Copyright & Fair-use Agreement

UNLV Special Collections provides copies of materials to facilitate private study, scholarship, or research. Material not in the public domain may be used according to fair use of copyrighted materials as defined by copyright law. Please cite us.

Please note that UNLV may not own the copyright to these materials and cannot provide permission to publish or distribute materials when UNLV is not the copyright holder. The user is solely responsible for determining the copyright status of materials and obtaining permission to use material from the copyright holder and for determining whether any permissions relating to any other rights are necessary for the intended use, and for obtaining all required permissions beyond that allowed by fair use.

Read more about our reproduction and use policy.

I agree.Information

Digital ID

Permalink

Details

More Info

Rights

Digital Provenance

Publisher

Transcription

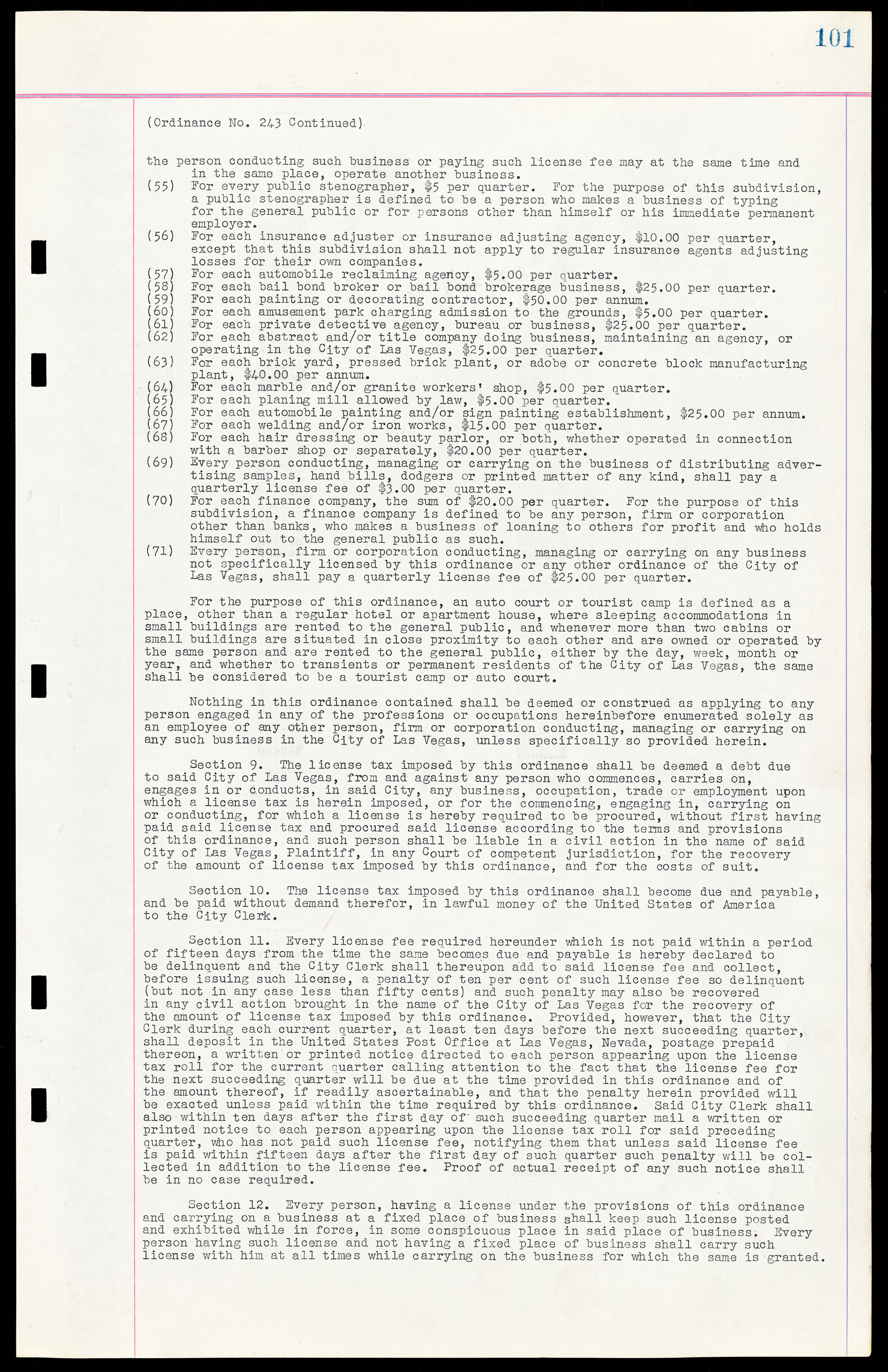

(Ordinance No. 243 Continued) the person conducting such business or paying such license fee may at the same time and in the same place, operate another business. (55) For every public stenographer, $5 per quarter. For the purpose of this subdivision, a public stenographer is defined to be a person who makes a business of typing for the general public or for persons other than himself or his immediate permanent employer. (56) For each insurance adjuster or insurance adjusting agency, $10.00 per quarter, except that this subdivision shall not apply to regular insurance agents adjusting losses for their own companies. (57) For each automobile reclaiming agency, $5.00 per quarter. (58) For each bail bond broker or bail bond brokerage business, $25.00 per quarter. (59) For each painting or decorating contractor, $50.00 per annum. (60) For each amusement park charging admission to the grounds, $5.00 per quarter. (61) For each private detective agency, bureau or business, $25.00 per quarter. (62) For each abstract and/or title company doing business, maintaining an agency, or operating in the City of Las Vegas, $25.00 per quarter. (63) For each brick yard, pressed brick plant, or adobe or concrete block manufacturing plant, $40.00 per annum. (64) For each marble and/or granite workers' shop, $5.00 per quarter. (65) For each planing mill allowed by law, $5.00 per quarter. (66) For each automobile painting and/or sign painting establishment, $25.00 per annum. (67) For each welding and/or iron works, $15.00 per quarter. (63) For each hair dressing or beauty parlor, or both, whether operated in connection with a barber shop or separately, $20.00 per quarter. (69) Every person conducting, managing or carrying on the business of distributing advertising samples, hand bills, dodgers or printed matter of any kind, shall pay a quarterly license fee of $3.00 per quarter. (70) For each finance company, the sum of $20.00 per quarter. For the purpose of this subdivision, a finance company is defined to be any person, firm or corporation other than banks, who makes a business of loaning to others for profit and who holds himself out to the general public as such. (71) Every person, firm or corporation conducting, managing or carrying on any business not specifically licensed by this ordinance or any other ordinance of the City of Las Vegas, shall pay a quarterly license fee of $25.00 per quarter. For the purpose of this ordinance, an auto court or tourist camp is defined as a place, other than a regular hotel or apartment house, where sleeping accommodations in small buildings are rented to the general public, and whenever more than two cabins or small buildings are situated in close proximity to each other and are owned or operated by the same person and are rented to the general public, either by the day, week, month or year, and whether to transients or permanent residents of the City of Las Vegas, the same shall be considered to be a tourist camp or auto court. Nothing in this ordinance contained shall be deemed or construed as applying to any person engaged in any of the professions or occupations hereinbefore enumerated solely as an employee of any other person, firm or corporation conducting, managing or carrying on any such business in the City of Las Vegas, unless specifically so provided herein. Section 9. The license tax imposed by this ordinance shall be deemed a debt due to said City of Las Vegas, from and against any person who commences, carries on, engages in or conducts, in said City, any business, occupation, trade or employment upon which a license tax is herein imposed, or for the commencing, engaging in, carrying on or conducting, for which a license is hereby required to be procured, without first having paid said license tax and procured said license according to the terms and provisions of this ordinance, and such person shall be liable in a civil action in the name of said City of Las Vegas, Plaintiff, in any Court of competent jurisdiction, for the recovery of the amount of license tax imposed by this ordinance, and for the costs of suit. Section 10. The license tax imposed by this ordinance shall become due and payable, and be paid without demand therefor, in lawful money of the United States of America to the City Clerk. Section 11. Every license fee required hereunder which is not paid within a period of fifteen days from the time the same becomes due and payable is hereby declared to be delinquent and the City Clerk shall thereupon add to said license fee and collect, before issuing such license, a penalty of ten per cent of such license fee so delinquent (but not in any case less than fifty cents) and such penalty may also be recovered in any civil action brought in the name of the City of Las Vegas for the recovery of the amount of license tax imposed by this ordinance. Provided, however, that the City Clerk during each current quarter, at least ten days before the next succeeding quarter, shall deposit in the United States Post Office at Las Vegas, Nevada, postage prepaid thereon, a written or printed notice directed to each person appearing upon the license tax roll for the current quarter calling attention to the fact that the license fee for the next succeeding quarter will be due at the time provided in this ordinance and of the amount thereof, if readily ascertainable, and that the penalty herein provided will be exacted unless paid within the time required by this ordinance. Said City Clerk shall also within ten days after the first day of such succeeding quarter mail a written or printed notice to each person appearing upon the license tax roll for said preceding quarter, who has not paid such license fee, notifying them that unless said license fee is paid within fifteen days after the first day of such quarter such penalty will be collected in addition to the license fee. Proof of actual receipt of any such notice shall be in no case required. Section 12. Every person, having a license under the provisions of this ordinance and carrying on a business at a fixed place of business shall keep such license posted and exhibited while in force, in some conspicuous place in said place of business. Every person having such license and not having a fixed place of business shall carry such license with him at all times while carrying on the business for which the same is granted.