Copyright & Fair-use Agreement

UNLV Special Collections provides copies of materials to facilitate private study, scholarship, or research. Material not in the public domain may be used according to fair use of copyrighted materials as defined by copyright law. Please cite us.

Please note that UNLV may not own the copyright to these materials and cannot provide permission to publish or distribute materials when UNLV is not the copyright holder. The user is solely responsible for determining the copyright status of materials and obtaining permission to use material from the copyright holder and for determining whether any permissions relating to any other rights are necessary for the intended use, and for obtaining all required permissions beyond that allowed by fair use.

Read more about our reproduction and use policy.

I agree.Information

Digital ID

Permalink

Details

More Info

Rights

Digital Provenance

Publisher

Transcription

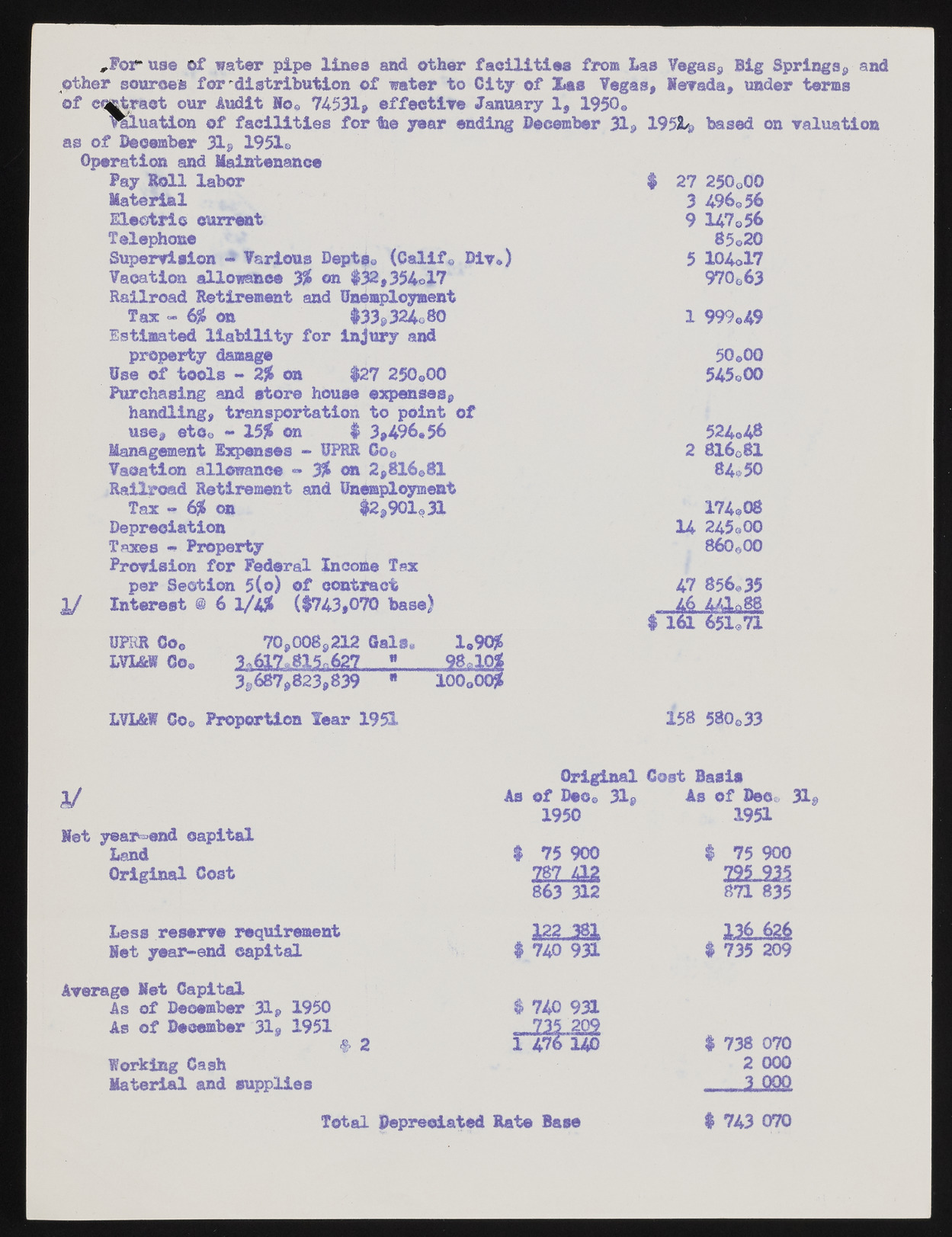

,Foi~ uae of water pipe lines and other facilities from Las Vegasfl Big Springs, and other sources for'distribution of water to City of Xss Vegas, Nevada, under terms of extract our Audit No© 74531, effective January 1, 1950# Wluation of facilities for ihe year ending December 31, 195L& based on valuation as of December 31, 1951a Operation and Maintenance Fay Soil labor Material Electric current Telephone Supervision - Various Deptso (Calif© Div.) Vacation allowance % cm $32,354o17 Railroad Retirement and Unemployment Tax - 6% on $33,324o80 Estimated liability for injury and property damage Use of tools - 2% on $27 250oQ0 Purchasing and store house expenses, handling, transportation to point of use, etc,, ~ 15% on $ 3,496.56 UPRR Co0 LVL&W Go, 70,008,212 Gals. .... 3,687,823,839 ? LVL&W Go© Proportion Tear 1951 1©90# 3 & M lOOoO 27 250o00 3 496©56 9 147®56 85©20 5 104ol7 970o63 1 999®49 50 ©00 545oOO 524®48 Management Expenses - UPRR Co® 2 8I608I Vacation allowance *» 3% on 2,816©81 Railroad Retirement and Unemployment 84© 50 Tax - 6% on $2,901©31 174©08 Depreciation 14 245a00 Taxes «* Property Provision for Federal Income Tax 860*00 per Section 5(0) of contract 47 856©35 %j Interest @ 6 1/4* ($743,070 base) .46 $ 161 651®71 158 580®33 1/ Net year-end capital Land Original Cost Original Cost Basis As of Deo© 31, As of Dee* 31, 1950 1951 $ 75 900 $ 75 900 2 E L 0 2 225,935 863 312 871 835 Less reserve requirement Net year-end capital m j g k $ 740 931 1 2 1 6 2 6 $ 735 209 Average Net Capital As of December 31, 1950 As of December 31, 1951 Working Cash Material and supplies 2 $ 740 931 - 211.202 1 476 140 $ 738 070 2 000 3 000 Total Depredated Bate Base $ 743 070