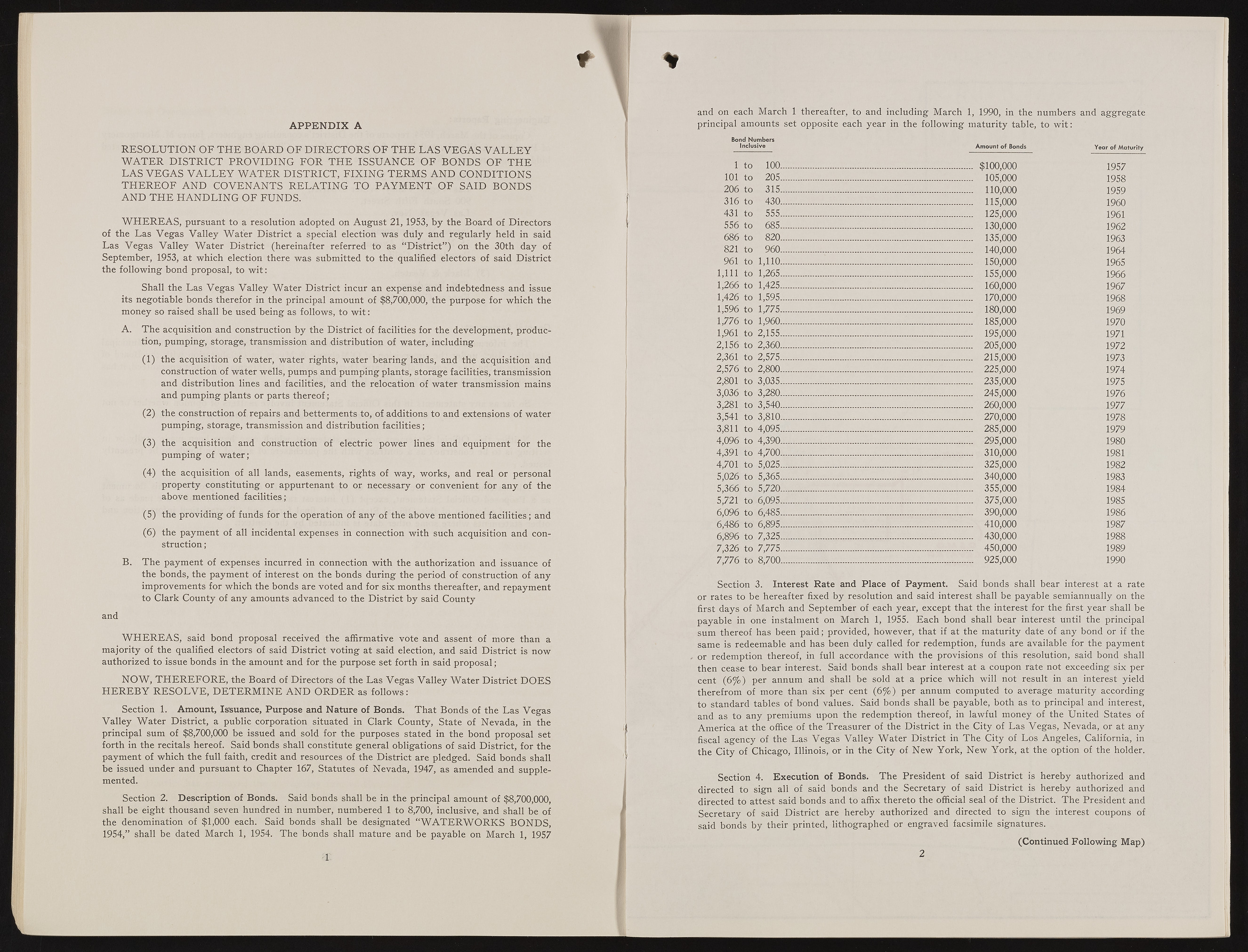

A PPEN D IX A R E S O L U T IO N O F T H E BOARD O F D IR E C T O R S O F T H E LAS V EG A S V A L L E Y W A T E R D IS T R IC T P R O V ID IN G FO R T H E ISSU A N C E O F BO N D S O F T H E LAS VEGAS V A L L E Y W A T E R D IST R IC T , F IX IN G T E R M S A N D C O N D IT IO N S T H E R E O F AN D C O V EN A N TS R E L A T IN G TO P A Y M E N T O F SA ID BONDS AN D T H E H A N D L IN G O F FU ND S. W H E R E A S , pursuant to a resolution adopted on A ugust 21, 1953, by the Board of Directors of the Las Vegas Valley W ater D istrict a special election was duly and regularly held in said Las Vegas Valley W ater D istrict (hereinafter referred to as “D istrict”) on the 30th day of September, 1953, at which election there was subm itted to the qualified electors of said D istrict the following bond proposal, to w it: Shall the Las Vegas Valley W ater D istrict incur an expense and indebtedness and issue its negotiable bonds therefor in the principal am ount of $8,700,000, the purpose for which the money so raised shall be used being as follows, to w it: A. The acquisition and construction by the D istrict of facilities for the development, production, pumping, storage, transmission and distribution of water, including (1) the acquisition of water, w ater rights, w ater bearing lands, and the acquisition and construction of w ater wells, pumps and pum ping plants, storage facilities, transm ission and distribution lines and facilities, and the relocation of w ater transm ission mains and pum ping plants or parts th ereo f; (2) the construction of repairs and betterm ents to, of additions to and extensions of w ater pumping, storage, transm ission and distribution facilities; (3) the acquisition and construction of electric power lines and equipment for the pum ping of w ater; (4) the acquisition of all lands, easements, rights of way, works, and real or personal property constituting or appurtenant to or necessary or convenient for any of the above mentioned facilities; (5) the providing of funds for the operation of any of the above mentioned facilities; and (6) the payment of all incidental expenses in connection with such acquisition and construction ; The paym ent of expenses incurred in connection w ith the authorization and issuance of the bonds, the payment of interest on the bonds during the period of construction of any improvements for which the bonds are voted and for six months thereafter, and repaym ent to Clark County of any amounts advanced to the D istrict by said County B. and W H E R E A S , said bond proposal received the affirmative vote and assent of more than a m ajority of the qualified electors of said D istrict voting a t said election, and said D istrict is now authorized to issue bonds in the am ount and for the purpose set forth in said proposal; N O W , T H E R E F O R E , the Board of Directors of the Las Vegas Valley W ater D istrict D O ES H E R E B Y R E SO L V E , D E T E R M IN E AN D O R D E R as follow s: Section 1. Amount, Issuance, Purpose and Nature of Bonds. T h at Bonds of the Las Vegas Valley W ater D istrict, a public corporation situated in Clark County, State of Nevada, in the principal sum of $8,700,000 be issued and sold for the purposes stated in the bond proposal set forth in the recitals hereof. Said bonds shall constitute general obligations of said D istrict, for the paym ent of which the full faith, credit and resources of the D istrict are pledged. Said bonds shall be issued under and pursuant to Chapter 167, Statutes of Nevada, 1947, as amended and supplemented. Section 2. Description of Bonds. Said bonds shall be in the principal am ount of $8,700,000, shall be eight thousand seven hundred in number, numbered 1 to 8,700, inclusive, and shall be of the denomination of $1,000 each. Said bonds shall be designated “W A T E R W O R K S BONDS, 1954,” shall be dated March 1, 1954. The bonds shall m ature and be payable on March 1, 1957 1 and on each March 1 thereafter, to and including March 1, 1990, in the numbers and aggregate principal amounts set opposite each year in the following m aturity table, to w it: Bond Numbers inclusive Amount of Bonds Year of Maturity 1 to 100................................................................................ $100,000 1957 101 to 205............................................................................... 105,000 1958 206 to 315............................................................................... 110,000 1959 316 to 430............................................................................... 115,000 1960 431 to 555.............................................................................. 125,000 1961 556 to 685............................................................................... 130,000 1962 686 to 820............................................................................... 135,000 1963 821 to 960............................................................................... 140,000 1964 961 to 1,110............. ....'............................................................ 150,000 1965 1,111 to 1,265........................................................................ 155,000 1966 1,266 to 1,425.............................................................................. 160,000 1967 1,426 to 1,595........................... 170,000 1968 1,596 to 1,775.............................. 180,000 1969 1.776 to 1,960......... 185,000 1970 1,961 to 2,155............................................................................. 195,000 1971 2,156 to 2,360......................................................................,....... 205,000 1972 2,361 to 2,575....... ..... ................................................................ 215,000 1973 2,576 to 2,800........................ .........A............. .......................... 225,000 1974 2,801 to 3,035............................................................................. 235,000 1975 3,036 to 3,280...................... 245,000 1976 3,281 to 3,540............................................................................. 260,000 1977 3,541 to 3,810............................................................................. 270,000 1978 3,811 to 4,095........ 285,000 1979 4.096 to 4,390............................................................................. 295,000 1980 4,391 to 4,700........ ...............................................;..... ,..T.,i... 310,000 1981 4,701 to 5,025................................................ 325,000 1982 5,026 to 5,365............................ 340,000 1983 5,366 to 5,720.................................... ...A..!.;.,,,,.,..................... 355,000 1984 5,721 to .6,095.............................................................................. 375,000 1985 6.096 to 6,485........................... 390,000 1986 6,486 to 6,895............................................................................. 410,000 1987 6,896 to 7,325..................... 430,000 1988 7,326 to 7,775.............................. 450,000 1989 7.776 to 8,700................. 925,000 1990 Section 3. Interest Rate and Place of Payment. Said bonds shall bear interest at a rate or rates to be hereafter fixed by resolution and said interest shall be payable semiannually on the first days of March and September of each year, except that the interest for the first year shall be payable in one instalm ent on March 1, 1955. Each bond shall bear interest until the principal sum thereof has been paid; provided, however, that if at the m aturity date of any bond or if the same is redeemable and has been duly called for redemption, funds are available for the payment or redemption thereof, in full accordance with the provisions of this resolution, said bond shall then cease to bear interest. Said bonds shall bear interest at a coupon rate not exceeding six per cent (6% ) per annum and shall be sold at a price which will not result in an interest yield therefrom of more than six per cent (6%) per annum computed to average m aturity according to standard tables of bond values. Said bonds shall be payable, both as to principal and interest, and as to any premiums upon the redemption thereof, in lawful money of the United States of America at the office of the T reasurer of the D istrict in the City of Las Vegas, Nevada, or at any fiscal agency of the Las Vegas Valley W ater D istrict in The City of Los Angeles, California, in the City of Chicago, Illinois, or in the City of New York, New York, at the option of the holder. Section 4. Execution of Bonds. The President of said D istrict is hereby authorized and directed to sign all of said bonds and the Secretary of said D istrict is hereby authorized and directed to attest said bonds and to affix thereto the official seal of the District. The President and Secretary of said D istrict are hereby authorized and directed to sign the interest coupons of said bonds by their printed, lithographed or engraved facsimile signatures. (Continued Following Map) 2