Copyright & Fair-use Agreement

UNLV Special Collections provides copies of materials to facilitate private study, scholarship, or research. Material not in the public domain may be used according to fair use of copyrighted materials as defined by copyright law. Please cite us.

Please note that UNLV may not own the copyright to these materials and cannot provide permission to publish or distribute materials when UNLV is not the copyright holder. The user is solely responsible for determining the copyright status of materials and obtaining permission to use material from the copyright holder and for determining whether any permissions relating to any other rights are necessary for the intended use, and for obtaining all required permissions beyond that allowed by fair use.

Read more about our reproduction and use policy.

I agree.Information

Digital ID

Permalink

More Info

Rights

Digital Provenance

Publisher

Transcription

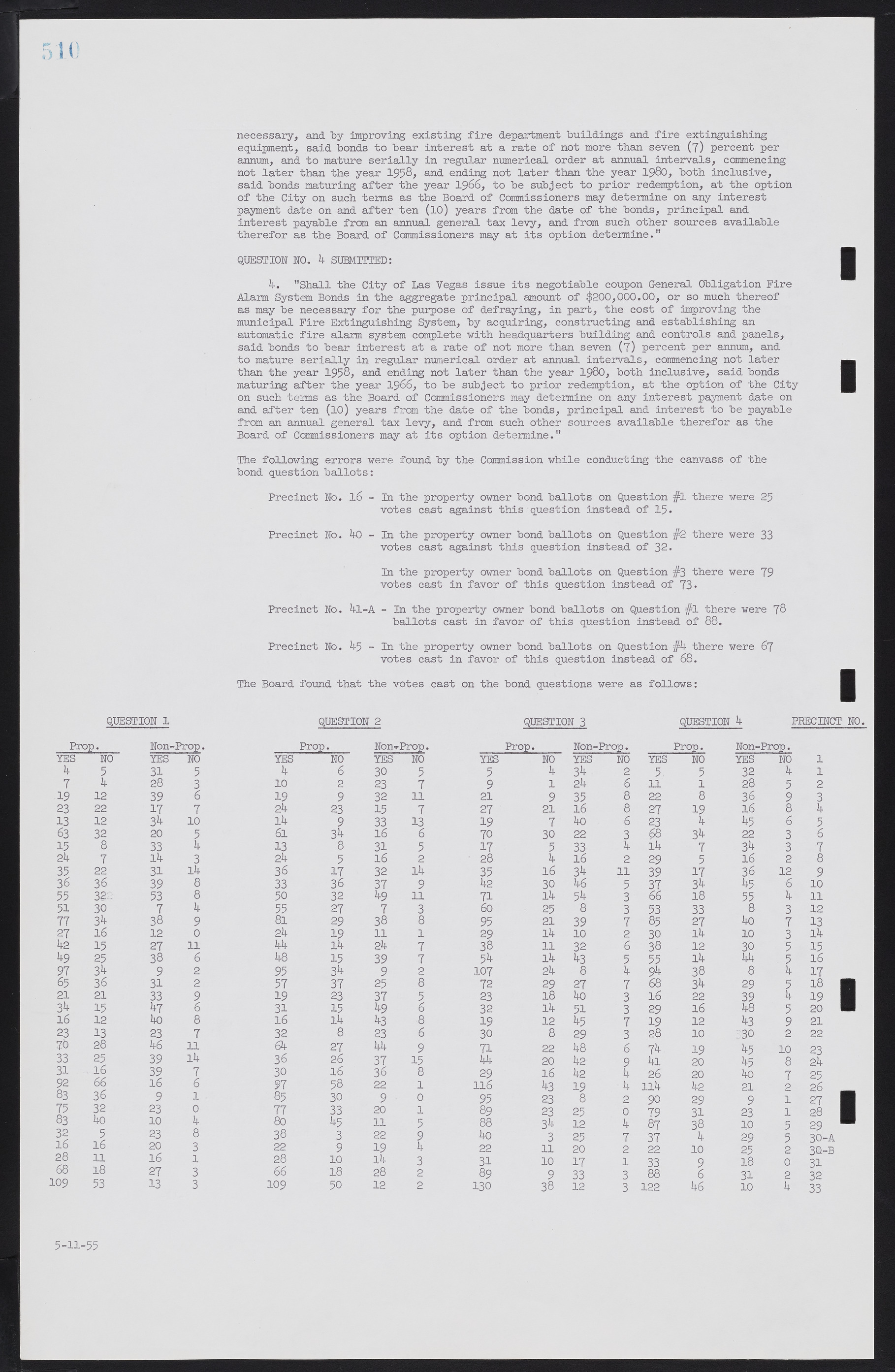

necessary, and by improving existing fire department buildings and fire extinguishing equipment, said bonds to bear interest at a rate of not more than seven (7) percent per annum, and to mature serially in regular numerical order at annual intervals, commencing not later than the year 1958, and ending not later than the year 1980, both inclusive, said bonds maturing after the year 1966, to be subject to prior redemption, at the option of the City on such terms as the Board of Commissioners may determine on any interest payment date on and after ten (10) years from the date of the bonds, principal and interest payable from an annual general tax levy, and from such other sources available therefor as the Board of Commissioners may at its option determine." QUESTION NO. 4 SUBMITTED: 4. "Shall the City of Las Vegas issue its negotiable coupon General Obligation Fire Alarm System Bonds in the aggregate principal amount of $200,000.00, or so much thereof as may be necessary for the purpose of defraying, in part, the cost of improving the municipal Fire Extinguishing System, by acquiring, constructing and establishing an automatic fire alarm system complete with headquarters building and controls and panels, said bonds to bear interest at a rate of not more than seven (7) percent per annum, and to mature serially in regular numerical order at annual intervals, commencing not later than the year 1958, and ending not later than the year 1980, both inclusive, said bonds maturing after the year 1966, to be subject to prior redemption, at the option of the City on such terms as the Board of Commissioners may determine on any interest payment date on and after ten (10) years from the date of the bonds, principal and interest to be payable from an annual general tax levy, and from such other sources available therefor as the Board of Commissioners may at its option determine." The following errors were found by the Commission while conducting the canvass of the bond question ballots: Precinct No. 16 - In the property owner bond ballots on Question #1 there were 25 votes cast against this question instead of 15. Precinct No. 40 - In the property owner bond ballots on Question #2 there were 33 votes cast against this question instead of 32. In the property owner bond ballots on Question #3 there were 79 votes cast in favor of this question instead of 73. Precinct No. 41-A - In the property owner bond ballots on Question #1 there were 78 ballots cast in favor of this question instead of 88. Precinct No. 45 - In the property owner bond ballots on Question #4 there were 67 votes cast in favor of this question instead of 68. The Board found that the votes cast on the bond questions were as follows: QUESTION 1 QUESTION 2 QUESTION 3 QUESTION 4 PRECINCT NO. Prop. Non-Prop. Prop. Non-Prop. Prop. Non-Prop. Prop. Non-Prop. YES NO YES NO YES NO YES NO YES NO YES NO YES NO YES NO 5-11-55