Copyright & Fair-use Agreement

UNLV Special Collections provides copies of materials to facilitate private study, scholarship, or research. Material not in the public domain may be used according to fair use of copyrighted materials as defined by copyright law. Please cite us.

Please note that UNLV may not own the copyright to these materials and cannot provide permission to publish or distribute materials when UNLV is not the copyright holder. The user is solely responsible for determining the copyright status of materials and obtaining permission to use material from the copyright holder and for determining whether any permissions relating to any other rights are necessary for the intended use, and for obtaining all required permissions beyond that allowed by fair use.

Read more about our reproduction and use policy.

I agree.Information

Digital ID

Permalink

Details

More Info

Rights

Digital Provenance

Publisher

Transcription

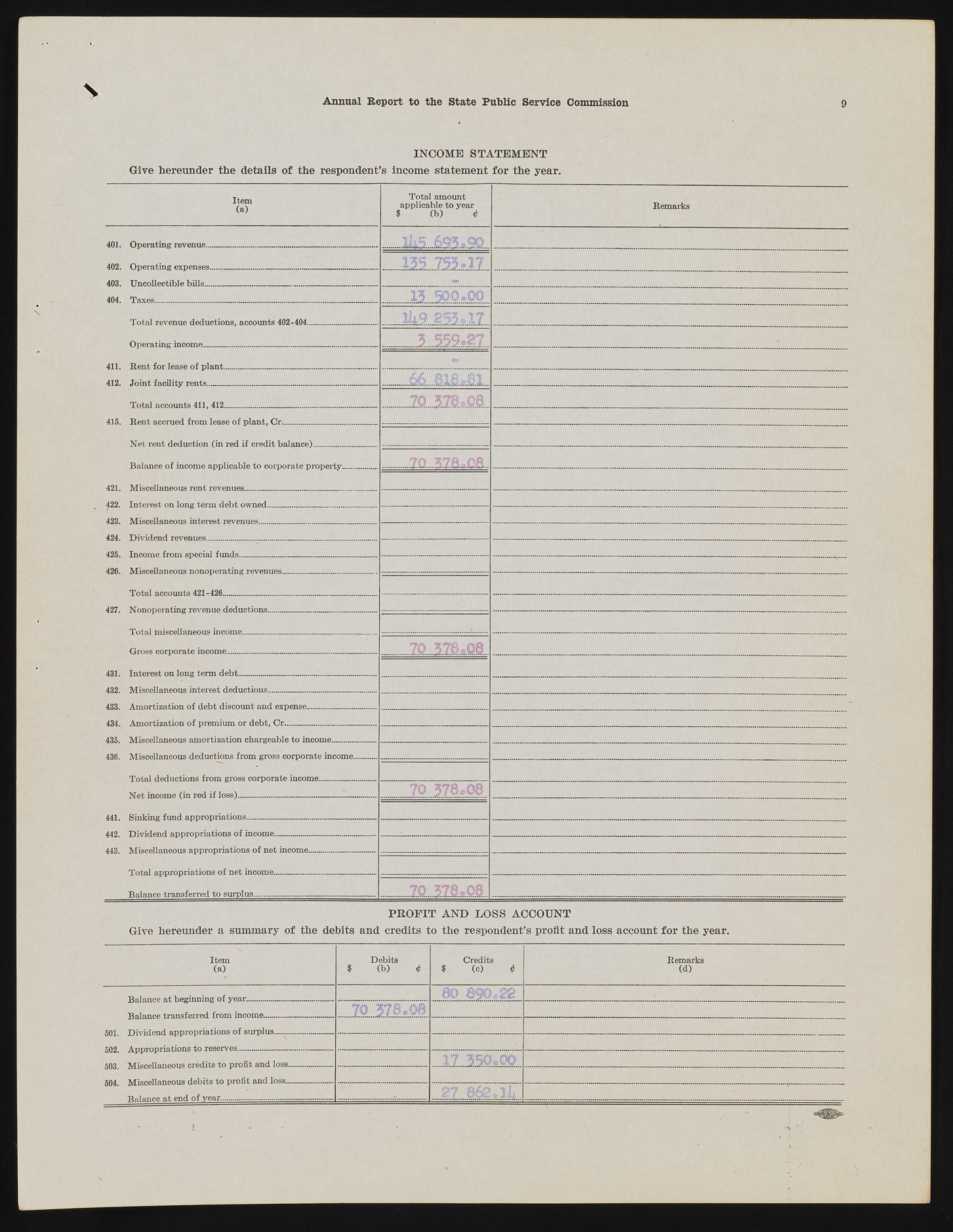

Annual Report to the State Public Service Commission 9 INCOME STATEMENT Give hereunder the details of the respondent’s income statement for the year. Item (a) Total amount applicable to year $ (b ) 4 Remarks 401. Operating revenue------------------- ------------ ------------------------- 402. Operating expenses______________ ____________ ___________ 1 3 5 7 5 3 , 1 7 403. Uncollectible bills______________ _____ ____________ 404. Taxes....................................... .......I...................................... 1 3 5 0 0 * 0 0 Total revenue deductions, accounts 402-404................................ ........ J h & S S L J Z - Operating income.............................................................................. / / A * A A * /U j i O owO 7 0 Gross corporate income......................— ........................................ 431. Interest on long term debt................... ............................... ............ 432. Miscellaneous interest deductions............ ..................................... 433. Amortization of debt discount and expense................................ 434. Amortization of premium or debt, C r.......................................... 435. Miscellaneous amortization chargeable to income._________ 436. Miscellaneous deductions from gross corporate income-------- Total deductions from gross corporate income_____________ Net income (in red if loss).................... ................................ — Balance transferred to surplus....................................................... PRO FIT AND LOSS ACCOUNT Give hereunder a summary of the debits and credits to the respondent’s profit and loss account for the year. Item (a) Debits $ (b) 4 Credits $ (c) 4 Remarks (d) 70 378.08 1 7 3 5 0 *0 0 Balance at end of B B H H I ---------------------