Copyright & Fair-use Agreement

UNLV Special Collections provides copies of materials to facilitate private study, scholarship, or research. Material not in the public domain may be used according to fair use of copyrighted materials as defined by copyright law. Please cite us.

Please note that UNLV may not own the copyright to these materials and cannot provide permission to publish or distribute materials when UNLV is not the copyright holder. The user is solely responsible for determining the copyright status of materials and obtaining permission to use material from the copyright holder and for determining whether any permissions relating to any other rights are necessary for the intended use, and for obtaining all required permissions beyond that allowed by fair use.

Read more about our reproduction and use policy.

I agree.Information

Digital ID

Permalink

Details

More Info

Rights

Digital Provenance

Publisher

Transcription

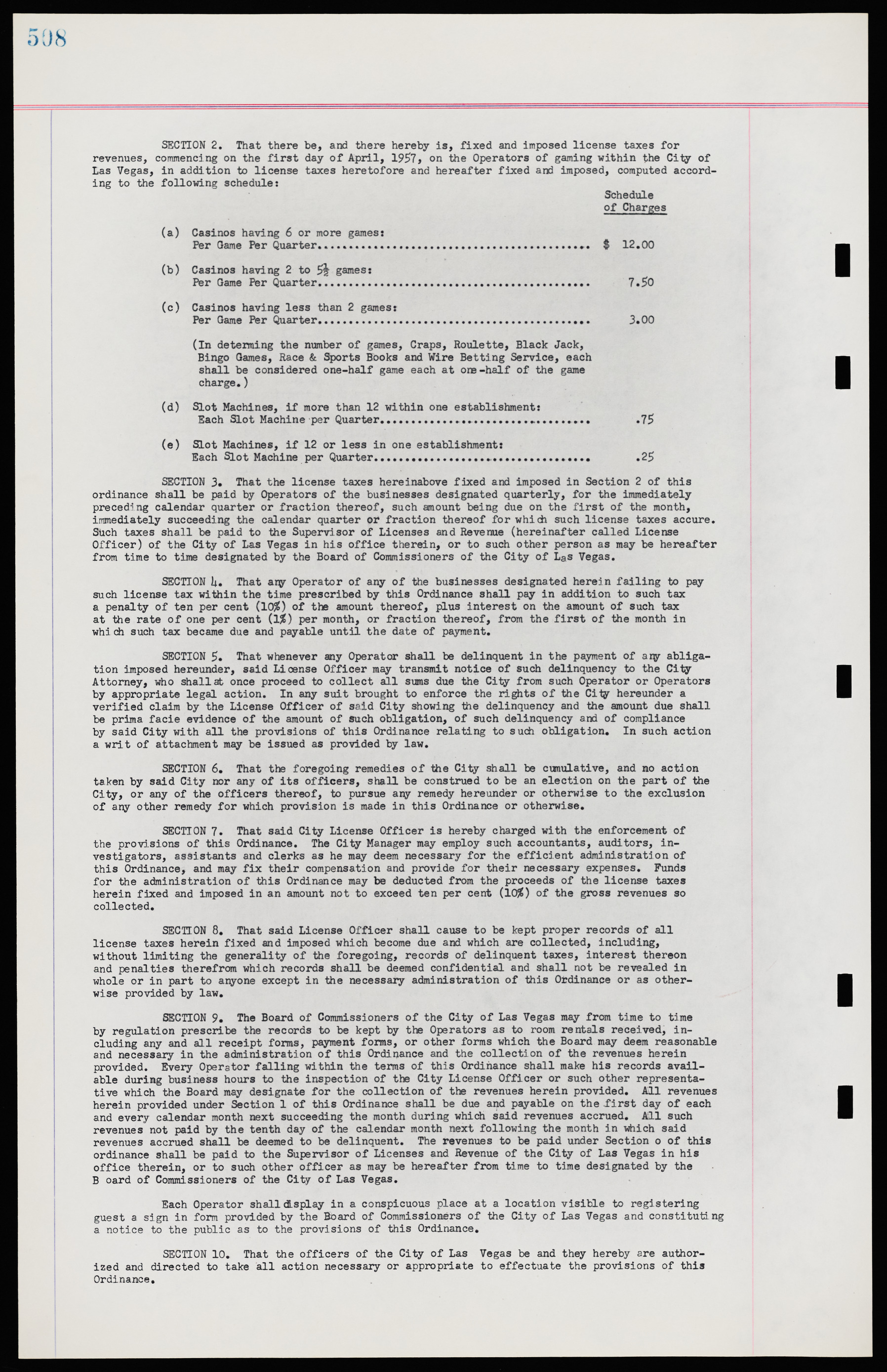

SECTION 2. That there be, and there hereby is, fixed and imposed license taxes for revenues, commencing on the first day of April, 1957, on the Operators of gaming within the City of Las Vegas, in addition to license taxes heretofore and hereafter fixed and imposed, computed according to the following schedule: Schedule of Charges (a) Casinos having 6 or more games: Per Game Per Quarter............................................. $ 12.00 (b) Casinos having 2 to 5^ games: Per Game Per Quarter............................................. 7.50 (c) Casinos having less than 2 games: Per Game Per Quarter............................................. 3*00 (In determining the number of games, Craps, Roulette, Black Jack, Bingo Games, Race & Sports Books and Wire Betting Service, each shall be considered one-half game each at ore -half of the game charge.) (d) Slot Machines, if more than 12 within one establishment: Each Slot Machine per Quarter.................................. .75 (e) Slot Machines, if 12 or less in one establishment: Each Slot Machine per Quarter............................ .25 SECTION 3. That the license taxes hereinabove fixed and imposed in Section 2 of this ordinance shall be paid by Operators of the businesses designated quarterly, for the immediately preceding calendar quarter or fraction thereof, such amount being due on the first of the month, immediately succeeding the calendar quarter or fraction thereof for which such license taxes accrue. Such taxes shall be paid to the Supervisor of Licenses and Revenue (hereinafter called License Officer) of the City of Las Vegas in his office therein, or to such other person as may be hereafter from time to time designated by the Board of Commissioners of the City of Las Vegas. SECTION 4. That any Operator of any of the businesses designated herein failing to pay such license tax within the time prescribed by this Ordinance shall pay in addition to such tax a penalty of ten per cent (10%) of the amount thereof, plus interest on the amount of such tax at the rate of one per cent (1%) per month, or fraction thereof, from the first of the month in which such tax became due and payable until the date of payment. SECTION 5. That whenever any Operator shall be delinquent in the payment of any obliga- tion imposed hereunder, said License Officer may transmit notice of such delinquency to the City Attorney, who shall at once proceed to collect all sums due the City from such Operator or Operators by appropriate legal action. In any suit brought to enforce the rights of the City hereunder a verified claim by the License Officer of said City showing the delinquency and the amount due shall be prima facie evidence of the amount of such obligation, of such delinquency and of compliance by said City with all the provisions of this Ordinance relating to such obligation. In such action a writ of attachment may be issued as provided by law. SECTION 6. That the foregoing remedies of the City shall be cumulative, and no action taken by said City nor any of its officers, shall be construed to be an election on the part of the City, or any of the officers thereof, to pursue any remedy hereunder or otherwise to the exclusion of any other remedy for which provision is made in this Ordinance or otherwise. SECTION 7. That said City License Officer is hereby charged with the enforcement of the provisions of this Ordinance. The City Manager may employ such accountants, auditors, investigators, assistants and clerks as he may deem necessary for the efficient administration of this Ordinance, and may fix their compensation and provide for their necessary expenses. Funds for the administration of this Ordinance may be deducted from the proceeds of the license taxes herein fixed and imposed in an amount not to exceed ten per cent (10%) of the gross revenues so collected. SECTION 8. That said License Officer shall cause to be kept proper records of all license taxes herein fixed and imposed which become due and which are collected, including, without limiting the generality of the foregoing, records of delinquent taxes, interest thereon and penalties therefrom which records shall be deemed confidential and shall not be revealed in whole or in part to anyone except in the necessary administration of this Ordinance or as otherwise provided by law. SECTION 9. The Board of Commissioners of the City of Las Vegas may from time to time by regulation prescribe the records to be kept by the Operators as to room rentals received, including any and all receipt forms, payment forms, or other forms which the Board may deem reasonable and necessary in the administration of this Ordinance and the collection of the revenues herein provided. Every Operator falling within the terms of this Ordinance shall make his records available during business hours to the inspection of the City License Officer or such other representative which the Board may designate for the collection of the revenues herein provided. All revenues herein provided under Section 1 of this Ordinance shall be due and payable on the first day of each and every calendar month next succeeding the month during which said revenues accrued. All such revenues not paid by the tenth day of the calendar month next following the month in which said revenues accrued shall be deemed to be delinquent. The revenues to be paid under Section o of this ordinance shall be paid to the Supervisor of Licenses and Revenue of the City of Las Vegas in his office therein, or to such other officer as may be hereafter from time to time designated by the Board of Commissioners of the City of Las Vegas. Each Operator shall display in a conspicuous place at a location visible to registering guest a sign in form provided by the Board of Commissioners of the City of Las Vegas and constituting a notice to the public as to the provisions of this Ordinance. SECTION 10. That the officers of the City of Las Vegas be and they hereby are authorized and directed to take all action necessary or appropriate to effectuate the provisions of this Ordinance.