Copyright & Fair-use Agreement

UNLV Special Collections provides copies of materials to facilitate private study, scholarship, or research. Material not in the public domain may be used according to fair use of copyrighted materials as defined by copyright law. Please cite us.

Please note that UNLV may not own the copyright to these materials and cannot provide permission to publish or distribute materials when UNLV is not the copyright holder. The user is solely responsible for determining the copyright status of materials and obtaining permission to use material from the copyright holder and for determining whether any permissions relating to any other rights are necessary for the intended use, and for obtaining all required permissions beyond that allowed by fair use.

Read more about our reproduction and use policy.

I agree.Information

Digital ID

Permalink

More Info

Rights

Digital Provenance

Publisher

Transcription

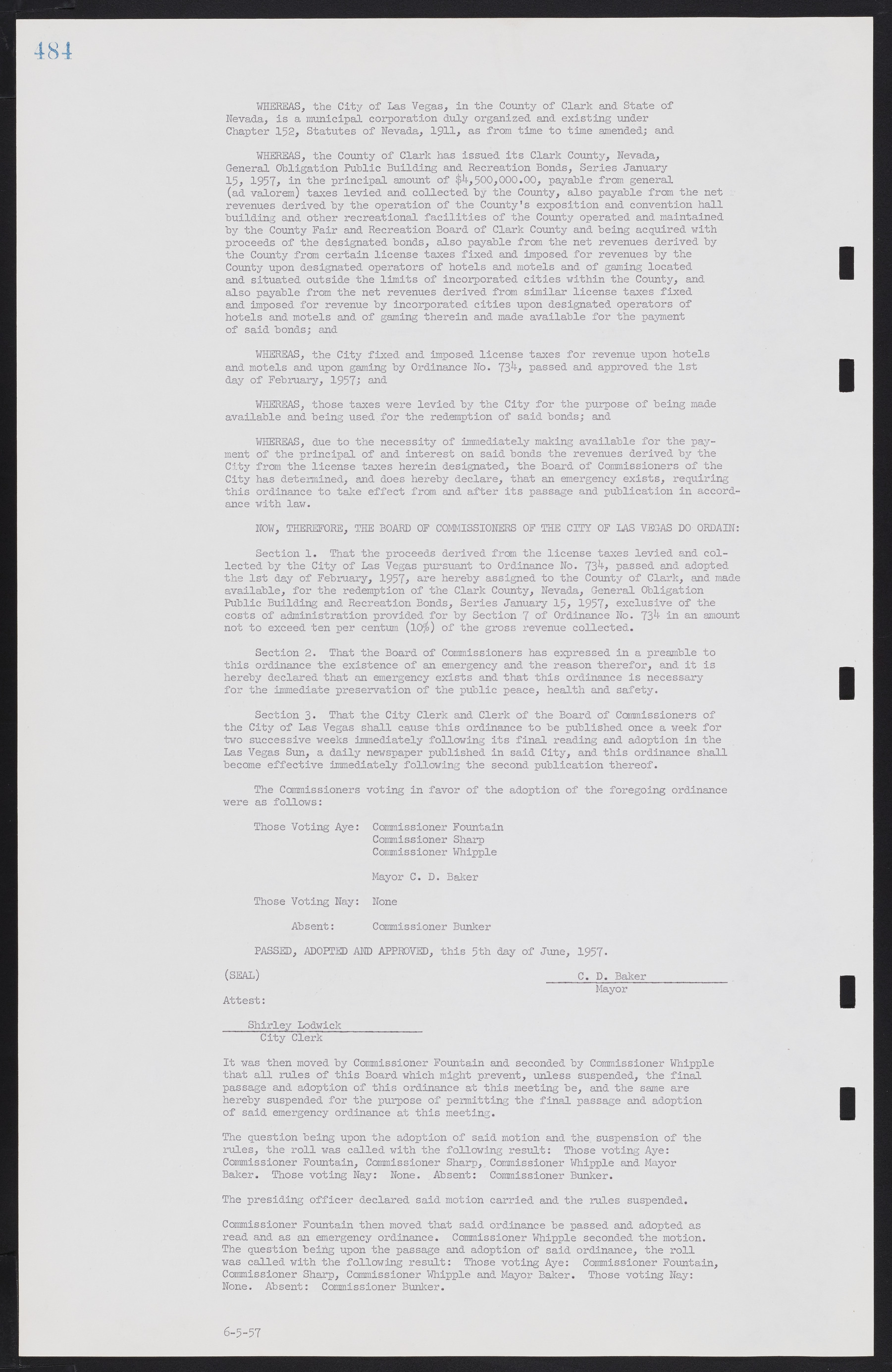

WHEREAS, the City of Las Vegas, in the County of Clark and State of Nevada, is a municipal corporation duly organized and existing under Chapter 152, Statutes of Nevada, 1911, as from time to time amended; and WHEREAS, the County of Clark has issued its Clark County, Nevada, General Obligation Public Building and Recreation Bonds, Series January 15, 1957, in the principal amount of $4,500,000.00, payable from general (ad valorem) taxes levied and collected by the County, also payable from the net revenues derived by the operation of the County's exposition and convention hall building and other recreational, facilities of the County operated and maintained by the County Fair and Recreation Board of Clark County and being acquired with proceeds of the designated bonds, also payable from the net revenues derived by the County from certain license taxes fixed and imposed for revenues by the County upon designated operators of hotels and motels and of gaming located and situated outside the limits of incorporated cities within the County, and also payable from the net revenues derived from similar license taxes fixed and imposed for revenue by incorporated cities upon designated operators of hotels and motels and of gaming therein and made available for the payment of said bonds; and WHEREAS, the City fixed and imposed license taxes for revenue upon hotels and motels and upon gaming by Ordinance No. 734, passed and approved the 1st day of February, 1957; and WHEREAS, those taxes were levied by the City for the purpose of being made available and being used for the redemption of said bonds; and WHEREAS, due to the necessity of immediately making available for the payment of the principal of and interest on said bonds the revenues derived by the City from the license taxes herein designated, the Board of Commissioners of the City has determined, and does hereby declare, that an emergency exists, requiring this ordinance to take effect from and after its passage and publication in accordance with law. NOW, THEREFORE, THE BOARD OF COMMISSIONERS OF THE CITY OF LAS VEGAS DO ORDAIN: Section 1. That the proceeds derived from the license taxes levied and collected by the City of Las Vegas pursuant to Ordinance No. 734, passed and adopted the 1st day of February, 1957; are hereby assigned to the County of Clark, and made available, for the redemption of the Clark County, Nevada, General Obligation Public Building and Recreation Bonds, Series January 15, 1957; exclusive of the costs of administration provided for by Section 7 of Ordinance No. 734 in an amount not to exceed ten per centum (10%) of the gross revenue collected. Section 2. That the Board of Commissioners has expressed in a preamble to this ordinance the existence of an emergency and the reason therefor, and it is hereby declared that an emergency exists and that this ordinance is necessary for the immediate preservation of the public peace, health and safety. Section 3. That the City Clerk and Clerk of the Board of Commissioners of the City of Las Vegas shall cause this ordinance to be published once a week for two successive weeks immediately following its final, reading and adoption in the Las Vegas Sun, a daily newspaper published in said City, and this ordinance shall become effective immediately following the second publication thereof. The Commissioners voting in favor of the adoption of the foregoing ordinance were as follows: Those Voting Aye: Commissioner Fountain Commissioner Sharp Commissioner Whipple Mayor C. D. Baker Those Voting Nay: None Absent: Commissioner Bunker PASSED, ADOPTED AND APPROVED, this 5th day of June, 1957. (SEAL) C. D. Baker_____________ Mayor Attest: Shirley Lodwick_____________ City Clerk It was then moved by Commissioner Fountain and seconded by Commissioner Whipple that all rules of this Board which might prevent, unless suspended, the final passage and adoption of this ordinance at this meeting be, and the same are hereby suspended for the purpose of permitting the final passage and adoption of said emergency ordinance at this meeting. The question being upon the adoption of said motion and the. suspension of the rules, the roll was called with the following result: Those voting Aye: Commissioner Fountain, Commissioner Sharp, Commissioner Whipple and Mayor Baker. Those voting Nay: None. Absent: Commissioner Bunker. The presiding officer declared said motion carried and the rules suspended. Commissioner Fountain then moved that said ordinance be passed and adopted as read and as an emergency ordinance. Commissioner Whipple seconded the motion. The question being upon the passage and adoption of said ordinance, the roll was called with the following result: Those voting Aye: Commissioner Fountain, Commissioner Sharp, Commissioner Whipple and Mayor Baker. Those voting Nay: None. Absent: Commissioner Bunker.