Copyright & Fair-use Agreement

UNLV Special Collections provides copies of materials to facilitate private study, scholarship, or research. Material not in the public domain may be used according to fair use of copyrighted materials as defined by copyright law. Please cite us.

Please note that UNLV may not own the copyright to these materials and cannot provide permission to publish or distribute materials when UNLV is not the copyright holder. The user is solely responsible for determining the copyright status of materials and obtaining permission to use material from the copyright holder and for determining whether any permissions relating to any other rights are necessary for the intended use, and for obtaining all required permissions beyond that allowed by fair use.

Read more about our reproduction and use policy.

I agree.Information

Digital ID

Permalink

Details

More Info

Rights

Digital Provenance

Publisher

Transcription

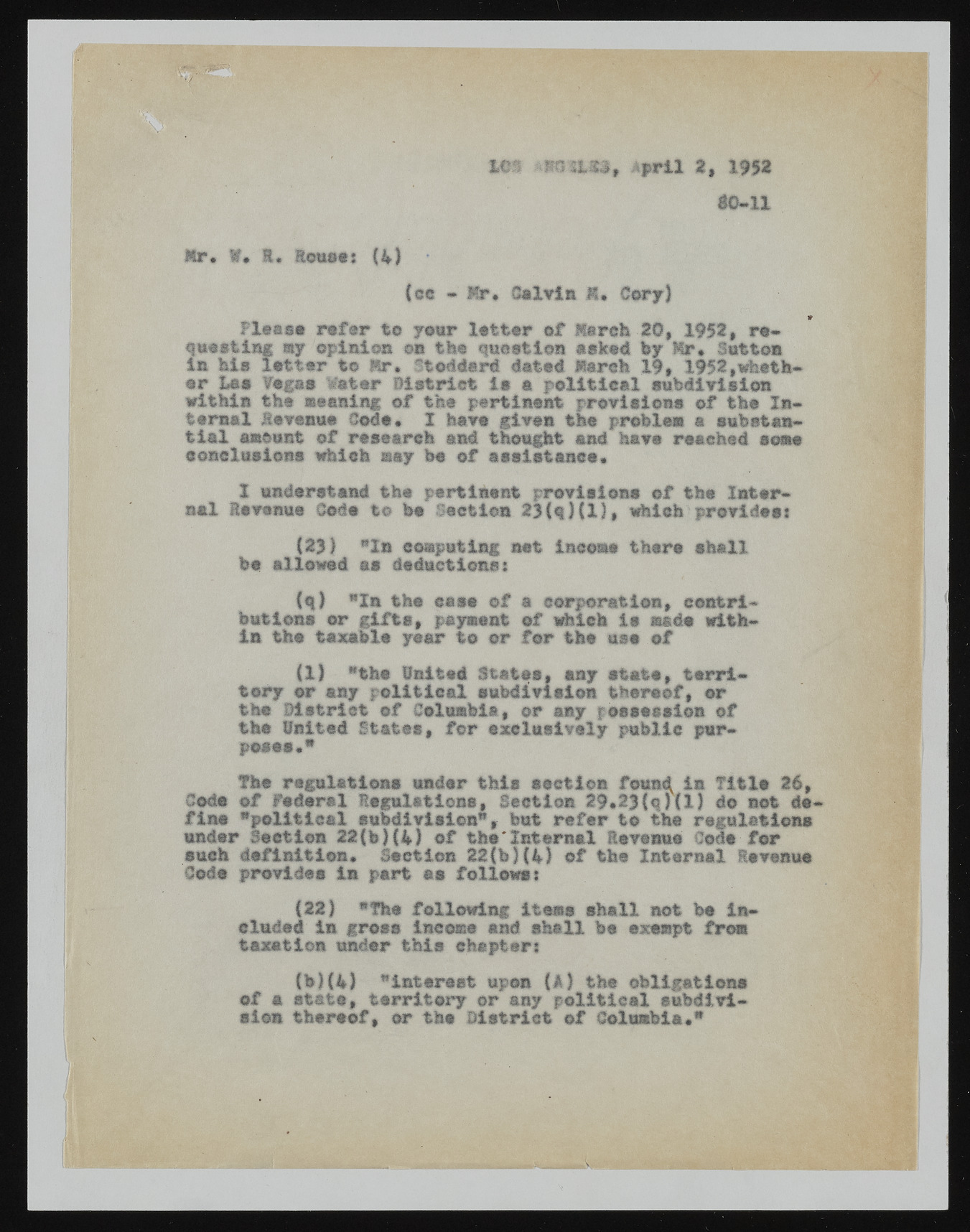

i p .;pril 2, 1952 60-11 Mr. If# R. Rouse: {4} (sc - Mr# Calvin 1, Cory) Please refer to your latter of March 20, 1952, requesting my opinion on the question asked by Hr* Sutton in his letter to Mr. Stoddard dated March 19, 1952,whether Lea Vegas Mater District ia a political subdivision within the meaning of the pertinent provisions of the Internal Revenue Coda* I have given the problem a substantial amount of research and thought and have reached some conclusions which may be of assistance* 1 understand the pertinent provisions of the Internal Revenue Code to be Section 23(e )(1), which provides: (23) "In computing net income there shall be allowed aa deductions: (q) "In the case of a corporation, contri-butions or gifts, payment of which is made within the taxable year to or for the use of (1) "the United States, any atate, territory or any political subdivision thereof, or the District of Columbia, or any possession of the United States, for exclusively public purposes*” The regulations under this section foun^ in Title 26, Code of Federal Regulations, Section 29*23(q)(l) do not define "political subdivision", but refer to the regulations under Section 22(b)(4) of the'Internal Revenue Code for such definition* Section 22(b)(4) of the Internal Revenue Code provides in part as follows: (22) "The following items shall not be Included in gross Income and shall be exempt from taxation under this chapter: (b)(4) "interest upon (1) the obligations of a state, territory or any political subdivision thereof, or the District of Columbia*"