Copyright & Fair-use Agreement

UNLV Special Collections provides copies of materials to facilitate private study, scholarship, or research. Material not in the public domain may be used according to fair use of copyrighted materials as defined by copyright law. Please cite us.

Please note that UNLV may not own the copyright to these materials and cannot provide permission to publish or distribute materials when UNLV is not the copyright holder. The user is solely responsible for determining the copyright status of materials and obtaining permission to use material from the copyright holder and for determining whether any permissions relating to any other rights are necessary for the intended use, and for obtaining all required permissions beyond that allowed by fair use.

Read more about our reproduction and use policy.

I agree.Information

Digital ID

Permalink

Details

More Info

Rights

Digital Provenance

Publisher

Transcription

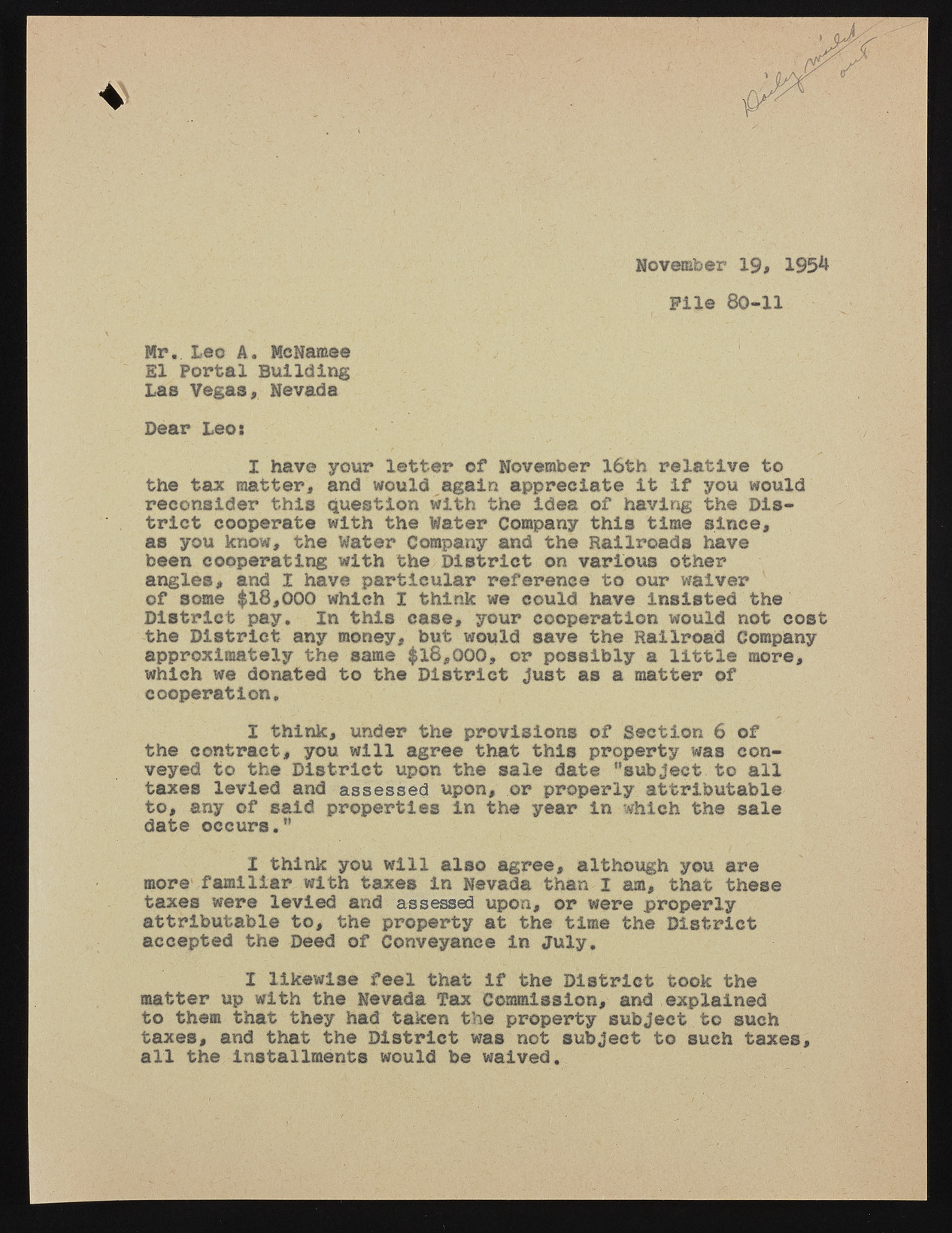

November 1 9 , 195^ Pile 80-11 Mr.. Leo A. McNamee El Portal Building Las Vegas, Nevada Dear Leo: I have your letter of November 16th relative to the tax matter, and would again appreciate it if you would reconsider this question with the idea of having the District cooperate with the Water Company this time since, as you know, the Water Company and the Railroads have been cooperating with the District on various other angles, and I have particular reference to our waiver of some $18,000 which I think we could have insisted the District pay. In this case, your cooperation would not cost the District any money, but would save the Railroad Company approximately the same $18 ,000, or possibly a little more, which we donated to the District Just as a matter of cooperation, I think, under the provisions of Section 6 of the contract, you will agree that this property was conveyed to the District upon the sale date "subject to all taxes levied and a sse sse d upon, or properly attributable to, any of said properties in the year in which the sale date occurs." I think you will also agree, although you are more familiar with taxes in Nevada than I am, that these taxes were levied and assessed upon, or were properly attributable to, the property at the time the District accepted the Deed of Conveyance in July, I I likewise feel that if the District took the matter up with the Nevada Tax Commission, and explained to them that they had taken the property subject to such taxes, and that the District was not subject to such taxes, all the Installments would be waived.