Copyright & Fair-use Agreement

UNLV Special Collections provides copies of materials to facilitate private study, scholarship, or research. Material not in the public domain may be used according to fair use of copyrighted materials as defined by copyright law. Please cite us.

Please note that UNLV may not own the copyright to these materials and cannot provide permission to publish or distribute materials when UNLV is not the copyright holder. The user is solely responsible for determining the copyright status of materials and obtaining permission to use material from the copyright holder and for determining whether any permissions relating to any other rights are necessary for the intended use, and for obtaining all required permissions beyond that allowed by fair use.

Read more about our reproduction and use policy.

I agree.Information

Digital ID

Permalink

Details

Member of

More Info

Rights

Digital Provenance

Publisher

Transcription

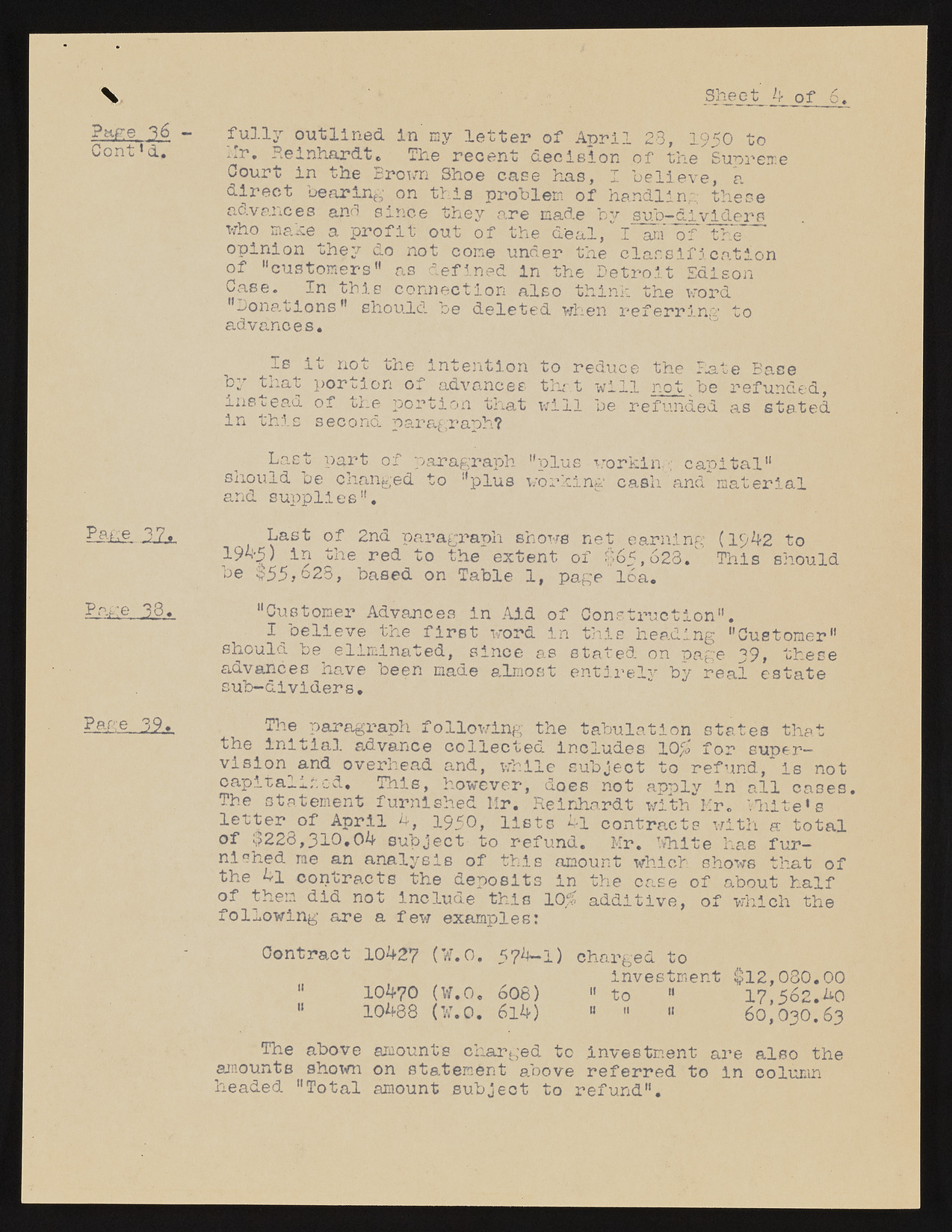

V Page 36 Cont1&. Page 37, P^e 33. Page 39. fully outlined in my letter of April 28, 1950 to i>;r. Reinhardt. The recent decision of the Supreme Court in the Brown Shoe case has, I believe, k direct bearing on this problem of handlin' these advances and since they are made by sub—dividers who make a profit out of the deal, ” I~axa of The opinion they do not cone under the classification of "customers" as defined in the Detroit Edison Case. In this connection also think the word "Donations" should be deleted when referring to advances. Sheet 5 of 6. Is it not the intentior by that portion of advances instead of the portion that in this second paragraph? Last part of paragraph should be changed to "plus and supplies11. to reduce the Rate Base that will not be refunded, will be refunded as stated "plus working capital" working cash and material Last of 2nd paragraph shows net earning (1942 to 1945) in the red to the extent of §65,623/ This should be §55,623, based on Table 1, page 16a. "Customer Advances in Aid of Construction". I believe the first word in this heading "Customer" should be eliminated, since as stated on page 39, these advances have been made almost entirely by real estate sub-dividers. The paragraph following the tabulation states that the initial advance collected includes 10fb for supervision and overhead and, while subject to refund, is not capitalized. This, however, does not apply in all cases. The statement furnished Hr. Reinhardt with Hr. White1s letter of April 4, 1950, lists 4l contracts with a total of §223,310.04 subject to refund. Mr. White has furnished me an analysis of this amount which shows that of the 4l contracts the deposits in the case of about half of then did not include this 10,£ additive, of which the following are a few examples: Contract 11 11 10427 (W.O, 574-1) charged to Investment 10470 (W.O. 608) » to " 10488 (W.O. 6l4) “ » « §12,030.00 17,562.^0 60,030.63 The above amounts charged to investment are also the amounts shown on statement above referred to in column headed "Total amount subject to refund".