Copyright & Fair-use Agreement

UNLV Special Collections provides copies of materials to facilitate private study, scholarship, or research. Material not in the public domain may be used according to fair use of copyrighted materials as defined by copyright law. Please cite us.

Please note that UNLV may not own the copyright to these materials and cannot provide permission to publish or distribute materials when UNLV is not the copyright holder. The user is solely responsible for determining the copyright status of materials and obtaining permission to use material from the copyright holder and for determining whether any permissions relating to any other rights are necessary for the intended use, and for obtaining all required permissions beyond that allowed by fair use.

Read more about our reproduction and use policy.

I agree.Information

Digital ID

Permalink

More Info

Rights

Digital Provenance

Publisher

Transcription

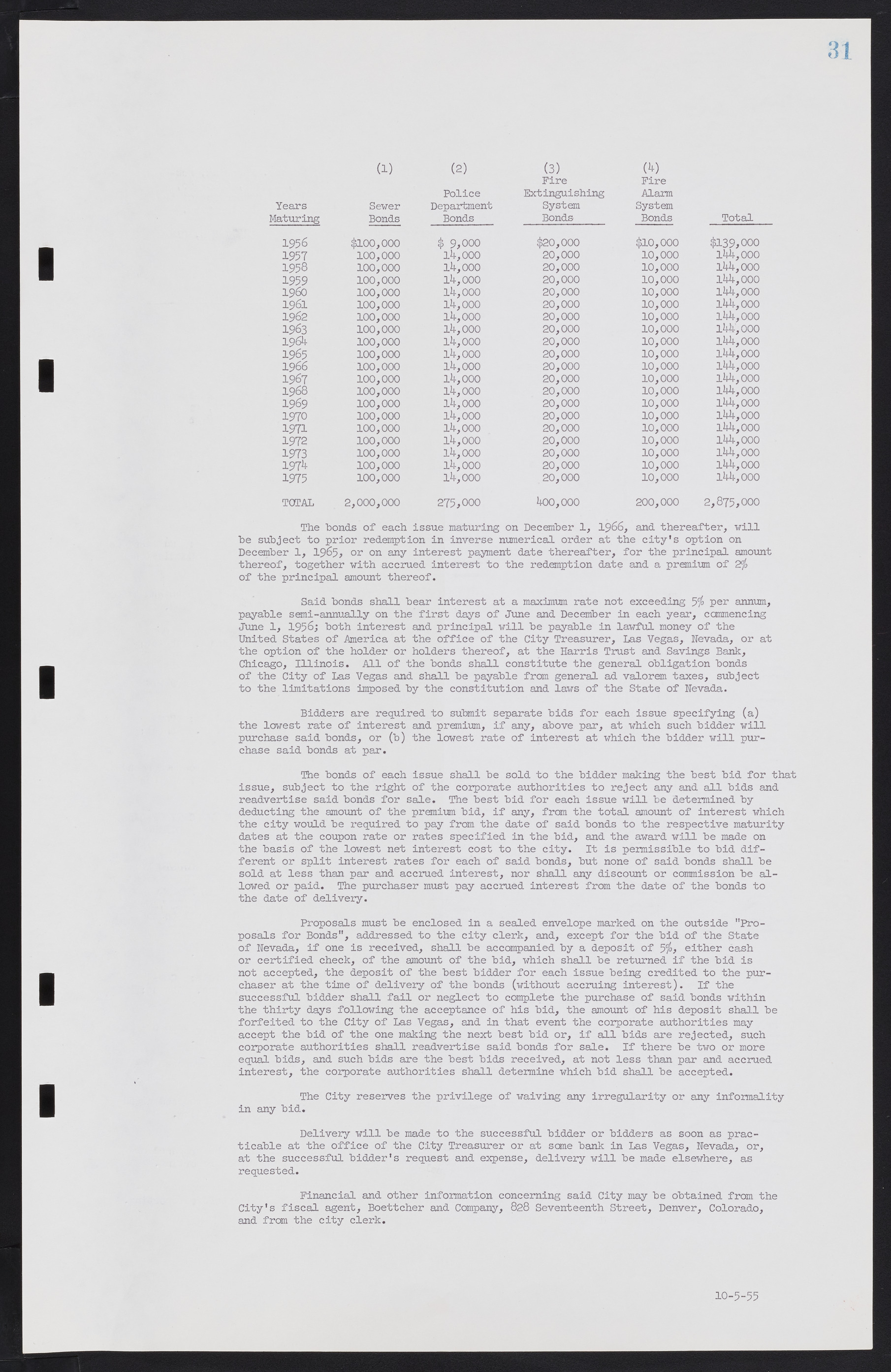

(1) (2) (3) (4) Fire Fire Police Extinguishing Alarm Years Sever Department System System Maturing Bonds Bonds Bonds_____ Bonds Total 1956 $100,000 $ 9,000 $20,000 $10,000 $139,000 1957 100,000 14,000 20,000 10,000 144,000 1958 100,000 14,000 20,000 10,000 144,000 1959 100,000 14,000 20,000 10,000 144,000 1960 100,000 14,000 20,000 10,000 144,000 1961 100,000 14,000 20,000 10,000 144,000 1962 100,000 14,000 20,000 10,000 144,000 1963 100,000 14,000 20,000 10,000 144,000 1964 100,000 14,000 20,000 10,000 144,000 1965 100,000 14,000 20,000 10,000 144,000 1966 100,000 14,000 20,000 10,000 144,000 1967 100,000 14,000 20,000 10,000 144,000 1968 100,000 14,000 20,000 10,000 144,000 1969 100,000 14,000 20,000 10,000 144,000 1970 100,000 14,000 20,000 10,000 144,000 1971 100,000 14,000 20,000 10,000 144,000 1972 100,000 14,000 20,000 10,000 144,000 1973 100,000 14,000 20,000 10,000 144,000 1974 100,000 14,000 20,000 10,000 144,000 1975 100,000 14,000 20,000 10,000 144,000 TOTAL 2,000,000 275,000 400,000 200,000 2,875,000 The bonds of each issue maturing on December 1, 1966, and thereafter, will be subject to prior redemption in inverse numerical order at the city's option on December 1, 1965, or on any interest payment date thereafter, for the principal amount thereof, together with accrued interest to the redemption date and a premium of 2% of the principal amount thereof. Said bonds shall bear interest at a maximum rate not exceeding 5% per annum, payable semi-annually on the first days of June and December in each year, commencing June 1, 1956; both interest and principal will be payable in lawful money of the United States of America at the office of the City Treasurer, Las Vegas, Nevada, or at the option of the holder or holders thereof, at the Harris Trust and Savings Bank, Chicago, Illinois. All of the bonds shall constitute the general obligation bonds of the City of Las Vegas and shall be payable from general ad valorem taxes, subject to the limitations imposed by the constitution and laws of the State of Nevada. Bidders are required to submit separate bids for each issue specifying (a) the lowest rate of interest and premium, if any, above par, at which such bidder will purchase said bonds, or (b) the lowest rate of interest at which the bidder will purchase said bonds at par. The bonds of each issue shall be sold to the bidder making the best bid for that issue, subject to the right of the corporate authorities to reject any and all bids and readvertise said bonds for sale. The best bid for each issue will be determined by deducting the amount of the premium bid, if any, from the total amount of interest which the city would be required to pay from the date of said bonds to the respective maturity dates at the coupon rate or rates specified in the bid, and the award will be made on the basis of the lowest net interest cost to the city. It is permissible to bid different or split interest rates for each of said bonds, but none of said bonds shall be sold at less than par and accrued interest, nor shall any discount or commission be allowed or paid. The purchaser must pay accrued interest from the date of the bonds to the date of delivery. Proposals must be enclosed in a sealed envelope marked on the outside "Proposals for Bonds", addressed to the city clerk, and, except for the bid of the State of Nevada, if one is received, shall be accompanied by a deposit of 5%; either cash or certified check, of the amount of the bid, which shall be returned if the bid is not accepted, the deposit of the best bidder for each issue being credited to the purchaser at the time of delivery of the bonds (without accruing interest). If the successful bidder shall fail or neglect to complete the purchase of said bonds within the thirty days following the acceptance of his bid, the amount of his deposit shall be forfeited to the City of Las Vegas, and in that event the corporate authorities may accept the bid of the one making the next best bid or, if all bids are rejected, such corporate authorities shall readvertise said bonds for sale. If there be two or more equal bids, and such bids are the best bids received, at not less than par and accrued interest, the corporate authorities shall determine which bid shall be accepted. The City reserves the privilege of waiving any irregularity or any informality in any bid. Delivery will be made to the successful bidder or bidders as soon as practicable at the office of the City Treasurer or at sane bank in Las Vegas, Nevada, or, at the successful bidder's request and expense, delivery will be made elsewhere, as requested. Financial and other information concerning said City may be obtained from the City's fiscal agent, Boettcher and Company, 828 Seventeenth Street, Denver, Colorado, and from the city clerk. 10-5-55