Copyright & Fair-use Agreement

UNLV Special Collections provides copies of materials to facilitate private study, scholarship, or research. Material not in the public domain may be used according to fair use of copyrighted materials as defined by copyright law. Please cite us.

Please note that UNLV may not own the copyright to these materials and cannot provide permission to publish or distribute materials when UNLV is not the copyright holder. The user is solely responsible for determining the copyright status of materials and obtaining permission to use material from the copyright holder and for determining whether any permissions relating to any other rights are necessary for the intended use, and for obtaining all required permissions beyond that allowed by fair use.

Read more about our reproduction and use policy.

I agree.Information

Digital ID

Permalink

Details

Member of

More Info

Rights

Digital Provenance

Publisher

Transcription

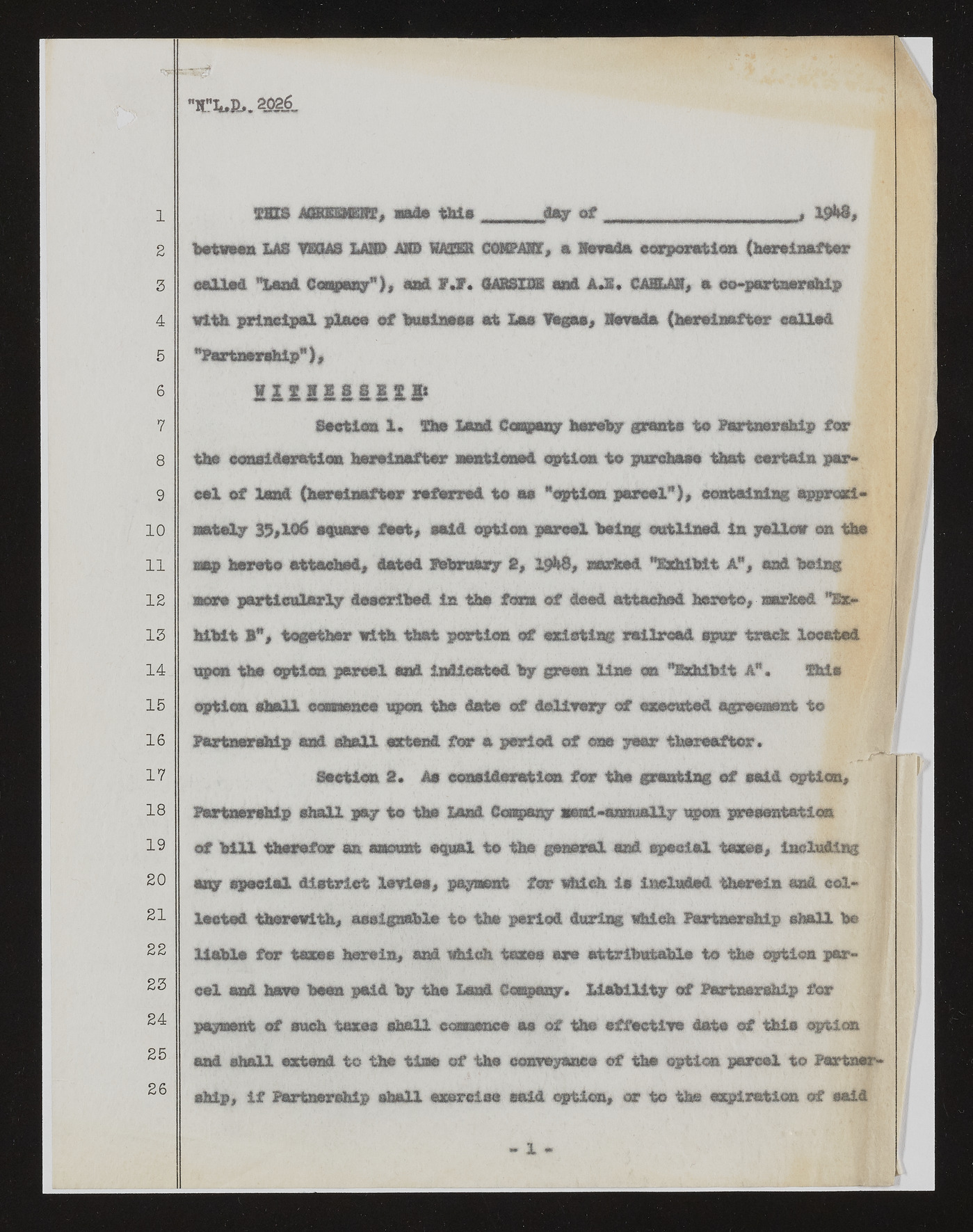

1 2 3 4 5 6 7 8 9 10 11 12 13 14 15 16 17 18 19 20 21 22 23 24 25 26 ?vr'^ fflya A0SEBM8BB®, day of ias raws urn mm mm cmtm, a mmm mm^Am (hereinafter called "land Cco®eiiyM), and f .7. OdBSIBB end A.s. CASLAS* a co-partaership with principal place of boslneee at Im Vbgss* lewada (hereinafter called "Partnership"), Section 1* fhe bead Ccepaay herehy groats to Psrli»rebip for tbs conaidsratiem hereinafter mentioned option to purchase that certain par- eol of land (hereinafter referred to as "option parcel"), containing approximately %%%&& square feet* said option parcel being outlined la yellow fk tbs mf hereto attached* dated lebrasry t* 19fc$, narked "Exhibit A*, sad being more particularly described in tbs fora of deed attested hereto* marked "Sx- htUt B", together with that portion of existing railroad spur tract located upon tbs optica parcel sad Indicated by green line <m "Exhibit A". Shis option shall ccsamencc vegan tbs date off da&iwery off executed agreement to Partasrefclp aad then eachend for a period of one pit tlMKreaftcr. Section f • As eoaatdcratioa for tins granting of said option* Partnership shall pay to tbs land Ccapaay aaeal*amaair upon prcsentatieis; off bill therefor an amount equal to fk# general and special taxes* ideluding any special district levies* payment for- which is indeed therein and col~ looted therewith., assignable to tbs period during wfcieh Partnership shall be liable for taxes herein* and v&ieh taxes axe attributable to the optica parcel and base been paid by the lend Company. liability of Bsrtsarahip fear payment of such taxes shall ccamssace as of the effective date of tbie option and shall extend to- the time of tbs conveyance of the option parcel to Partnership* if ivurtnerahip shall exercise eaid option* or to the expiration off said 1 -