Copyright & Fair-use Agreement

UNLV Special Collections provides copies of materials to facilitate private study, scholarship, or research. Material not in the public domain may be used according to fair use of copyrighted materials as defined by copyright law. Please cite us.

Please note that UNLV may not own the copyright to these materials and cannot provide permission to publish or distribute materials when UNLV is not the copyright holder. The user is solely responsible for determining the copyright status of materials and obtaining permission to use material from the copyright holder and for determining whether any permissions relating to any other rights are necessary for the intended use, and for obtaining all required permissions beyond that allowed by fair use.

Read more about our reproduction and use policy.

I agree.Information

Digital ID

Permalink

Details

More Info

Rights

Digital Provenance

Publisher

Transcription

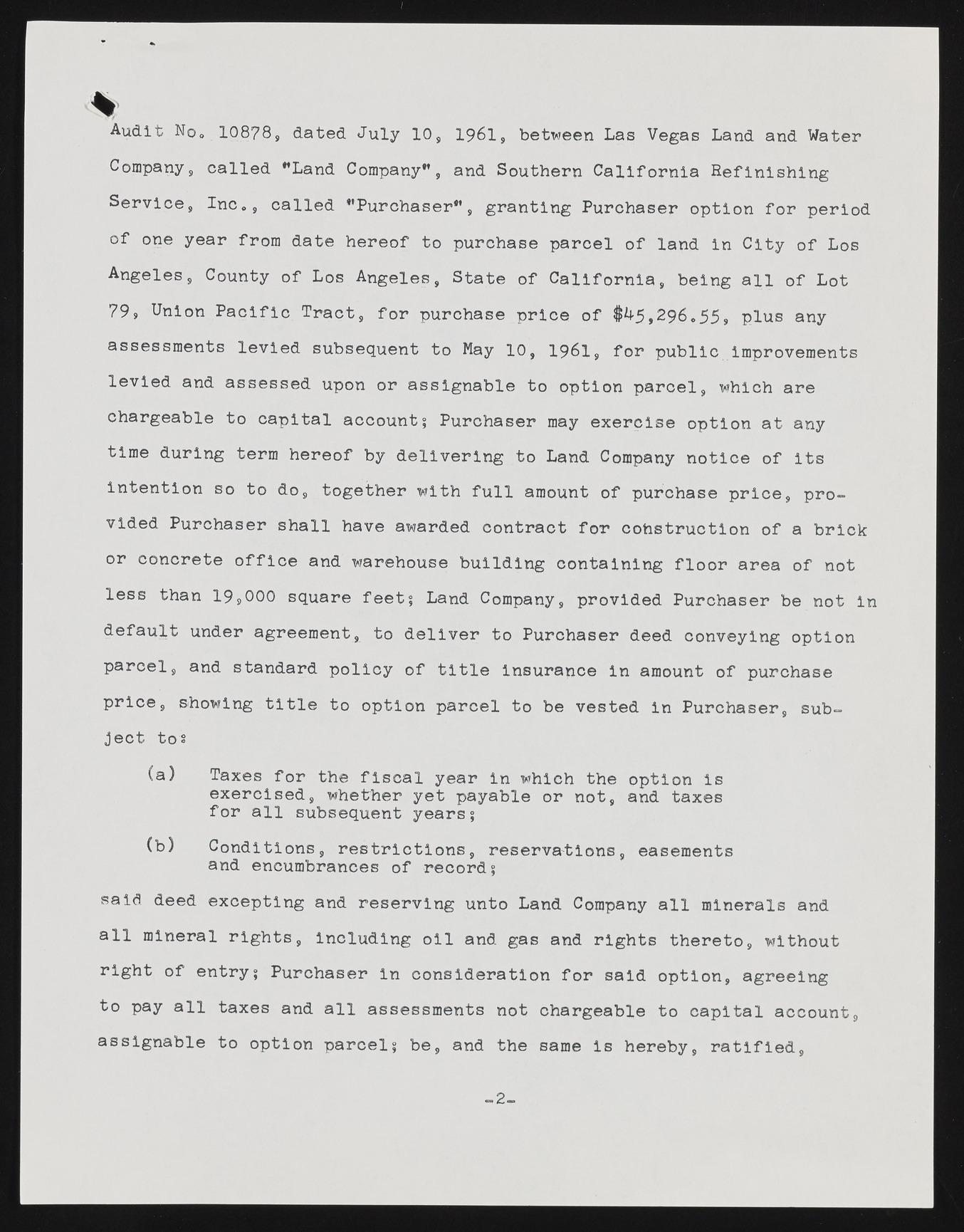

%Audit No0 10878, dated July 10, 1961, between Las Vegas Land and Water Company, called "Land Company", and Southern California Refinlshlng Service, Inc., called "Purchaser", granting Purchaser option for period of one year from date hereof to purchase parcel of land in City of Los Angeles, County of Los Angeles, State of California, being all of Lot 79, Union Pacific Tract, for purchase price of $^5 ,2 9 6 .5 5 , plus any assessments levied subsequent to May 1 0 , 1 9 6 I, for public improvements levied and assessed upon or assignable to option parcel, which are chargeable to capital account; Purchaser may exercise option at any time during term hereof by delivering to Land Company notice of its intention so to do, together with full amount of purchase price, provided Purchaser shall have awarded contract for cohstruction of a brick or concrete office and warehouse building containing floor area of not less than 19 ,0 0 0 square feet; Land Company, provided Purchaser be not in default under agreement, to deliver to Purchaser deed conveying option parcel, and standard policy of title insurance in amount of purchase price, showing title to option parcel to be vested in Purchaser, subject tos (a) Taxes for the fiscal year in which the option is exercised, whether yet payable or not, and taxes for all subsequent years; (b) Conditions, restrictions, reservations, easements and encumbrances of record; said deed excepting and reserving unto Land Company all minerals and all mineral rights, Including oil and gas and rights thereto, without right of entry; Purchaser in consideration for said option, agreeing to pay all taxes and all assessments not chargeable to capital account, assignable to option parcel; be, and the same is hereby, ratified, -2-