Copyright & Fair-use Agreement

UNLV Special Collections provides copies of materials to facilitate private study, scholarship, or research. Material not in the public domain may be used according to fair use of copyrighted materials as defined by copyright law. Please cite us.

Please note that UNLV may not own the copyright to these materials and cannot provide permission to publish or distribute materials when UNLV is not the copyright holder. The user is solely responsible for determining the copyright status of materials and obtaining permission to use material from the copyright holder and for determining whether any permissions relating to any other rights are necessary for the intended use, and for obtaining all required permissions beyond that allowed by fair use.

Read more about our reproduction and use policy.

I agree.Information

Digital ID

Permalink

Details

More Info

Rights

Digital Provenance

Publisher

Transcription

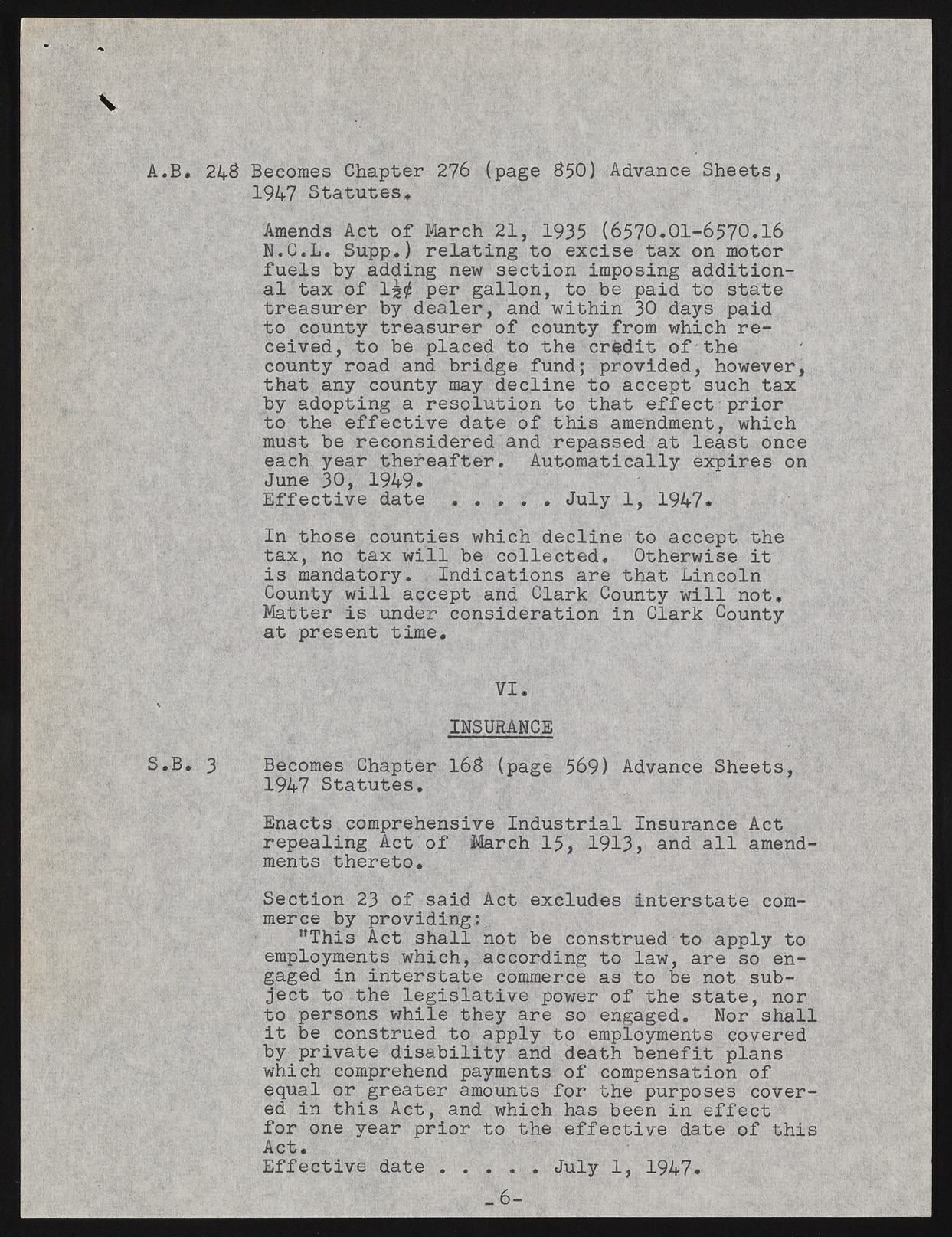

Amends Act of March 21, 1935 (6570.01-6570.16 N.C.L. Supp.) relating to excise tax on motor fuels by adding new section imposing additional tax of 1^0 per gallon, to be paid to state treasurer by dealer, and within 30 days paid to county treasurer of county from which received, to be placed to the credit of the county road and bridge fund; provided, however, that any county may decline to accept such tax by adopting a resolution to that effect prior to the effective date of this amendment, which must be reconsidered and repassed at least once each year thereafter. Automatically expires on June 30, 1949* Effective date ..... July 1, 1947* In those counties which decline to accept the tax, no tax will be collected. Otherwise it is mandatory, i Indications are that Lincoln County will accept and Clark County will not. Matter is under consideration in Clark County at present time. A.B. 248 Becomes Chapter 276 (page #50) Advance Sheets, 1947 Statutes* VI. INSURANCE S.B. 3 Becomes Chapter 16& (page 569) Advance Sheets, 1947 Statutes. Enacts comprehensive Industrial Insurance Act repealing Act of March 15, 1913, and all amendments thereto. Section 23 of said Act excludes interstate commerce by providing:,. "This Act shall not be construed to apply to employments which, according to law, are so engaged in interstate commerce as to be not subject to the legislative power of the state, nor to persons while they are so engaged. Nor shall it be construed to apply to employments covered by private disability and death benefit plans which comprehend payments of compensation of equal or greater amounts for the purposes covered in this Act, and which has been in effect for one year prior to the effective date of this Act. Effective date ... . . July 1, 1947. _ 6 -