Copyright & Fair-use Agreement

UNLV Special Collections provides copies of materials to facilitate private study, scholarship, or research. Material not in the public domain may be used according to fair use of copyrighted materials as defined by copyright law. Please cite us.

Please note that UNLV may not own the copyright to these materials and cannot provide permission to publish or distribute materials when UNLV is not the copyright holder. The user is solely responsible for determining the copyright status of materials and obtaining permission to use material from the copyright holder and for determining whether any permissions relating to any other rights are necessary for the intended use, and for obtaining all required permissions beyond that allowed by fair use.

Read more about our reproduction and use policy.

I agree.Information

Digital ID

Permalink

Details

Member of

More Info

Rights

Digital Provenance

Publisher

Transcription

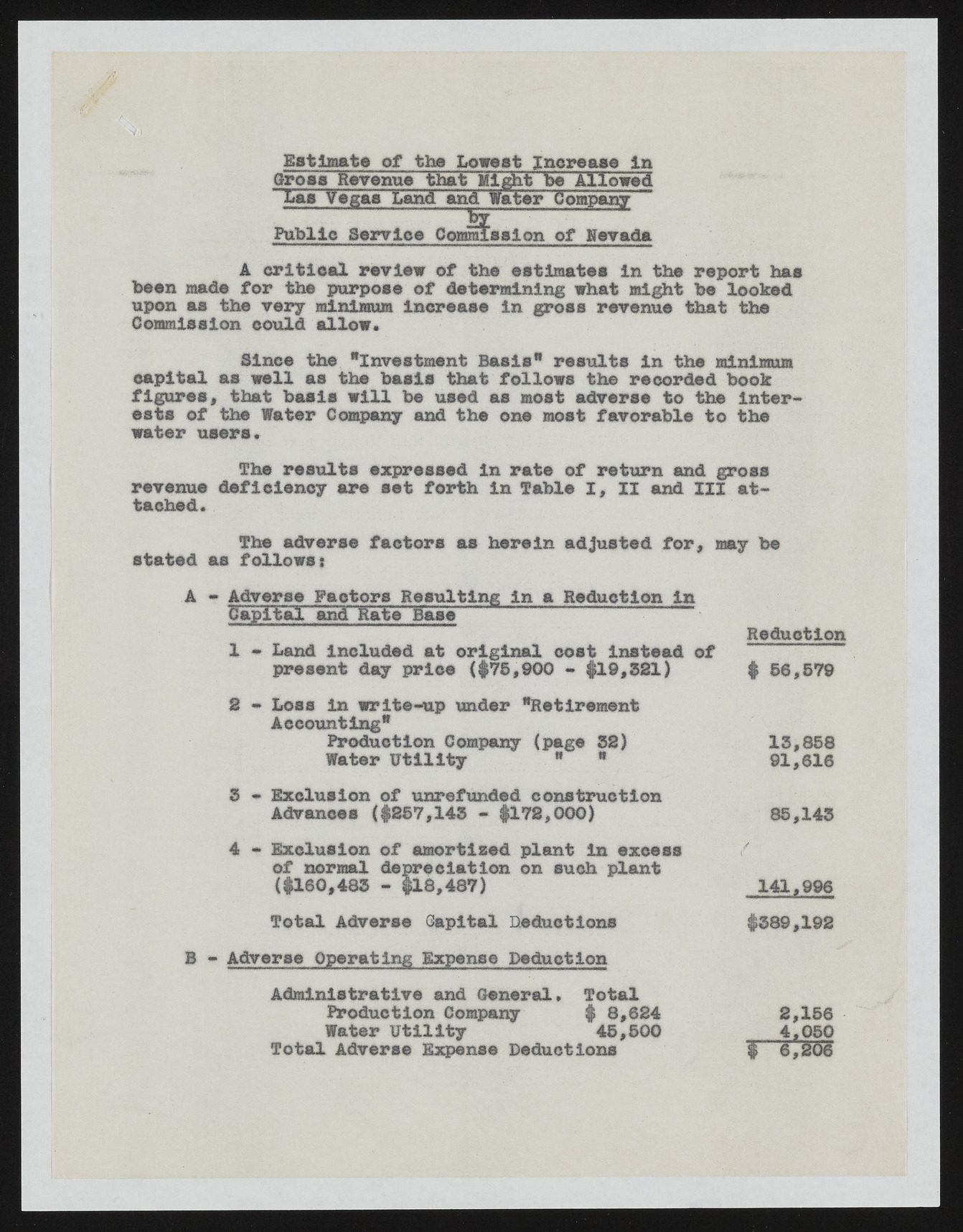

Estimate of the Lowe at Increase in GroaaRevenue that j^ght be Allowed I»aa Vegas Land and Water Company by Public Service Comalsalon of Nevada A critical review of the estimates in the report has been made for the purpose of determining what might be looked upon as the very minimum Increase In gross revenue that the Commission could allow. Since the "Investment Basis" results in the minimum capital as well as the basis that follows the recorded book figures, that basis will be used as most adverse to the Interests of the Water Company and the one most favorable to the water users* The results expressed In rate of return and gross revenue deficiency are set forth in Table I, II and III attached. The adverse factors as herein adjusted for, may be stated as followsi A - Adverse Factors Resulting in a Reduction in Capital and Rate Base 1 * Land Included at original coat Instead of present day price ($75,900 - $19,321) Reduction $ 56,579 2 - Loss In write-up under "Retirement Accounting* Production Company (page 32) Water Utility * * 13,858 91,616 3 - Exclusion of unrefunded construction Advances ($257,143 - $172,000) 85,143 4 - Exclusion of amortized plant in excess of normal depreciation on such plant ($160,483 - $18,487) 141,996 Total Adverse Capital Deductions $339,192 Adverse Operating Expense Deduction Administrative and General* Total Production Company $ 8,624 Water Utility 45,500 Total Adverse Expense Deductions 2,156 4.050 1 6,206