Copyright & Fair-use Agreement

UNLV Special Collections provides copies of materials to facilitate private study, scholarship, or research. Material not in the public domain may be used according to fair use of copyrighted materials as defined by copyright law. Please cite us.

Please note that UNLV may not own the copyright to these materials and cannot provide permission to publish or distribute materials when UNLV is not the copyright holder. The user is solely responsible for determining the copyright status of materials and obtaining permission to use material from the copyright holder and for determining whether any permissions relating to any other rights are necessary for the intended use, and for obtaining all required permissions beyond that allowed by fair use.

Read more about our reproduction and use policy.

I agree.Information

Digital ID

Permalink

Details

More Info

Rights

Digital Provenance

Publisher

Transcription

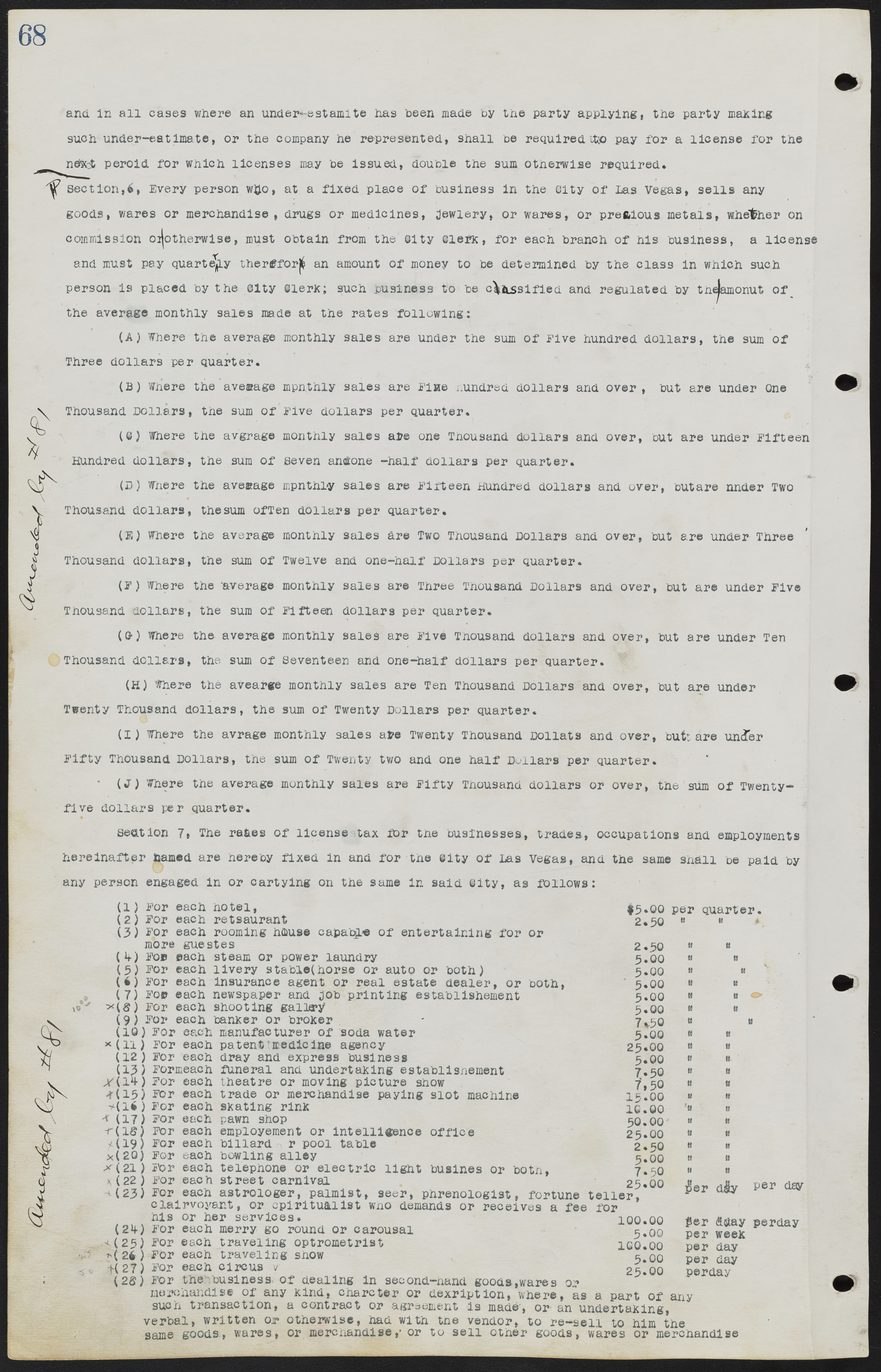

and in all cases where an under-estimate has been made by the party applying, the party maxing such under-estimate, or the company he represented, shall be required to pay for a license for the next period for which licenses may be issued, double the sum otherwise required. Section 6. Every person who, at a fixed place of business in the City of Las Vegas, sells any goods, wares or merchandise, drugs or medicines, jewelry, or wares, or previous metals, whether on commission or otherwise, must obtain from the City Clerk, for each branch of his business, a license and must pay quarterly therefore an amount of money to be determined by the class in which such person is placed by the City Clerk; such business to be classified and regulated by the amount of the average monthly sales made at the rates following: (A) Where the average monthly sales are under the sum of Five hundred dollars, the sum of Three dollars per quarter. (B) Where the average monthly sales are Five hundred dollars and over, but are under One Thousand Dollars, the sum of Five dollars per quarter. (C) Where the average monthly sales are one Thousand dollars and over, but are under Fifteen Hundred dollars, the sum of seven and one -half dollars per quarter. (D) Where the average monthly sales are Fifteen Hundred dollars and over, but are under Two Thousand dollars, the sum ofTen dollars per quarter. (E) Where the average monthly sales are Two Thousand Dollars and over, but are under Three Thousand dollars, the sum of Twelve and one-half Dollars per quarter. (F) Where the average monthly sales are Three Thousand Dollars and over, but are under Five Thousand dollars, the sum of Fifteen dollars per quarter. (G) Where the average monthly sales are Five Thousand dollars and over, but are under Ten Thousand dollars, the sum of Seventeen and one-half dollars per quarter. (H) Where the average monthly sales are Ten Thousand Dollars and over, but are under Twenty Thousand dollars, the sum of Twenty Dollars per quarter. (I) Where the average monthly sales are Twenty Thousand Dollars and over, but are under Fifty Thousand Dollars, the sum of Twenty two and one half Dollars per quarter. (J) Where the average monthly sales are Fifty Thousand dollars or over, the sum of Twenty- five dollars per quarter. Section 7. The rates of license tax for the businesses, trades, occupations and employments hereinafter named are hereby fixed in and for the City of Las Vegas, and the same shall be paid by any person engaged in or carrying on the same in said City, as follows: (1) For each hotel, $5.00 per quarter. (2) For each restaurant 2.50 " " (3) For each rooming house capable of entertaining for or more quests 2.50 " " (4) For each steam or power laundry 5.00 (5) For each livery stable (horse or auto or both) 5.00 " (6) For each insurance agent or real estate dealer, or both, 5.00 " " (7) For each newspaper and job printing establishment 5.00 " " (8) For each shooting gallery 5.00 " (9) For each banker or broker 7.50 " " (10) For each manufacturer of soda water 5.00 " (11) For each patent medicine agency 25.00 (12) For each dray and express business 5.00 (13) For each funeral and undertaxing establishment 7.50 " (14) For each theatre or moving picture show 7.50 (15) For each trade or merchandise paying slot machine 15.00 " " (16) For each skating rink 10.00 (17) For each pawn shop 50.00 (18) For each employment or intelligence office 25.00 (19) For each billiard or pool table 2.50 (20) For each bowling alley 5.00 " (21) For each telephone or electric light business or both, 7.50 (22) For each street carnival 25.00 per day (23) For each astrologer, palmist, seer, phrenologist, fortune teller, clairvoyant, or spiritualist who demands or receives a fee for his or her services. 100.00 per day (24) For each merry go round or carousel 5.00 per week (25) For each traveling optometrist 100.00 per day (24) For each traveling show 5.00 per day (27) For each circus 25.00 per day (28) For the business of dealing in second-hand goods, wares or merchandise of any kind, character or description, where, as a part of any such transaction, a contract or agreement is made, or an undertaking, verbal, written or otherwise, had with the vendor, to re-sell to him the same goods, wares, or merchandise, or to sell other goods, wares or merchandise