Copyright & Fair-use Agreement

UNLV Special Collections provides copies of materials to facilitate private study, scholarship, or research. Material not in the public domain may be used according to fair use of copyrighted materials as defined by copyright law. Please cite us.

Please note that UNLV may not own the copyright to these materials and cannot provide permission to publish or distribute materials when UNLV is not the copyright holder. The user is solely responsible for determining the copyright status of materials and obtaining permission to use material from the copyright holder and for determining whether any permissions relating to any other rights are necessary for the intended use, and for obtaining all required permissions beyond that allowed by fair use.

Read more about our reproduction and use policy.

I agree.Information

Digital ID

Permalink

Details

More Info

Rights

Digital Provenance

Publisher

Transcription

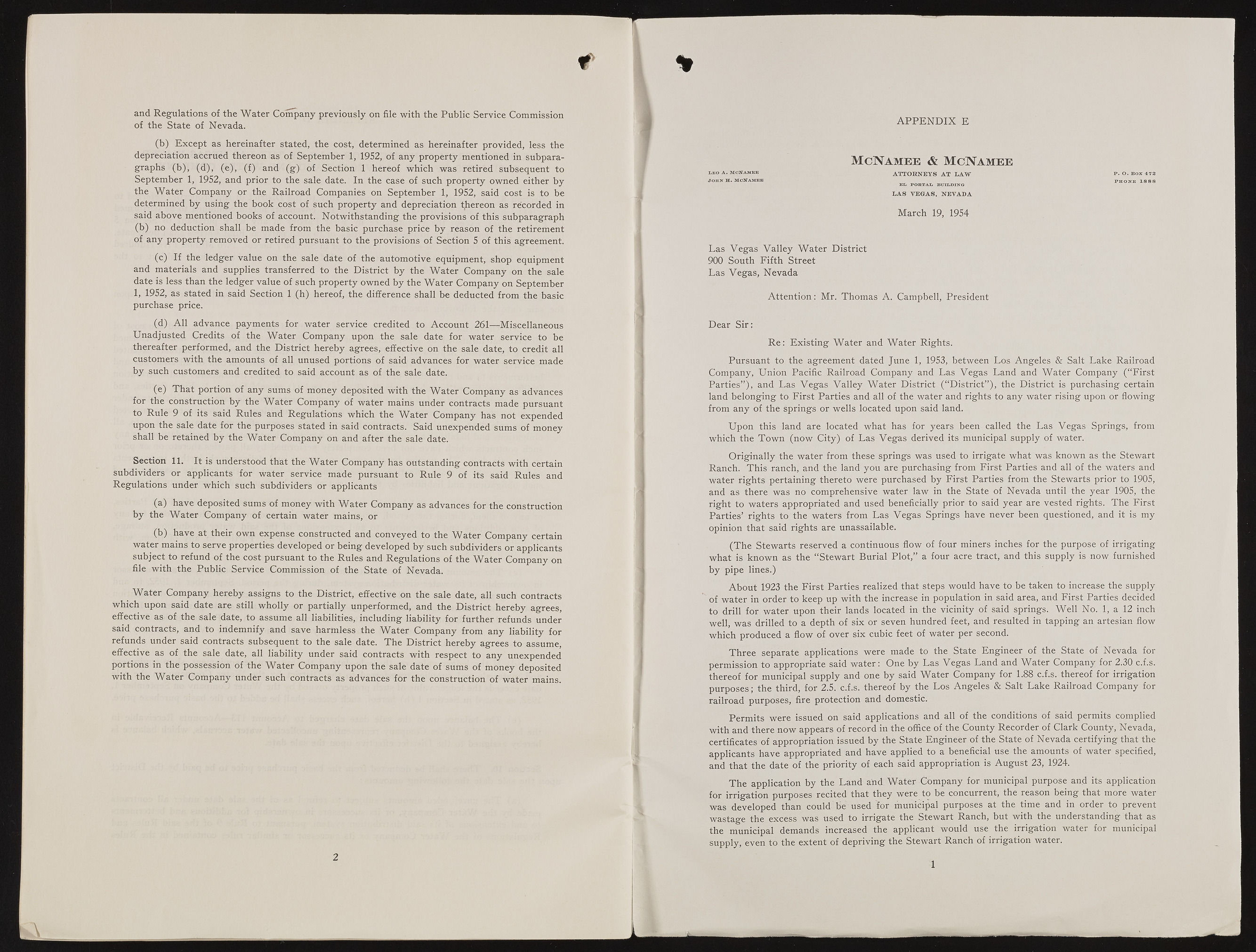

and Regulations of the W ater Company previously on file w ith the Public Service Commission of the State of Nevada. (b) Except as hereinafter stated, the cost, determined as hereinafter provided, less the depreciation accrued thereon as of September 1, 1952, of any property mentioned in subparagraphs (b), (d), (e), (f) and (g) of Section 1 hereof which was retired subsequent to Septem ber 1, 1952, and prior to the sale date. In the case of such property owned either by the W ater Company or the Railroad Companies on September 1, 1952, said cost is to be determined by using the book cost of such property and depreciation thereon as recorded in said above mentioned books of account. N otw ithstanding the provisions of this subparagraph (b) no deduction shall be made from the basic purchase price by reason of the retirem ent of any property removed or retired pursuant to the provisions of Section 5 of this agreement. (c) If the ledger value on the sale date of the autom otive equipment, shop equipment and m aterials and supplies transferred to the D istrict by the W ater Company on the sale date is less than the ledger value of such property owned by the W ater Company on September 1, 1952, as stated in said Section 1 (h) hereof, the difference shall be deducted from the basic purchase price. (d) All advance payments for w ater service credited to Account 261—Miscellaneous U nadjusted Credits of the W ater Company upon the sale date for w ater service to be thereafter performed, and the D istrict hereby agrees, effective on the sale date, to credit all customers w ith the amounts of all unused portions of said advances for w ater service made by such customers and credited to said account as of the sale date. (e) T h at portion of any sums of money deposited with the W ater Company as advances for the construction by the W ater Company of w ater mains under contracts made pursuant to Rule 9 of its said Rules and Regulations which the W ater Company has not expended upon the sale date for the purposes stated in said contracts. Said unexpended sums of money shall be retained by the W ater Company on and after the sale date. Section 11. It is understood th at the W ater Company has outstanding contracts with certain subdividers or applicants for w ater service made pursuant to Rule 9 of its said Rules and Regulations under which such subdividers or applicants (a) have deposited sums of money with W ater Company as advances for the construction by the W ater Company of certain w ater mains, or (b) have at their own expense constructed and conveyed to the "Water Company certain w ater mains to serve properties developed or being developed by such subdividers or applicants subject to refund of the cost pursuant to the Rules and Regulations of the W ater Company on file w ith the Public Service Commission of the State of Nevada. W ater Company hereby assigns to the D istrict, effective on the sale date, all such contracts which upon said date are still wholly or partially unperformed, and the D istrict hereby agrees, effective as of the sale date, to assume all liabilities, including liability for further refunds under said contracts, and to indemnify and save harmless the W ater Company from any liability for refunds under said contracts subsequent to the sale date. The D istrict hereby agrees to assume, effective as of the sale date, all liability under said contracts w ith respect to any unexpended portions in the possession of the W ater Company upon the sale date of sums of money deposited w ith the W ater Company under such contracts as advances for the construction of w ater mains. 2 A P P E N D IX E L e o A . M c U a m e e J o h n H . M c N a m e e M c N a m e e & M c N a m e e A TTO RN EY S A T LAW E L p o r t a l b u i l d i n g LA S V EG A S, NEVADA March 19, 1954 P . O . BOX 4 7 2 P H O N E 1 8 8 8 Las Vegas Valley W ater D istrict 900 South Fifth Street Las Vegas, Nevada A ttention: Mr. Thomas A. Campbell, President Dear Sir: R e: E xisting W ater and W ater Rights. Pursuant to the agreem ent dated June 1, 1953, between Los Angeles & Salt Lake Railroad Company, Union Pacific Railroad Company and Las Vegas Land and W ater Company (“First Parties”), and Las Vegas Valley W ater D istrict (“D istrict”), the D istrict is purchasing certain land belonging to F irst Parties and all of the w ater and rights to any water rising upon or flowing from any of the springs or wells located upon said land. Upon this land are located w hat has for years been called the Las Vegas> Springs, from which the Tow n (now City) of Las Vegas derived its municipal supply of water. O riginally the w ater from these springs was used to irrigate w hat was known as the Stew art Ranch. This ranch, and the land you are purchasing from F irst Parties and all of the waters and Water rights pertaining thereto were purchased by F irst Parties from the Stewarts prior to 1905, and as there was no comprehensive water law in the State of Nevada until the year 1905, the right to w aters appropriated and used beneficially prior to said year are vested rights.. The First Parties’ rights to the w aters from Las Vegas Springs have never been questioned, and it is my opinion th at said rights are unassailable. (The Stew arts reserved a continuous flow of four miners inches for the purpose of irrigating w hat is known as the “Stew art Burial Plot,” a four acre tract, and this supply is now furnished by pipe lines.) A bout 1923 the F irst Parties realized that steps would have to be taken to increase the supply of w ater in order to keep up w ith the increase in population in said area, and F irst Parties decided to drill for w ater upon their lands located in the vicinity of said springs. W ell No. 1, a 12 inch well, was drilled to a depth of six or seven hundred feet, and resulted in tapping an artesian flow which produced a flow of over six cubic feet of w ater per second. T hree separate applications were made to the State Engineer of the State of Nevada for permission to appropriate said w ater: One by Las Vegas Land and W ater Company for 2.30 c.f.s. thereof for municipal supply and one by said W ater Company for 1.88 c.f.s. thereof for irrigation purposes; the third, for 2.5. c.f.s. thereof by the Los Angeles & Salt Lake Railroad Company for railroad purposes, fire protection and domestic. Perm its were issued on said applications and all of the conditions of said perm its complied w ith and there now appears of record in the office of the County Recorder of Clark County, Nevada, certificates of appropriation issued by the State Engineer of the State of Nevada certifying that the applicants have appropriated and have applied to a beneficial use the amounts of w ater specified, and th at the date of the priority of each said appropriation is A ugust 23, 1924. The application by the Land and W ater Company for municipal purpose and its application for irrigation purposes recited th at they were to be concurrent, the reason being th at more water was developed than could be used for municipal purposes at the time and in order to prevent wastage the excess was used to irrigate the Stew art Ranch, but w ith the understanding that as the municipal demands increased the applicant would use the irrigation w ater for municipal supply, even to the extent of depriving the Stew art Ranch of irrigation water. 1