Copyright & Fair-use Agreement

UNLV Special Collections provides copies of materials to facilitate private study, scholarship, or research. Material not in the public domain may be used according to fair use of copyrighted materials as defined by copyright law. Please cite us.

Please note that UNLV may not own the copyright to these materials and cannot provide permission to publish or distribute materials when UNLV is not the copyright holder. The user is solely responsible for determining the copyright status of materials and obtaining permission to use material from the copyright holder and for determining whether any permissions relating to any other rights are necessary for the intended use, and for obtaining all required permissions beyond that allowed by fair use.

Read more about our reproduction and use policy.

I agree.Information

Digital ID

Permalink

Details

More Info

Rights

Digital Provenance

Publisher

Transcription

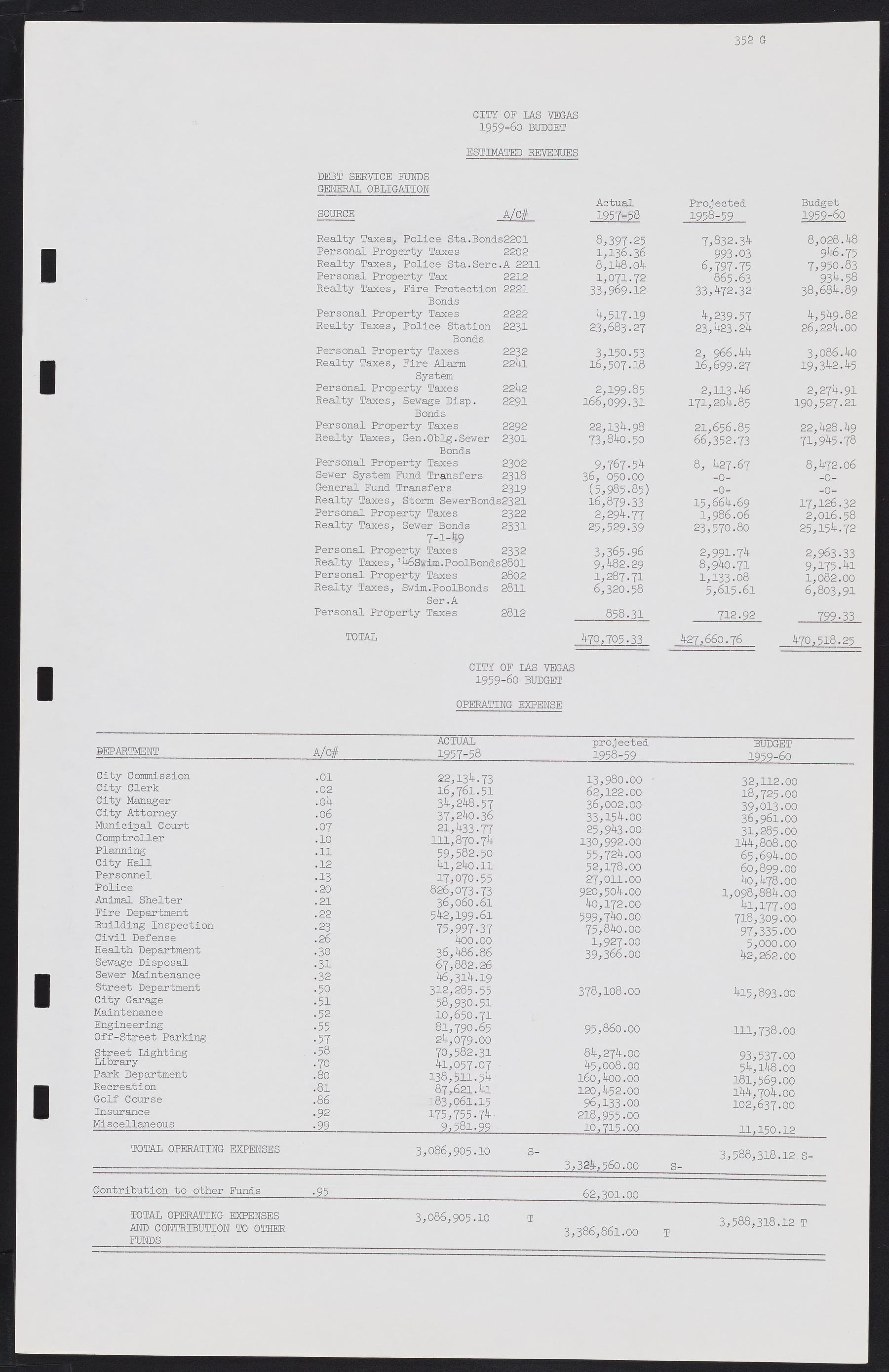

352 G CITY OF IAS VEGAS 1959-60 BUDGET ESTIMATED REVENUES DEBT SERVICE FUNDS GENERAL OBLIGATION Actual Projected Budget SOURCE A/C# 1957-58 1958-59 1959-60 Realty Taxes:, Police Sta. Bonds 2201 8,397.25 7,832.34 8,028.48 Personal Property Taxes 2202 1,136.36 993.03 946.75 Realty Taxes, Police Sta. Serc. A 2211 8,148.04 6,797.75 7,950.83 Personal Property Tax 2212 1,071.72 865.63 934.58 Realty Taxes, Fire Protection 2221 33,989.12 33,472.32 38,684.89 Bonds Personal Property Taxes 2222 4,517.19 4,239.57 4,549.82 Realty Taxes, Police Station 2231 23,683.27 23,423.24 26,224.00 Bonds Personal. Property Taxes 2232 3,150.53 2,966.44 3,086.40 Realty Taxes, Fire Alarm 2241 16,507.18 16,699.27 19,342. System Personal Property Taxes 2242 2,199.85 2,113.46 2,274.91 Realty Taxes, Sewage Disp. 2291 166,099.31 171,204.85 190,527.21 Bonds Personal Property Taxes 2292 22,134.98 21,656.85 22,428.49 Realty Taxes, Gen. Oblg. Sewer 2301 73,840.50 66,352.73 71,945.78 Bonds Personal Property Taxes 2302 9,767.54 8,427.67 8,472.06 Sewer System Fund Transfers 2318 36, 050.00 -0- -0- General Fund Transfers 2319 (5,985.85) -0- -0- Realty Taxes, Storm Sewer Bonds 2321 16,879.33 15,664.69 17,126.32 Personal Property Taxes 2322 2,294.77 1,986.06 2,016.585 Realty Taxes, Sewer Bonds 2331 25,529.39 23,570.80 25,154.72 7-1-49 Personal. Property Taxes 2332 3,365.96 2,991.74 2,963.33 Realty Taxes, 46 Swim. Pool Bonds 2801 9,482.29 8,940.71 9,175.41 Personal Property Taxes 2802 1,287.71 1,133.08 1,082.00 Realty Taxes, Swim. Pool Bonds 2811 6,320.58 5,615.61 6,803.91 Ser-A Personal Property Taxes 2812 _____858.31 712.92 799.33 TOTAL 470,705.33 427,660.76 470,518.25 CITY OF LAS VEGAS 1959-60 BUDGET OPERATING EXPENSE ACTUAL projected BUDGET DEPARTMENT_________________________A/C#________________1957-58__________________1958-59__________________1959-60_________ City Commission .01 22,134.73 13,980.00 32,112.00 City Clerk .02 16,761.51 62,122.00 18,725.00 City Manager .04 34,248.57 36,002.00 39,013.00 City Attorney .06 37,240.36 33,154.00 36,961.00 Municipal Court .07 21,433.77 25,943.00 31,285.00 Comptroller .10 111,870.74 130,992.00 144,808.00 Planning .11 59,582.50 55,724.00 65,694.00 City Hall .12 41,240.11 52,178.00 60,899.00 Personnel .13 17,070.55 27,011.00 40,478.00 Police .20 826,073.73 920,504.00 1,098,884.00 Animal Shelter .21 36,060.61 40,172.00 41,177.00 Fire Department .22 542,199.61 599,740.00 718,309.00 Building Inspection .23 75,997.37 75,840.00 97,335.00 Civil Defense .26 400.00 1,927.00 5,000.00 Health Department .30 36,486.86 39,366.00 42,262.00 Sewage Disposal .31 67,882.26 Sewer Maintenance .32 46,314.19 Street Department .50 312,285.55 378,108.00 415,893.00 City Garage .51 58,930.51 Maintenance .52 10,650.71 Engineering .55 81,790.65 95,860.00 111,738.00 Off-Street Parking .57 24,079.00 Street Lighting .58 70,582.31 84,274.00 93,537.00 Library .70 41,057.07 45,008.00 54,148.00 Park Department .80 138,511.54 160,400.00 181,569.00 Recreation .81 87,621.41 120,452.00 144,704.00 Golf Course .86 163,061.15 96,133.00 102,637.00 Insurance .92 175,755.74. 218,955.00 Miscellaneous______________________.99___________________9,581.99_______________10,715.00_______________11,150.12 TOTAL OPERATING EXPENSES 3,086,905.10 S- 3,588,318.12 S- ———————————————_________________3,324,560.00 S-_______ ___________ Contribution to other Funds________.95 ________________________________________62,301 00 TOTAL OPERATING EXPENSES 3,086,905.10 T 3,588,318.12 T AND CONTRIBUTION TO OTHER 3,386,861.00 T ______FUNDS__________________________________