Copyright & Fair-use Agreement

UNLV Special Collections provides copies of materials to facilitate private study, scholarship, or research. Material not in the public domain may be used according to fair use of copyrighted materials as defined by copyright law. Please cite us.

Please note that UNLV may not own the copyright to these materials and cannot provide permission to publish or distribute materials when UNLV is not the copyright holder. The user is solely responsible for determining the copyright status of materials and obtaining permission to use material from the copyright holder and for determining whether any permissions relating to any other rights are necessary for the intended use, and for obtaining all required permissions beyond that allowed by fair use.

Read more about our reproduction and use policy.

I agree.Information

Digital ID

Permalink

Details

Member of

More Info

Rights

Digital Provenance

Publisher

Transcription

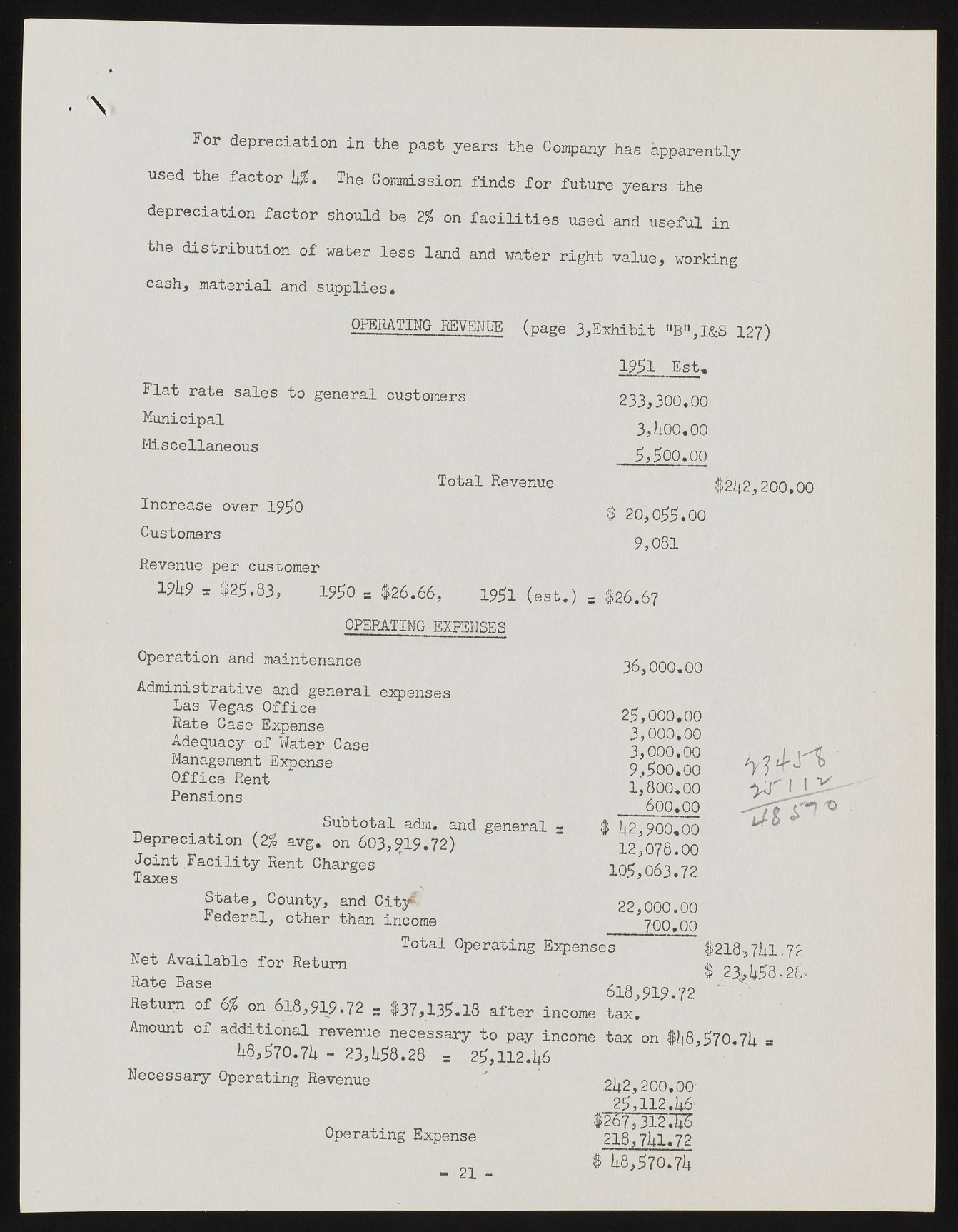

For depreciation in the past years the Company has apparently used the factor 1\%. The Commission finds for future years the depreciation factor should be 2% on facilities used and useful in the distribution of water less land and water right value, working cash, material and supplies. OPERATING REVENUE (page 3,Exhibit "B",I&S 127) 1951 Est. Flat rate sales to general customers Municipal Miscellaneous Total Revenue Increase over 1950 Customers 233,300.00 3,1*00.00 5,5oo.oo $ 20,055.00 9,081 $21*2,200.00 Revenue per customer 191*9 * $25.83, 1950 s $26.66, 1951 (est.) = $26.67 OPERATING EXPENSES Operation and maintenance Administrative and general expenses Las Vegas Office Rate Case Expense Adequacy of Water Case Management Expense Office Rent Pensions Subtotal adm. and general - Depreciation (2% avg. on 603,^19.72) Joint Facility Rent Charges Taxes gjtpgMpt State, County, and City*' Federal, other than income Total Operating Expenses Net Available for Return Rate Base 618 919 72 Return of 6% on 618,919.72 = $37,135.18 after income tax! Amount of additional revenue necessary to pay income tax on $1*8,570.71* U 1*8,570.71* - 23,1*58.28 s 25,112.1*6 Necessary Operating Revenue / ' 21*2 200.00 36,000.00 25.000. 00 3.000. 00 3.000. 00 9.500.00 1.800.00 600.00 $ 1*2,900.00 12,078.00 105,063.72 22.000. 00 700,00 $218 >7l*l -72 $ 23j,l*58e28' Operating Expense 25,112.1*6 .$26?, 312 3*5 218,71*1.72 $ 1*8,570.71* - 21 -