Copyright & Fair-use Agreement

UNLV Special Collections provides copies of materials to facilitate private study, scholarship, or research. Material not in the public domain may be used according to fair use of copyrighted materials as defined by copyright law. Please cite us.

Please note that UNLV may not own the copyright to these materials and cannot provide permission to publish or distribute materials when UNLV is not the copyright holder. The user is solely responsible for determining the copyright status of materials and obtaining permission to use material from the copyright holder and for determining whether any permissions relating to any other rights are necessary for the intended use, and for obtaining all required permissions beyond that allowed by fair use.

Read more about our reproduction and use policy.

I agree.Information

Digital ID

Permalink

Details

More Info

Rights

Digital Provenance

Publisher

Transcription

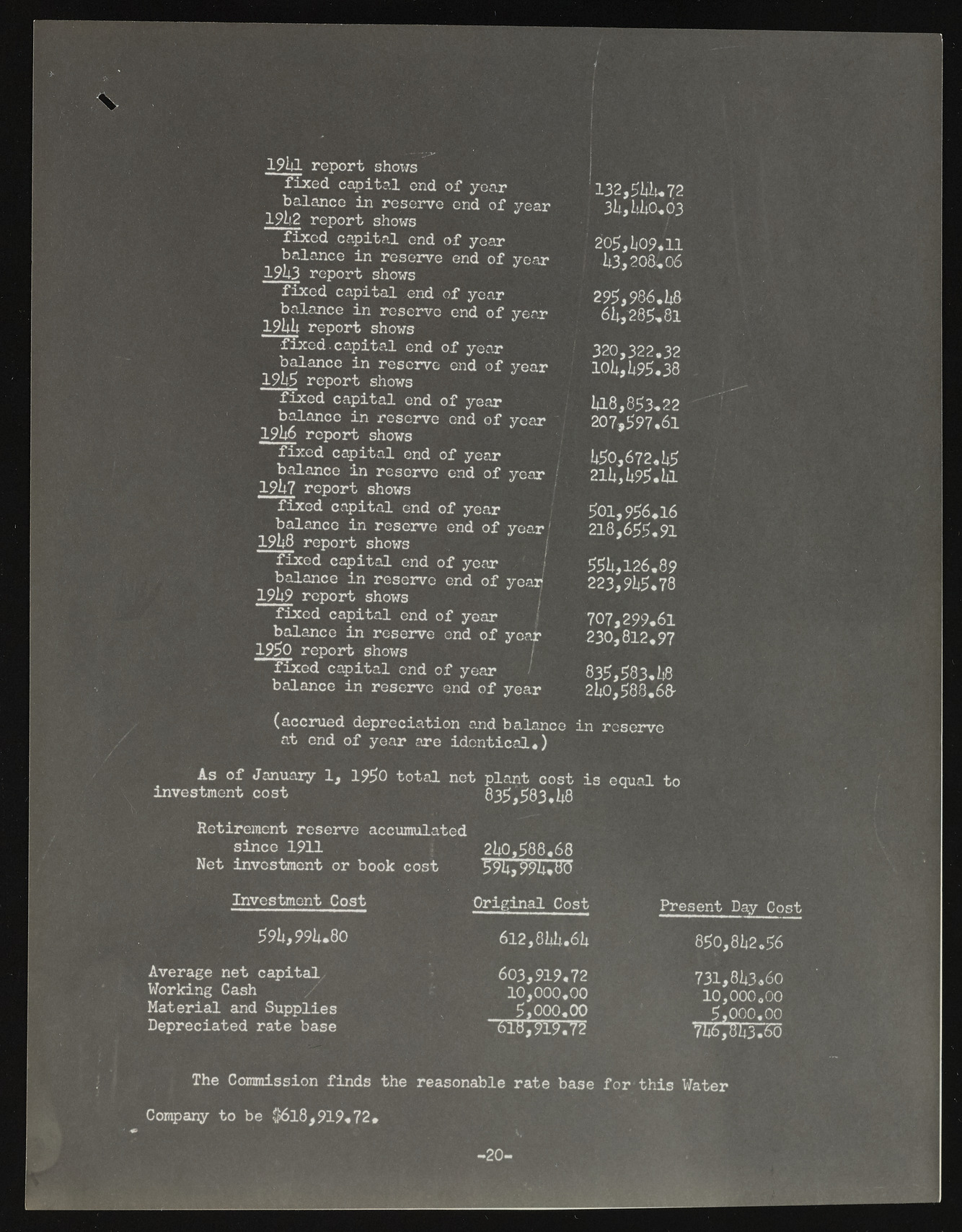

19l*l report shows fixed capital er balance in resei 19l*2 report shows -- — * wuw* V 19l*3 report shows fixed capital end of year balance in reserve end 191*1* report shows ~ f i x e d .capital end of year balance 191*5 repor ti ns hroewsserve end of fixed capital end of year balance in reserve end of 19l*6 report shows fixed capital end of year balance in reserve end of 19l*7 report shows fixed capital end of year 19lb*a8l arnecpeor ti ns rheowsserve end of fixed capital end of year balance in reserve end of 19l*9 report shows fixed capital end of year balance in reserve end of 1900 report shows “"Taxed capital end of year balance in reserve end of (accrued depreciation and balance in reserve at end of year are identical*) As of January 1, 1950 total net plant cost is equal to investment cost 835,583.1*8 Retirement reserve accumulated since 1911 21*0,588.68 Net investment or book cost !>91*,£9i*»'8<3 : r year 132,51*lu72 3l*, 1*1*0.03 *1 year 205,1*09.11 1*3,208.06 i ‘ year 295,986.1*8 61*,285.81 ' year 320,322.32 101*, 1*95.38 year 12*0178,,589573..6212 year j 1*50,672.1*5 211*, 1*95.1*1 year / 501,956.16 218,655.91 1 year! 525213,*9,11*256..7889 year 707,299.61 230,812.97 year 835,583.1*8 21*0,588.68' Investment Cost 59l*,99l*.80 Average net capital Working Cash Material and Supplies Depreciated rate base Original Cost 6l2,81*l*.61* 603,919.72 10,000,00 5,000.00 I j'IB',$19.72 Present Day Cost 850,81*2.56 731,81*3.60 10,000.00 5,000.00 71*6,81*3.60 The Commission finds the reasonable rate base for this Water Company to be $618,919.72. - 2 0 -