Copyright & Fair-use Agreement

UNLV Special Collections provides copies of materials to facilitate private study, scholarship, or research. Material not in the public domain may be used according to fair use of copyrighted materials as defined by copyright law. Please cite us.

Please note that UNLV may not own the copyright to these materials and cannot provide permission to publish or distribute materials when UNLV is not the copyright holder. The user is solely responsible for determining the copyright status of materials and obtaining permission to use material from the copyright holder and for determining whether any permissions relating to any other rights are necessary for the intended use, and for obtaining all required permissions beyond that allowed by fair use.

Read more about our reproduction and use policy.

I agree.Information

Digital ID

Permalink

Details

More Info

Rights

Digital Provenance

Publisher

Transcription

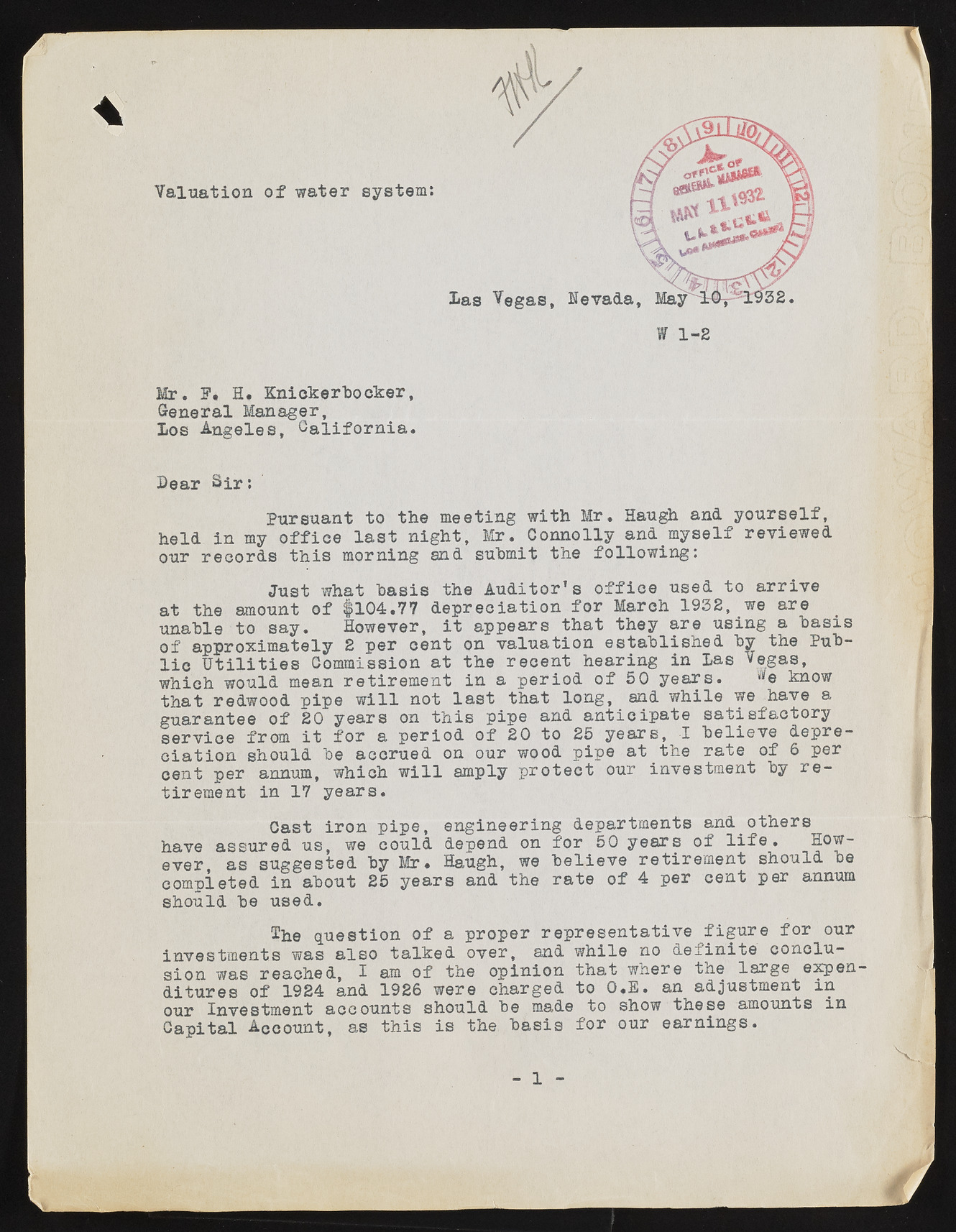

/ V aluation o f water system; Mr. F. H. Knickerbocker, General Manager, Los Angeles, C a lifo rn ia . Dear Sir: Pursuant to the meeting with Mr. Haugh and y o u rse lf, held in my o ffic e l a s t n ig h t, Mr. Connolly and myself reviewed our records th is morning and submit the follow ing: Ju st what b a sis the Auditor’ s o ffic e used to arriv e a t the amount o f fl0 4 .7 7 d ep reciation fo r March 1932, we are unable to say. However, i t appears th a t they are using a b a sis o f approximately 2 per cent on valuation estab lish ed by the Publ i c U t i l i t i e s Commission a t the recen t hearing in Las Vegas, which would mean retirem ent in a period o f 5 0 y ears. v»e know th a t redwood pipe w ill not l a s t th at long, and while we have a guarantee o f 20 years on th is pipe and a n tic ip a te s a tis fa c to ry serv ice from i t fo r a period o f 20 to 25 y ears, I b eliev e deprec ia tio n should be accrued on our wood pipe a t the ra te of 6 per cent per annum, which w ill amply p ro te ct our investment by r e tirem ent in 17 y ears. Cast iron pipe, engineering departments and others have assured us, we could depend on fo r 50 years of l i f e . However as suggested by Mr• Haugh, we b eliev e retirem ent should be completed in about 25 years and the ra te of 4 per cent per annum should be used. She question of a proper rep resen tativ e fig u re fo r our investm ents was also talk ed over, and while no d e fin ite conclusion was reached, I am of the opinion th a t where the large expend itu res of 1924 and 1926 were charged to O.E. an adjustment in our Investment accounts should be made to show these amounts in C apital Account, as th is is the b a sis fo r our earn in gs. - 1 -