Copyright & Fair-use Agreement

UNLV Special Collections provides copies of materials to facilitate private study, scholarship, or research. Material not in the public domain may be used according to fair use of copyrighted materials as defined by copyright law. Please cite us.

Please note that UNLV may not own the copyright to these materials and cannot provide permission to publish or distribute materials when UNLV is not the copyright holder. The user is solely responsible for determining the copyright status of materials and obtaining permission to use material from the copyright holder and for determining whether any permissions relating to any other rights are necessary for the intended use, and for obtaining all required permissions beyond that allowed by fair use.

Read more about our reproduction and use policy.

I agree.Information

Digital ID

Permalink

Details

More Info

Rights

Digital Provenance

Publisher

Transcription

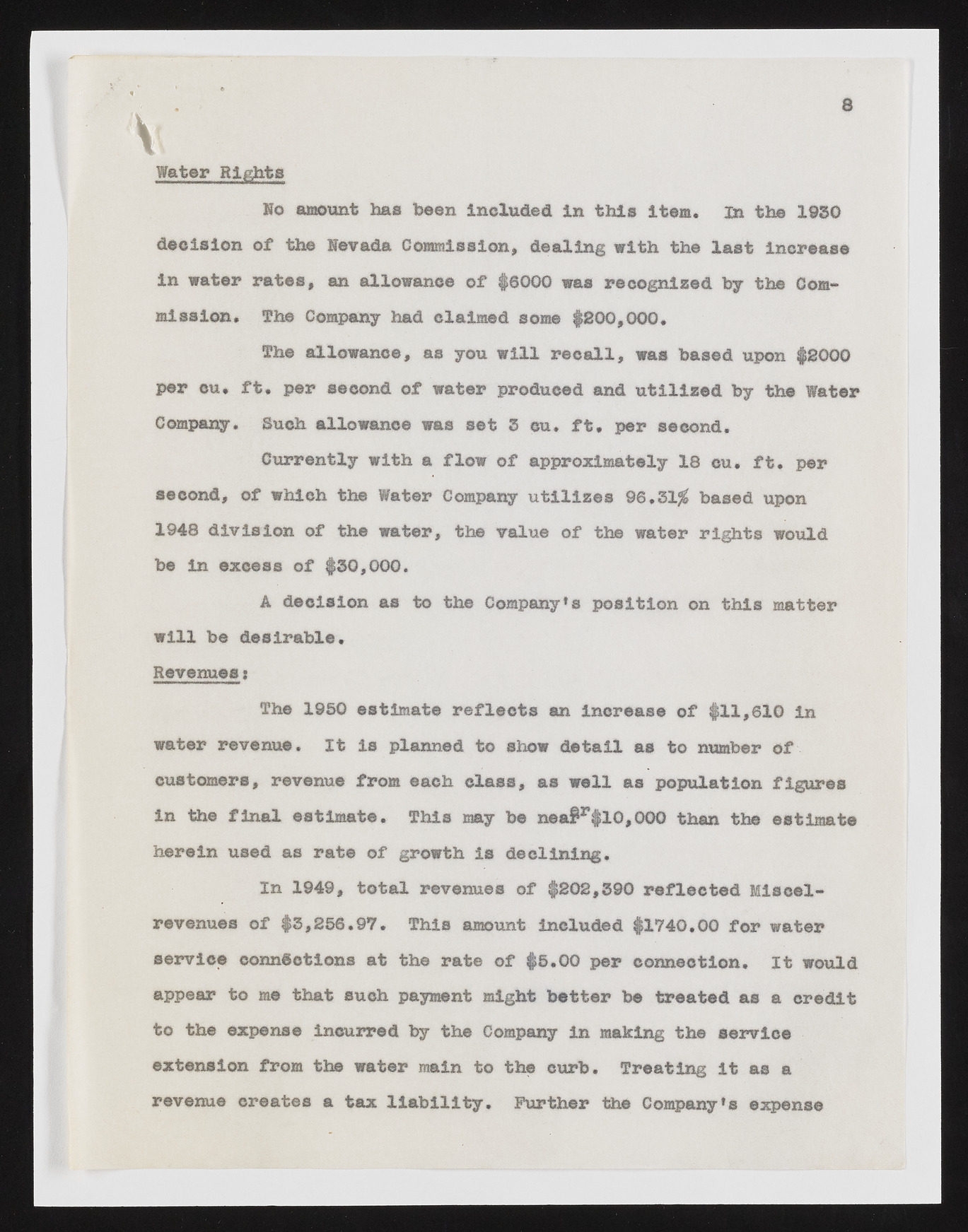

Water Rights Wo amount has been included in this item. In the 1930 decision of the Nevada Commission, dealing with the last increase in water rates, an allowance of #6000 was recognised by the Commission* The Company had claimed some #200,000, The allowance, as you will recall, was based upon #2000 per cu, ft, per second of water produced and utilised by the Water Company. Such allowance was set 3 cu. ft, per second. Currently with a flow of approximately 18 eu. ft. per second, of which the Water Company utilizes 96,31$ based upon 1948 division of the water, the value of the water rights would be in excess of #30,000. A decision as to the Company’s position on this matter will be desirable. Revenues t The 19S0 estimate reflects an increase of #11,610 in water revenue. It is planned to show detail as to number of customers, revenue from each class, as well as population figures in the final estimate, This may be neafr#10,000 than the estimate herein used as rate of growth is declining. In 1949, total revenues of #202,390 reflected Miseel-revenuea of #3,256.97. This amount Included #1740,00 for water service connections at the rate of #5.00 per connection. It would appear to me that such payment might better be treated as a credit to the expense incurred by the Company in making the service extension from the water main to the curb. Treating it as a revenue creates a tax liability. Further the Company’s expense