Copyright & Fair-use Agreement

UNLV Special Collections provides copies of materials to facilitate private study, scholarship, or research. Material not in the public domain may be used according to fair use of copyrighted materials as defined by copyright law. Please cite us.

Please note that UNLV may not own the copyright to these materials and cannot provide permission to publish or distribute materials when UNLV is not the copyright holder. The user is solely responsible for determining the copyright status of materials and obtaining permission to use material from the copyright holder and for determining whether any permissions relating to any other rights are necessary for the intended use, and for obtaining all required permissions beyond that allowed by fair use.

Read more about our reproduction and use policy.

I agree.Information

Digital ID

Permalink

Details

More Info

Rights

Digital Provenance

Publisher

Transcription

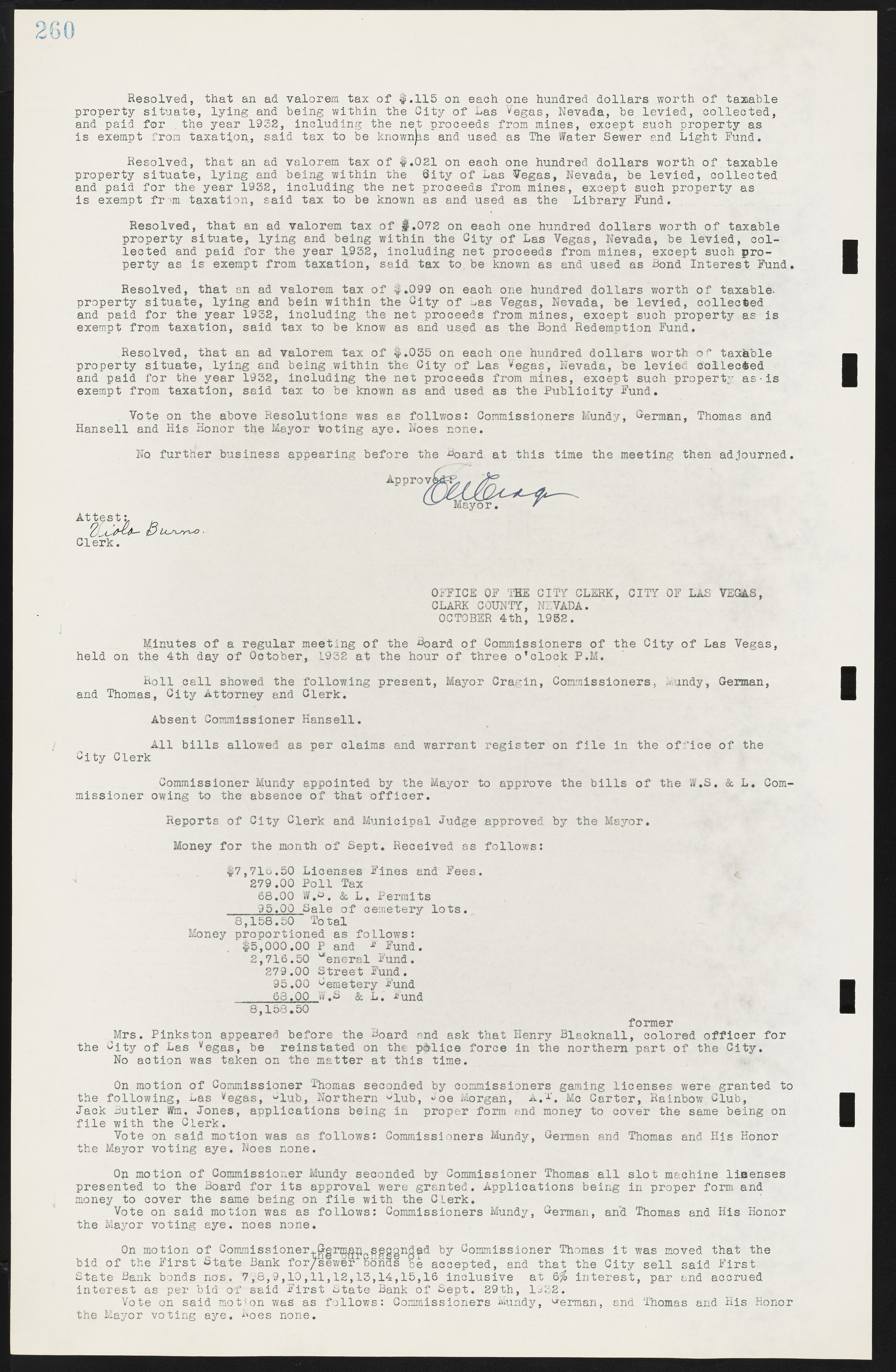

Resolved, that an ad valorem tax of $.115 on each one hundred dollars worth of taxable property situate, lying and being within the City of Las Vegas, Nevada, be levied, collected, and paid for the year 1932, including the net proceeds from mines, except such property as is exempt from taxation, said tax to be known as and used as The Water Sewer end Light Fund. Resolved, that an ad valorem tax of $.021 on each one hundred dollars worth of taxable property situate, lying and being within the City of Las Vegas, Nevada, be levied, collected and paid for the year 1932, including the net proceeds from mines, except such property as is exempt from taxation, said tax to be known as and used as the Library Fund. Resolved, that an ad valorem tax of $.072 on each one hundred dollars worth of taxable property situate, lying and being within the City of Las Vegas, Nevada, be levied, collected and paid for the year 1932, including net proceeds from mines, except such property as is exempt from taxation, said tax to be known as and used as Bond Interest Fund. Resolved, that an ad valorem tax of $.099 on each one hundred dollars worth of taxable property situate, lying and being within the City of Las Vegas, Nevada, be levied, collected and paid for the year 1932, including the net proceeds from mines, except such property as is exempt from taxation, said tax to be know as and used as the Bond Redemption Fund, Resolved, that an ad valorem tax of $.035 on each one hundred dollars worth of taxable property situate, lying and being within the City of Las Vegas, Nevada, be levied collected and paid for the year 1932, including the net proceeds from mines, except such property as is exempt from taxation, said tax to be known as and used as the Publicity Fund. Vote on the above Resolutions was as follows: Commissioners Mundy, German, Thomas and Hansell and His Honor the Mayor voting aye. Noes none. No further business appearing before the Board at this time the meeting then adjourned. OFFICE OF TEE CITY CLERK, CITY OF LAS VEGAS, CLARK COUNTY, NEVADA. OCTOBER 4th, 1932. Minutes of a regular meeting of the Board of Commissioners of the City of Las Vegas, held on the 4th day of October, 1932 at the hour of three o'clock P.M. Roll call showed the following present, Mayor Cragin, Commissioners, Mundy, German, and Thomas, City Attorney and Clerk. Absent Commissioner Hansell. All bills allowed as per claims and warrant register on file in the office of the City Clerk Commissioner Mundy appointed by the Mayor to approve the bills of the W.S. & L. Commissioner owing to the absence of that officer. Reports of City Clerk and Municipal Judge approved by the Mayor. Money for the month of Sept. Received as follows: $7,716.50 Licenses Fines and Fees. 279.00 Poll Tax 68.00 W.S. & L. Permits ____95.00 Sale of cemetery lots. 8,158.50 Total Money proportioned as follows: $5,000.00 P and F Fund. 2,716.50 General Fund. 279.00 Street Fund. 95.00 Cemetery Fund _____68.00 W.S & L. Fund 8,158.50 former Mrs. Pinkston appeared before the Board and ask that Henry Blacknall, colored officer for the City of Las Vegas, be reinstated on the police force in the northern part of the City. No action was taken on the matter at this time. On motion of Commissioner Thomas seconded by commissioners gaming licenses were granted to the following, Las Vegas, Club, Northern Club, Joe Morgan, A.T. Mc Carter, Rainbow Club, Jack Butler Wm, Jones, applications being in proper form and money to cover the same being on file with the Clerk. Vote on said motion was as follows: Commissioners Mundy, German and Thomas and His Honor the Mayor voting aye. Noes none. On motion of Commissioner Mundy seconded by Commissioner Thomas all slot machine licenses presented to the Board for its approval were granted. Applications being in proper form and money to cover the same being on file with the Clerk. Vote on said motion was as follows: Commissioners Mundy, German, and Thomas and His Honor the Mayor voting aye. noes none. On motion of Commissioner German seconded by Commissioner Thomas it was moved that the bid of the First State Bank for the purchase of sewer bonds be accepted, and that the City sell State Bank bonds nos. 7,8,9,10,11,12,13,14,15,16 inclusive at 6% interest, par and accrued said First interest as per bid of said First State Bank of Sept. 29th, 1932. Vote on said motion was as follows: Commissioners Mundy, German, and Thomas and His Honor the Mayor voting aye. Noes none.