Copyright & Fair-use Agreement

UNLV Special Collections provides copies of materials to facilitate private study, scholarship, or research. Material not in the public domain may be used according to fair use of copyrighted materials as defined by copyright law. Please cite us.

Please note that UNLV may not own the copyright to these materials and cannot provide permission to publish or distribute materials when UNLV is not the copyright holder. The user is solely responsible for determining the copyright status of materials and obtaining permission to use material from the copyright holder and for determining whether any permissions relating to any other rights are necessary for the intended use, and for obtaining all required permissions beyond that allowed by fair use.

Read more about our reproduction and use policy.

I agree.Information

Digital ID

Permalink

Details

More Info

Rights

Digital Provenance

Publisher

Transcription

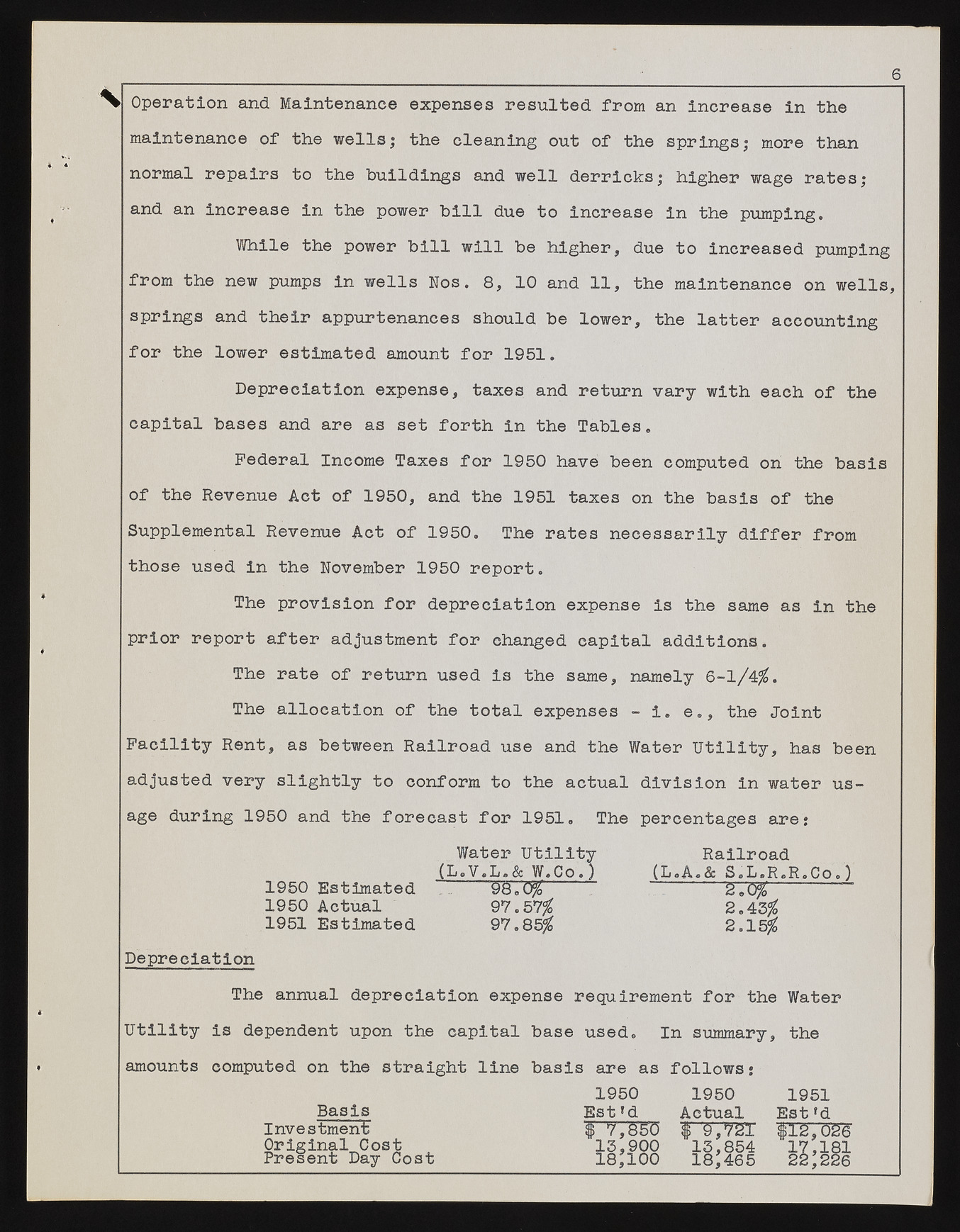

6 Operation and Maintenance expenses resulted from an increase in the maintenance of the wells; the cleaning out of the springs; more than normal repairs to the buildings and well derricks; higher wage rates; and an increase in the power bill due to increase in the pumping. While the power bill will be higher, due to increased pumping from the new pumps in wells Nos. 8, 10 and 11, the maintenance on wells, springs and their appurtenances should be lower, the latter accounting for the lower estimated amount for 1951. Depreciation expense, taxes and return vary with each of the capital bases and are as set forth in the Tables. Federal Income Taxes for 1950 have been computed on the basis of the Revenue Act of 1950, and the 1951 taxes on the basis of the Supplemental Revenue Act of 1950. The rates necessarily differ from those used in the November 1950 report. The provision for depreciation expense is the same as in the prior report after adjustment for changed capital additions. The rate of return used is the same, namely 6-1/4$. The allocation of the total expenses - i. e., the Joint Facility Rent, as between Railroad use and the Water Utility, has been adjusted very slightly to conform to the actual division in water usage during 1950 and the forecast for 1951. The percentages are: 1950 Estimated 1950 Actual 1951 Estimated Water Utility (L.V.L.& W.Co.) ““ 98.0$ 7 97.57$ 97.85$ Railroad _(L.A.& S.L.R.R.Co.) 2.43$ 2.15$ Depreciation The annual depreciation expense requirement for the Water Utility is dependent upon the capital base used. En summary , the amounts computed on the straight line basis are as follows: 1950 1950 1951 Basis Est'd Actual E s t ‘d Investment $ 7,850 f 9,721' #12,026 POrreisgeinnta lD aCyos tCost 1183*,190000 1183*,486554 17,181 22*226